⚠️ Educational Content Only: This article is for educational and informational purposes only and does not constitute financial, tax, investment, or legal advice. We do not provide financial advisory services or personalized investment recommendations. 529 plan rules are complex and individual circumstances vary significantly. Tax laws change regularly, and this information is current as of November 2025. The IRS has not issued comprehensive guidance on 529 to Roth IRA rollovers, and some interpretations remain uncertain. Before making any rollover decisions, consult with a qualified financial advisor, tax professional, or attorney who can evaluate your complete financial picture.

Starting January 1, 2024, the SECURE 2.0 Act created a game-changing exit strategy for overfunded 529 education savings accounts: the ability to roll up to $35,000 into a Roth IRA for the beneficiary, completely tax-free at the federal level. This 529 to Roth IRA rollover provision solves a problem that kept countless families from maximizing their 529 contributions. But the rules are strict, the IRS guidance is incomplete, and state tax traps can catch you off guard. This guide breaks down everything you need to know to use this strategy correctly.

Contents

- What Changed Under SECURE 2.0

- The Five Requirements You Must Meet

- Understanding the 15-Year Rule

- The 5-Year Contribution Seasoning Rule

- Why Roth IRA Income Limits Don’t Apply

- State Tax Implications: The Hidden Trap

- How to Execute the Rollover Step by Step

- 529 to Roth Rollover Eligibility Calculator

- Who Benefits Most From This Strategy

- Common Mistakes to Avoid

- Frequently Asked Questions

Already Maxing Your Retirement Accounts?

If you’re exploring advanced strategies like 529 rollovers, you should also understand the Backdoor Roth IRA and Mega Backdoor Roth strategies.

What Changed Under SECURE 2.0

Before December 29, 2022, families with leftover 529 funds faced an unpleasant choice. They could either change the beneficiary to another family member, pay income tax plus a 10% penalty on the earnings portion when withdrawing for non-educational expenses, or let the money sit unused indefinitely. This “overfunding fear” discouraged aggressive 529 saving, especially when college costs and scholarship outcomes remained uncertain.

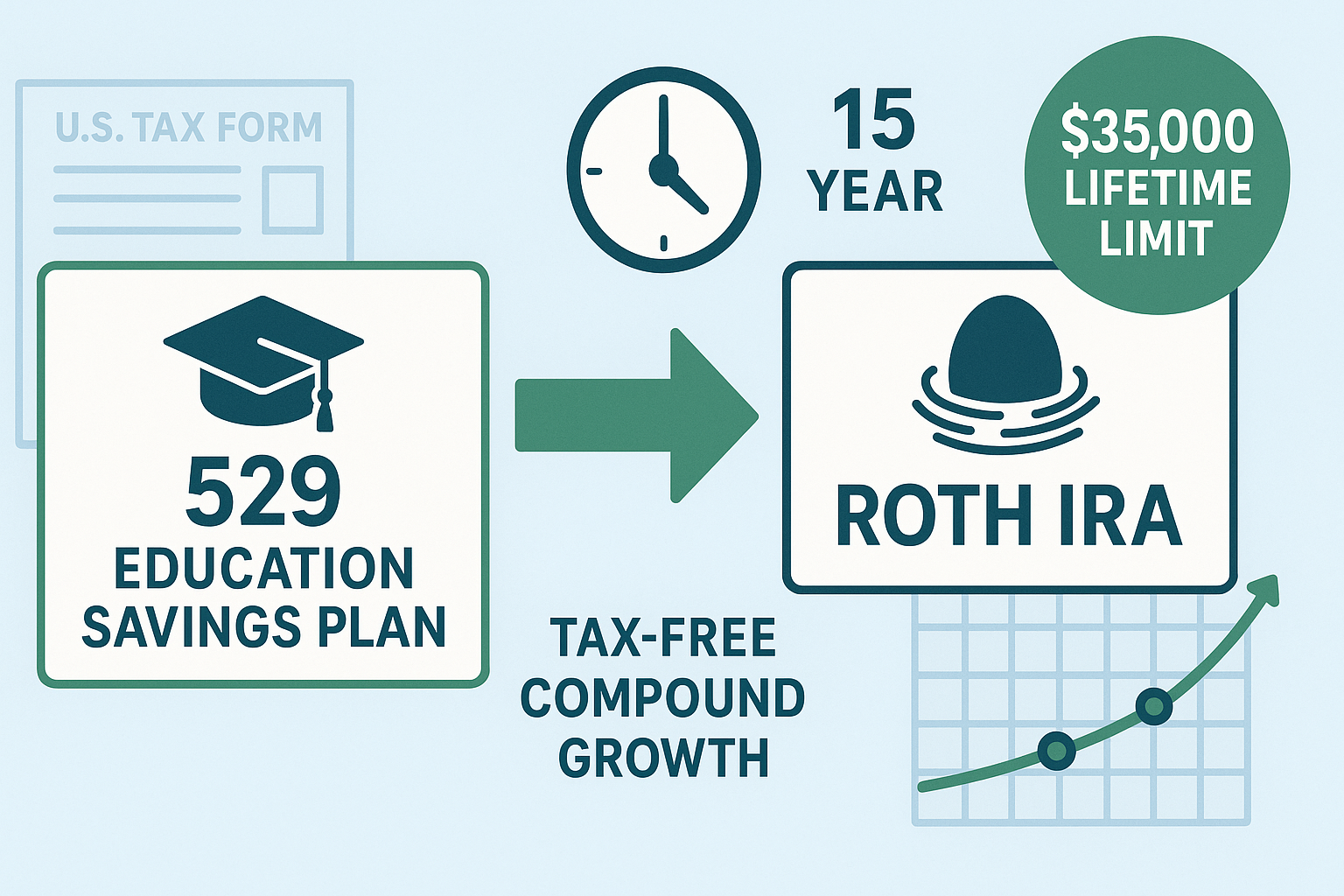

Section 126 of the SECURE 2.0 Act changed everything. Effective January 1, 2024, beneficiaries can now roll unused 529 funds directly into their own Roth IRA. The rollover counts as a contribution (not a conversion), the transfer is tax-free at the federal level, and the money begins growing tax-free for retirement.

SECURE 2.0 Section 126: Key Numbers

- Effective Date: January 1, 2024

- Lifetime Limit: $35,000 per beneficiary (not indexed to inflation)

- Annual Limit: $7,000 in 2025 ($8,000 if age 50+)

- Account Age Required: 529 must be open 15+ years

- Contribution Seasoning: Contributions from last 5 years excluded

The provision addresses a real problem. According to the College Savings Plans Network, the average 529 account balance was approximately $27,741 at year-end 2023. Many families, particularly those with multiple accounts from grandparents or those whose children received scholarships, end up with balances they can’t easily use.

But here’s what the headlines missed: this isn’t a retirement planning strategy. It’s an escape hatch. The restrictions are significant enough that financial planning expert Ed Slott warned advisors against overhyping the provision, calling it “no planning panacea.” Understanding exactly how these rules work determines whether this strategy makes sense for your family.

The Five Requirements You Must Meet

The 529 to Roth IRA rollover operates under five interconnected requirements that significantly limit who can benefit and when. Missing any single requirement transforms a tax-free rollover into a potentially taxable non-qualified withdrawal with penalties.

Requirement 1: The 529 Must Be Open at Least 15 Years

The account age requirement is straightforward but restrictive. The 529 plan must have been “maintained for the 15-year period ending on the date of such distribution.” This means accounts opened before January 1, 2009 became eligible on the provision’s January 1, 2024 effective date. For a newborn today, their 529 account won’t qualify until they turn 15 at the earliest.

The clock starts when you open the account, regardless of when you make contributions. Opening a 529 early, even with a token $50 contribution, begins the 15-year countdown.

Requirement 2: Only Contributions Older Than 5 Years Qualify

Recent contributions and their attributable earnings are excluded from rollover eligibility. Only contributions made more than five years before the rollover date can transfer to the Roth IRA. This prevents families from “stuffing” a 529 account right before conversion.

Important: The 5-year rule applies on a contribution-by-contribution basis. If you contributed $5,000 in 2020 and $3,000 in 2023, only the 2020 contribution (and its growth) would be eligible for rollover in 2025. The 2023 contribution must wait until 2028.

Requirement 3: Annual Limit Matches Roth IRA Contribution Limits

You can’t transfer all $35,000 at once. Annual rollovers are capped at the applicable Roth IRA contribution limit for that year:

| Age | 2025 Annual Limit | Years to Max $35,000 |

|---|---|---|

| Under 50 | $7,000 | 5 years |

| 50-59 | $8,000 | 4.4 years |

| 60-63 | $11,250 (super catch-up) | 3.1 years |

| 64+ | $8,000 | 4.4 years |

The 529 rollover counts against your total Roth IRA contribution limit for the year. If you contribute $4,000 directly to your Roth IRA in 2025, you can only roll over $3,000 from a 529 (assuming you’re under 50).

Requirement 4: The Beneficiary Must Have Earned Income

Just like regular Roth IRA contributions, you need earned income at least equal to your contribution amount. A teenager with a qualifying 529 but only $4,000 in part-time income can roll over just $4,000 that year, regardless of the $7,000 annual limit.

This creates a practical bottleneck. A 15-year-old with an eligible account but no job can’t roll over anything. A college student earning $6,000 from summer work can roll over $6,000. A recent graduate earning $60,000 can roll over the full $7,000.

Earned Income Sources That Count:

- Wages, salaries, tips from W-2 employment

- Self-employment income (Schedule C)

- Taxable alimony (pre-2019 divorce agreements)

- Combat pay (military)

What Doesn’t Count: Investment income, rental income, Social Security, scholarships, gifts

Requirement 5: Direct Trustee-to-Trustee Transfer Only

The rollover must be executed as a direct transfer from the 529 plan administrator to the Roth IRA custodian. You cannot take a distribution personally and deposit it into a Roth IRA. Taking the money yourself, even temporarily, converts the transaction into a non-qualified withdrawal, triggering federal and state income tax on earnings plus the 10% penalty.

This is the same requirement that applies to 401(k) rollovers and other qualified plan transfers. The money moves directly between financial institutions without touching your bank account.

Understanding the 15-Year Rule

The 15-year account age requirement generates more questions than any other aspect of this provision. Unfortunately, the IRS has provided minimal guidance, leaving families and financial advisors to operate on conservative assumptions.

When Does the Clock Start?

The 15-year period begins when the 529 account is opened, not when you first contribute a meaningful amount. This creates an important planning opportunity: open a 529 account as early as possible, even with a minimal contribution, to start the clock running.

Example: Early Account Opening Strategy

Scenario: Sarah opens a 529 with $100 the week her daughter Emma is born in 2025.

Result: Emma’s account becomes rollover-eligible in 2040, when she turns 15. If Emma earns income from a part-time job at 16, she could begin rolling over funds in 2041.

Alternative: If Sarah waits until Emma is 5 to open the account, rollover eligibility doesn’t begin until Emma is 20.

Does Changing the Beneficiary Reset the Clock?

This is the most significant unanswered question. The statute refers to the plan being “maintained for the 15-year period” but doesn’t specify whether the beneficiary must remain unchanged throughout.

The conservative consensus among financial planners, including Michael Kitces and Ed Slott, is to assume that changing the beneficiary resets the 15-year clock. Until the IRS issues guidance confirming otherwise, treat any beneficiary change as starting the countdown over.

This has major planning implications. If you have a 529 for an older child who received scholarships, you might be tempted to change the beneficiary to a younger sibling. Doing so would likely restart the 15-year requirement, delaying rollover eligibility by years or decades.

Does Rolling Between State Plans Reset the Clock?

Better news here. The general industry consensus is that transferring a 529 from one state’s plan to another does not reset the 15-year period. Virginia’s Invest529 explicitly states that changing 529 administrators “does not restart” the 15-year period.

However, the receiving plan won’t have records of your original account opening date. You must maintain documentation proving when the original account was established. Keep your initial account opening confirmation letter indefinitely.

The 5-Year Contribution Seasoning Rule

The 5-year contribution seasoning requirement works independently of the 15-year account age rule. Even if your account is 20 years old, contributions made within the last five years (and their attributable earnings) cannot be rolled over.

How the Rule Works in Practice

Imagine you have a 529 account opened in 2005 with the following contribution history:

| Year | Contribution | Eligible for 2025 Rollover? |

|---|---|---|

| 2005-2019 | $40,000 total | Yes (more than 5 years old) |

| 2020 | $5,000 | Yes (exactly 5 years) |

| 2021 | $5,000 | No (only 4 years) |

| 2022 | $5,000 | No (only 3 years) |

| 2023 | $3,000 | No (only 2 years) |

| 2024 | $2,000 | No (only 1 year) |

In this example, only the $45,000 contributed through 2020, plus its earnings, would be eligible for rollover in 2025. The $15,000 contributed from 2021-2024 must wait until it reaches the 5-year threshold.

Why This Rule Exists

Congress designed the 5-year rule to prevent gaming. Without it, wealthy families could contribute large sums to a 529, immediately roll those funds into a Roth IRA, and effectively bypass Roth IRA income limits while receiving state tax deductions. The seasoning requirement ensures the provision functions as intended: providing an exit for genuinely overfunded education accounts, not creating a new tax loophole.

Pro Tip: Stop contributing to a 529 at least 5 years before you expect the beneficiary to begin rollovers. If you anticipate rolling funds when your child is 22 (after college), stop making contributions by age 17 at the latest.

Why Roth IRA Income Limits Don’t Apply

Here’s where the 529 to Roth IRA rollover becomes genuinely valuable for high-income families. The normal Roth IRA income phase-outs do not apply to these rollovers.

Normal Roth IRA Income Limits for 2025

For regular Roth IRA contributions, high earners face phase-outs:

| Filing Status | Phase-Out Begins | Contributions Prohibited |

|---|---|---|

| Single | $150,000 MAGI | $165,000+ MAGI |

| Married Filing Jointly | $236,000 MAGI | $246,000+ MAGI |

A single professional earning $200,000 cannot contribute directly to a Roth IRA. Their only options are the Backdoor Roth IRA or Mega Backdoor Roth strategies.

529 Rollover Exception

The SECURE 2.0 provision explicitly exempts 529 rollovers from these income limits. A beneficiary earning $500,000 can still roll over $7,000 from their 529 to their Roth IRA. This creates a legitimate path to Roth IRA contributions for high earners who qualify under all other requirements.

Strategic Value for High Earners: If your child is likely to become a high-income professional (doctor, lawyer, software engineer, investment banker), the 529 to Roth IRA rollover may be their only straightforward path to Roth IRA contributions. Opening a 529 at birth and contributing modestly provides this option, even if the primary educational funding comes from other sources.

Of course, the beneficiary still needs earned income equal to the rollover amount. The income limit exemption doesn’t waive the earned income requirement. But for young professionals earning well above the Roth IRA phase-out thresholds, this provision offers a valuable opportunity.

State Tax Implications: The Hidden Trap

While the 529 to Roth IRA rollover is tax-free at the federal level, state tax treatment varies dramatically. This is where many families get surprised. Some states require you to pay back tax deductions you claimed years ago. One state treats the rollover as a penalty-worthy non-qualified distribution.

How States Classify 529 Rollovers

States fall into four categories for 529 to Roth IRA rollover tax treatment:

| Category | States | Tax Consequence |

|---|---|---|

| No State Income Tax | Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming | No state tax implications |

| Treats as Qualified | Georgia, Illinois, New York, Ohio, Pennsylvania, Virginia, Wisconsin, and 30+ others | No state tax implications |

| Requires Deduction Recapture | DC, Indiana, Louisiana, Massachusetts, Michigan, Minnesota, Utah, Vermont | Must add back previously deducted amounts |

| Treats as Non-Qualified | California | State income tax on earnings + 2.5% penalty |

States That Require Deduction Recapture

In recapture states, rolling 529 funds to a Roth IRA triggers the requirement to “recapture” any state tax deductions you previously claimed for those contributions. You must add the previously deducted amount back to your state taxable income in the year of the rollover.

Example: Recapture in Indiana

Scenario: Tom contributed $50,000 to Indiana’s CollegeChoice 529 over 10 years, claiming the 20% state tax credit (capped at $1,500 annually). He received $10,000 in total state tax credits.

Rollover: Tom rolls $35,000 to his daughter’s Roth IRA.

Recapture: Tom must add back a prorated portion of the credits he received. The exact calculation depends on Indiana’s recapture formula.

Recapture doesn’t necessarily make the rollover a bad idea, but you need to calculate the net benefit. In many cases, the long-term advantage of tax-free Roth growth outweighs the one-time recapture hit.

California: The Worst Case

California stands alone with the harshest treatment. The state classifies 529 to Roth IRA rollovers as non-qualified distributions, imposing state income tax on the earnings portion plus an additional 2.5% California tax. The California Franchise Tax Board’s Schedule CA instructions explicitly state that “California law does not conform to this federal provision.”

Since California never offered 529 contribution deductions, there’s no recapture issue. But the earnings tax and penalty apply regardless of whether you used an in-state or out-of-state 529 plan.

California Residents: Calculate your total tax cost before executing any rollover. On a $35,000 rollover with $15,000 in earnings, California would impose state income tax (up to 13.3% depending on your bracket) plus the 2.5% penalty on the $15,000 earnings portion. That could cost $2,000-$2,500 in state taxes alone.

Recent State Law Changes

Two significant changes occurred in 2024:

Illinois: Enacted SB 3133 (signed August 2, 2024) to treat rollovers as qualified distributions. Illinois account holders can now roll over without recapture concerns.

New York: Passed S.9701/A.10209 (signed September 5, 2024) classifying rollovers as qualified withdrawals. This was a major win for the state’s large 529 participant base.

Three states (Colorado, Missouri, and New Jersey) still have pending or unclear guidance as of November 2025. If you live in these states, consult a local tax professional before proceeding.

How to Execute the Rollover Step by Step

The actual mechanics of a 529 to Roth IRA rollover are straightforward once you understand the requirements. Here’s how to execute one correctly.

Step 1: Verify Your 529 Account Eligibility

Before initiating any transfer, confirm three things:

- Account age: Check your original account opening date. The account must be at least 15 years old on the date of distribution. Most 529 providers now display this date on quarterly statements or online account access.

- Contribution history: Review your contribution records to determine which amounts are at least 5 years old. Only seasoned contributions and their earnings qualify.

- Current balance versus eligible amount: Your rollover-eligible balance may be significantly less than your total balance if you’ve made recent contributions.

Step 2: Ensure the Beneficiary Has a Roth IRA

The Roth IRA must exist before you initiate the rollover. If the beneficiary doesn’t have one, open a Roth IRA at a brokerage like Fidelity, Vanguard, or Schwab. The account can have a zero balance initially.

The Roth IRA must be in the beneficiary’s name. You cannot roll 529 funds into a parent’s Roth IRA or any other person’s account.

Step 3: Contact Your 529 Plan Administrator

Request a direct rollover to a Roth IRA. Each 529 provider has its own process:

Major Provider Procedures:

- my529 (Utah): Use Form 310 (Roth IRA Rollover Request), processed within 3 business days

- Invest529 (Virginia): Online rollover initiation available

- Fidelity: Paper withdrawal request with wet signature (scan and upload after signing)

- Vanguard: Form S929, processed in approximately 10 days

- Ohio CollegeAdvantage: Online request through account portal

Step 4: Complete Required Attestations

All 529 providers require you to certify that you meet the rollover requirements. The IRS hasn’t created a tracking system for 529 rollovers, so providers place eligibility verification responsibility on account owners through attestation language.

You’ll typically certify that:

- The 529 account has been maintained for at least 15 years

- The amount being rolled over excludes contributions from the last 5 years

- The cumulative lifetime rollovers for this beneficiary will not exceed $35,000

- The beneficiary has earned income at least equal to the rollover amount

- The rollover will not exceed the annual Roth IRA contribution limit

Step 5: Track the Transfer

Monitor both accounts during the transfer process. The 529 provider will send funds directly to the Roth IRA custodian. Processing time varies from 3 days to 2 weeks depending on the institutions involved.

Once complete, verify that the Roth IRA custodian coded the deposit correctly as a contribution (not a conversion or rollover from an employer plan).

Step 6: Maintain Documentation

Keep comprehensive records indefinitely:

- Original 529 account opening confirmation (proves 15-year requirement)

- Contribution history statements showing dates and amounts

- Rollover request forms and confirmations

- Form 1099-Q from the 529 plan (Box 4b should be checked)

- Form 5498 from the Roth IRA custodian (shows contribution in Box 10)

- Running total of lifetime rollovers for each beneficiary

Tax Reporting: Qualifying 529 to Roth IRA rollovers require no reporting on your federal tax return. Per IRS Publication 970, “Don’t report tax-free distributions on your tax return.” However, retain all documentation in case of future IRS inquiry. State reporting may differ based on your jurisdiction.

Step 7: Track Your Lifetime Limit

The $35,000 limit applies per beneficiary across all 529 plans. If grandparents and parents each have separate 529 accounts for the same child, the combined lifetime rollovers cannot exceed $35,000.

No centralized tracking system exists. You must maintain your own records of all rollovers and ensure family members coordinate if multiple 529 accounts exist for the same beneficiary.

529 to Roth Rollover Eligibility Calculator

Use this calculator to determine when your 529 account becomes eligible for Roth IRA rollovers, how much you can transfer each year, and how long it will take to move the full $35,000 lifetime limit.

529 to Roth IRA Rollover Eligibility Calculator

Calculator Assumptions: This calculator assumes the beneficiary is under age 50 (using the $7,000 annual limit) unless specified otherwise. It uses the binding constraint (lowest of: annual limit, earned income, eligible balance, or remaining lifetime limit) to determine your maximum rollover. Projections assume 7% annual returns and do not account for inflation.

Who Benefits Most From This Strategy

The 529 to Roth IRA rollover works best as a contingency plan, not a primary retirement funding strategy. Certain scenarios deliver clear value while others offer marginal benefits at best.

Best Candidates for 529 Rollovers

Scenario 1: Scholarship Recipients

Profile: Emily, 22, received a full-ride scholarship to medical school. Her parents’ 529 has $80,000, opened when she was 3 years old.

Situation: Emily no longer needs the education funds, but taking a non-qualified withdrawal would cost income tax plus 10% penalty on the $40,000 in earnings.

Solution: Roll $35,000 to Emily’s Roth IRA over 5 years. The remaining $45,000 can fund a sibling’s education or transfer to grandchildren.

Tax Savings: Avoids roughly $6,000-$10,000 in federal taxes and penalties on the rollover portion.

Scenario 2: Overfunded Accounts from Multiple Contributors

Profile: Marcus, 24, has $120,000 across three 529 accounts (parents and both sets of grandparents). He attended community college and state university, spending only $50,000.

Situation: $70,000 in excess funds with no other family beneficiaries who need the money.

Solution: Roll $35,000 to Marcus’s Roth IRA. Use remainder for graduate school, change beneficiaries to future children, or accept the penalty on the rest.

Long-term Value: That $35,000 at age 24, growing at 7% for 41 years, becomes approximately $530,000 tax-free at age 65.

Scenario 3: High-Earning Young Professionals

Profile: Priya, 28, is a software engineer earning $220,000. She’s above Roth IRA income limits and her employer’s 401(k) doesn’t allow after-tax contributions for a Mega Backdoor Roth.

Situation: Priya’s parents have a 529 opened when she was born with $40,000 remaining (she received merit scholarships).

Solution: Roll $7,000 annually from the 529 to her Roth IRA. This bypasses the income limits that otherwise block her from Roth contributions.

Strategic Value: One of the few paths to Roth IRA contributions for high earners without access to mega backdoor strategies.

When the Strategy Offers Less Value

Not every family with a 529 should pursue rollovers. These situations offer minimal or questionable benefits:

Limited Value Scenarios:

- Young accounts: If the 529 is less than 10 years old, you’re still 5+ years from eligibility. Other uses may make more sense.

- No earned income: A beneficiary without a job can’t roll over anything. Waiting years for employment delays the strategy significantly.

- California residents: The state tax and 2.5% penalty on earnings may negate much of the benefit.

- Need funds for education: Don’t starve current education expenses to preserve rollover options.

- Better alternatives available: Changing beneficiaries to younger siblings or future grandchildren may provide more total value.

Grandparent Planning Opportunities

The FAFSA Simplification Act, effective for the 2024-2025 academic year, eliminated the previous treatment of grandparent-owned 529 distributions as countable student income. This removes a major barrier that previously discouraged grandparent funding.

Grandparents can now contribute aggressively to 529 accounts knowing that:

- Distributions won’t hurt the grandchild’s financial aid eligibility

- Any excess funds can roll to the beneficiary’s Roth IRA

- The $35,000 rollover provides a safety valve if college costs are overestimated

Combined with 5-year gift tax averaging (contributing up to $95,000 at once, or $190,000 for married couples), grandparents can front-load 529 contributions and let compounding work longer while maintaining the rollover escape hatch.

Planning for Future Generations?

The 529 to Roth rollover is just one piece of multi-generational wealth transfer. Learn how Roth IRAs compare to Traditional IRAs for long-term tax planning.

Common Mistakes to Avoid

The combination of incomplete IRS guidance and complex interacting rules creates multiple opportunities for costly errors. Here are the most common mistakes and how to avoid them.

Mistake 1: Taking a Distribution Instead of Direct Rollover

The single most expensive error is taking a 529 distribution personally with plans to deposit it into a Roth IRA. This doesn’t work. The distribution becomes non-qualified the moment funds hit your personal account, triggering federal and state income tax on earnings plus the 10% penalty.

Always: Request a direct trustee-to-trustee transfer. The money moves directly from the 529 administrator to the Roth IRA custodian.

Mistake 2: Exceeding the Annual Roth IRA Contribution Limit

The 529 rollover counts against your total Roth IRA contribution limit for the year. If you contribute $5,000 directly to your Roth and then roll over $7,000 from a 529, you’ve made $12,000 in contributions against a $7,000 limit. That’s a $5,000 excess contribution subject to a 6% annual penalty until corrected.

Always: Coordinate 529 rollovers with direct Roth IRA contributions to stay within annual limits.

Mistake 3: Ignoring the Earned Income Requirement

Having an eligible 529 account doesn’t automatically allow rollovers. The beneficiary must have earned income at least equal to the rollover amount. A college student without summer job income can’t roll over anything that year.

Always: Verify the beneficiary’s earned income before initiating any rollover.

Mistake 4: Rolling Over Recent Contributions

Contributions made within the last 5 years are not eligible for rollover. Rolling them over anyway creates a non-qualified distribution on that portion. Some 529 providers may not have systems sophisticated enough to track contribution ages, shifting the compliance burden entirely to you.

Always: Maintain detailed contribution records and calculate your 5-year-seasoned balance before each rollover.

Mistake 5: Exceeding the $35,000 Lifetime Limit

No centralized tracking system exists for 529 rollovers. If multiple family members have 529 accounts for the same beneficiary, it’s easy to accidentally exceed the $35,000 lifetime cap without realizing it.

Always: Coordinate among all 529 account owners for each beneficiary. Maintain a family-wide tracking spreadsheet.

Mistake 6: Assuming Beneficiary Changes Are Safe

Until the IRS clarifies otherwise, assume that changing a 529 beneficiary resets the 15-year clock. Converting an older sibling’s account to a younger sibling may disqualify it from rollovers for another 15 years.

Always: Consider opening a new 529 account for each child at birth rather than relying on beneficiary changes later.

Mistake 7: Forgetting State Tax Consequences

Federal tax-free treatment doesn’t guarantee state tax-free treatment. Residents of recapture states may owe back previously claimed deductions. California residents face state income tax plus an additional penalty on earnings.

Always: Research your state’s treatment before executing any rollover. Consult a local tax professional if guidance is unclear.

Documentation Checklist: Keep these records indefinitely:

- Original 529 account opening confirmation

- Annual contribution statements

- Rollover request confirmations

- Form 1099-Q from each rollover

- Form 5498 from Roth IRA custodian

- Running total of lifetime rollovers per beneficiary

Frequently Asked Questions

The 529 to Roth IRA rollover provision became effective January 1, 2024. It was created by Section 126 of the SECURE 2.0 Act, which passed on December 29, 2022. Accounts that were already 15+ years old became immediately eligible on January 1, 2024, assuming all other requirements were met.

No. The Roth IRA must be in the beneficiary’s name. A parent cannot roll 529 funds into their own Roth IRA. If you’re the 529 account owner and your child is the beneficiary, the rollover must go to a Roth IRA owned by your child. The beneficiary must also have earned income equal to or greater than the rollover amount.

The $35,000 lifetime limit applies per beneficiary, not per account. If a child has multiple 529 accounts (from parents, grandparents, or different state plans), the combined lifetime rollovers across all accounts cannot exceed $35,000. There is no centralized tracking system, so families must coordinate and maintain their own records.

The IRS has not issued guidance on this question. The conservative consensus among financial planning experts is to assume yes, changing the beneficiary likely resets the 15-year account age requirement. Until official guidance confirms otherwise, treat any beneficiary change as starting a new 15-year countdown.

Yes, but the combined total cannot exceed the annual Roth IRA contribution limit ($7,000 for 2025, $8,000 if age 50+). For example, if you contribute $4,000 directly to your Roth IRA, you can roll over a maximum of $3,000 from a 529. The rollover counts as a contribution, not a separate category.

Qualifying 529 to Roth IRA rollovers require no reporting on your federal tax return. The 529 plan issues Form 1099-Q with Box 4b checked to indicate the transfer. The Roth IRA custodian reports the contribution on Form 5498 (Box 10). Retain these forms but don’t report the rollover as income. State reporting may differ.

Amounts rolled over in excess of the $35,000 lifetime limit would be treated as excess Roth IRA contributions, subject to a 6% annual penalty until corrected. You would need to withdraw the excess contribution and its earnings before your tax filing deadline to avoid the penalty. Careful tracking is essential since no central database exists.

Both contributions and their attributable earnings can be rolled over, provided they meet the 5-year seasoning requirement. The entire value of contributions made more than 5 years ago, including growth, is eligible. Only contributions made within the last 5 years (and their earnings) are excluded.

No. The $35,000 lifetime limit is a fixed amount and is not indexed to inflation. Unlike contribution limits for 401(k)s and IRAs, which typically increase annually, the 529 to Roth IRA rollover cap will remain $35,000 unless Congress passes new legislation to change it.

The industry consensus is no, rolling from one state’s 529 plan to another does not reset the 15-year account age requirement. Virginia’s Invest529 explicitly states this in their guidance. However, the new plan won’t have records of your original opening date, so maintain documentation of when the original account was established.