CEO, The Savvy Investor Limited · Investment Educator

Updated: 27 November 2025 · Reading time: 12 minutes

⚠️ Important: This article provides educational information about ISAs and SIPPs for UK residents. It is not personalised financial advice. Your optimal choice depends on your individual circumstances, including income, tax bracket, retirement goals, and when you need access to funds. Tax treatment depends on individual circumstances and may change. ISA and pension rules are based on current legislation (2025/26 tax year) and may change in future. Please consult with an FCA-authorised financial adviser before making investment decisions.

ISA or SIPP? The November 2025 Budget fundamentally changed this decision. Pensions will be brought into inheritance tax from April 2027, the Cash ISA allowance for under-65s dropped to £12,000, and salary sacrifice benefits face restrictions from 2029. This guide breaks down exactly what changed, what stayed the same, and how to choose between these two tax-advantaged accounts based on your specific situation. Use our interactive calculator to see which wrapper builds more wealth for you.

Contents

- TL;DR: Quick Answers to the ISA vs SIPP Question

- Three Budget Changes That Reshape Retirement Planning

- ISA Rules for 2025/26: What You Need to Know

- SIPP Rules for 2025/26: Tax Relief and Limits

- Tax Efficiency at Different Income Levels

- Interactive ISA vs SIPP Calculator

- The Lifetime ISA: A Middle Ground Option

- Decision Framework: Who Should Choose What

- Frequently Asked Questions

TL;DR: Quick Answers to the ISA vs SIPP Question

Short on time? Here are the key answers based on the latest rules:

📊 The Quick Decision Guide

Choose a SIPP if:

- You pay 40% or 45% tax and want maximum tax relief

- You won’t need the money before age 57 (from 2028)

- Your employer offers salary sacrifice (save 8% National Insurance too)

- You earn between £100,000-£125,140 (60% effective relief)

Choose an ISA if:

- You pay 20% basic rate tax (the SIPP advantage is smaller)

- You might need money before age 55/57

- You want certainty of zero tax on withdrawals

- You’re planning for early retirement or a house deposit

Use BOTH if: You’ve maximised employer pension matching and still have money to invest. See the full decision framework.

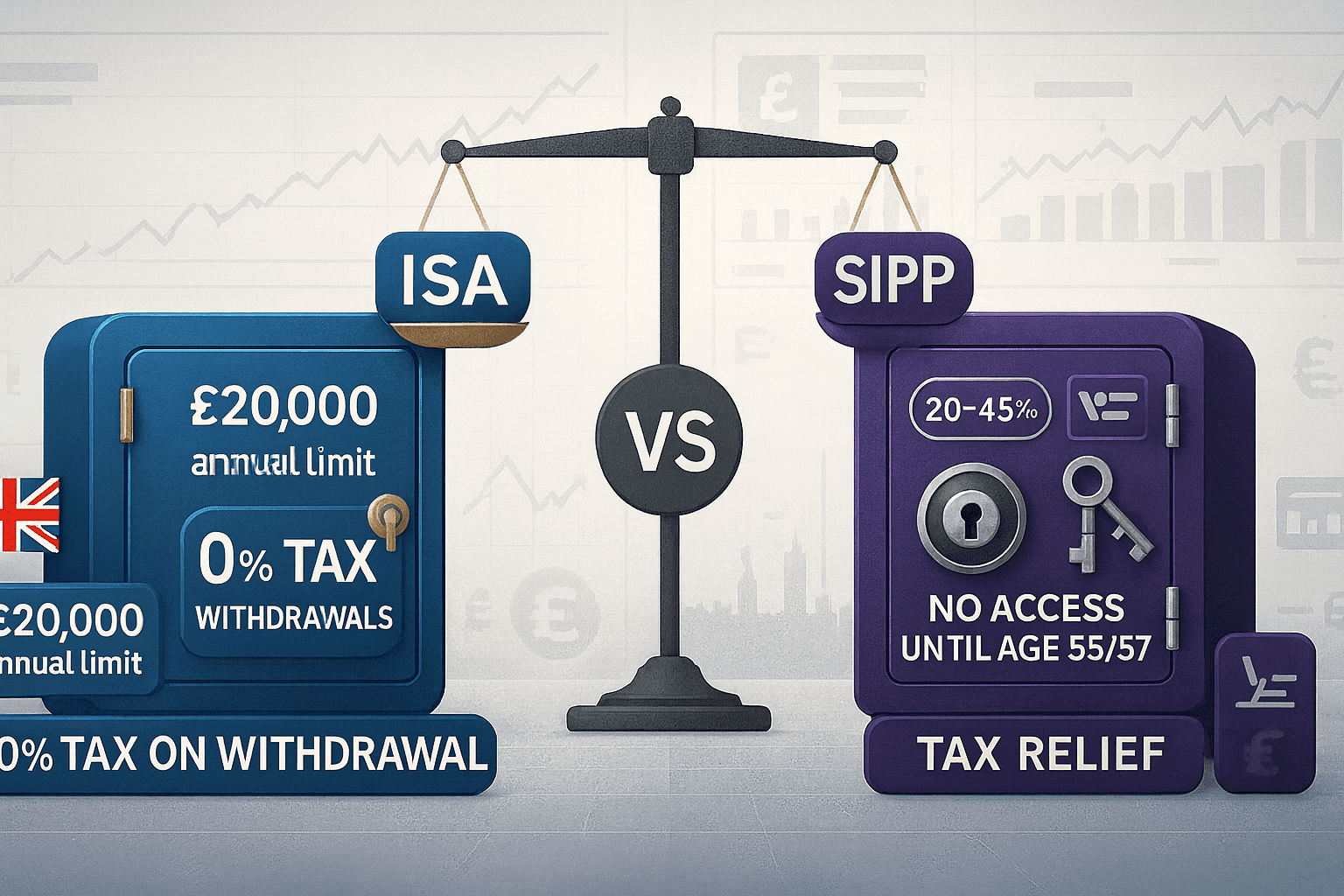

| Feature | ISA (Stocks & Shares) | SIPP |

|---|---|---|

| Annual Limit (2025/26) | £20,000 | £60,000 (or 100% of earnings) |

| Tax Relief on Contributions | None | 20%, 40%, or 45% |

| Investment Growth | Tax-free | Tax-free |

| Withdrawals | 100% tax-free, any time | 25% tax-free, 75% taxed as income (from age 55/57) |

| Access Age | Any age | 55 now, 57 from April 2028 |

| Inheritance Tax (from April 2027) | Part of estate | Part of estate (new change) |

| National Insurance Savings | None | Yes (via salary sacrifice, until 2029 cap) |

| Best For | Flexibility, early access, basic-rate taxpayers | Maximum tax relief, traditional retirement |

Want the full picture? Keep reading for detailed analysis of how the November 2025 Budget affects your choice, plus an interactive calculator to model your specific situation.

Three Budget Changes That Reshape Retirement Planning

The Autumn Budget delivered on 26 November 2025 introduced significant changes affecting both pensions and ISAs. While the headline numbers (£20,000 ISA allowance, £60,000 pension allowance, 25% tax-free lump sum) remain unchanged for 2025/26, three major announcements will reshape planning over the coming years.

1. Pensions Brought Into Inheritance Tax from April 2027

This is the biggest change to pension planning in a generation. From 6 April 2027, most unused defined contribution pension funds will be included in the deceased’s estate for inheritance tax purposes.

⚠️ The New Pension IHT Rules

The standard 40% IHT rate will apply above the nil-rate band (£325,000), with the residence nil-rate band (up to £175,000) also applicable where conditions are met. Spousal transfers remain exempt, so benefits passing to a surviving spouse or civil partner continue to escape IHT entirely.

Government estimates suggest approximately 10,500 estates will face new IHT liability annually. That represents roughly 1.5% of UK deaths. Around 38,500 estates will pay more IHT than previously, with an average increase of £34,000 when pension assets are included.

A significant concern remains unresolved: for deaths after age 75, beneficiaries may face both 40% IHT and income tax on inherited pension payments. This could create effective tax rates up to 67% on inherited pension wealth. HMRC is consulting on this double taxation issue.

What This Means for ISA vs SIPP: Previously, the standard advice was “spend ISAs first in retirement, preserve pensions for inheritance.” That strategy loses much of its rationale from April 2027. Pensions will sit alongside ISAs within your estate for IHT calculations. The playing field is now more level for inheritance purposes, though SIPPs still win on accumulation tax efficiency.

2. Cash ISA Allowance Cut to £12,000 for Under-65s

From April 2027, savers under 66 will see their Cash ISA allowance reduced from £20,000 to just £12,000. Over-65s retain the full £20,000 Cash ISA allowance following advocacy from Martin Lewis and consumer groups.

The overall £20,000 ISA allowance remains unchanged. This means under-65s can still deploy the full £20,000, but a minimum of £8,000 must go into investment ISAs (Stocks & Shares, Innovative Finance, or Lifetime ISAs) rather than cash. Existing Cash ISA balances are protected, and only new contributions face the restriction.

💡 Practical Impact

For most readers of Savvy Investor Guide who are investing rather than just saving in cash, this change has limited direct impact. If anything, it encourages more people toward Stocks & Shares ISAs, which typically deliver better long-term returns anyway. If you have been holding large cash balances in ISAs, consider whether a Stocks & Shares ISA might serve your long-term goals better.

3. Salary Sacrifice Capped from April 2029

Employee pension contributions made via salary sacrifice will only be exempt from National Insurance up to £2,000 annually from April 2029. Contributions above this threshold will attract employee NI (8% on earnings between £2,000-£50,270, 2% above) plus employer NI.

The Treasury expects this to raise £4.7 billion. For higher earners making large salary sacrifice contributions, the additional cost could be significant.

📊 Example: Salary Sacrifice After 2029

Someone earning £60,000 and sacrificing £10,000 into their pension currently:

- Now: Saves 8% employee NI (£800) plus their employer saves 15% employer NI (£1,500)

- From 2029: Only £2,000 exempt from NI. The remaining £8,000 attracts full NI charges

- Extra cost: Approximately £640 employee NI + £1,200 employer NI annually

Strategic response: If you have capacity to maximise salary sacrifice contributions now, the next few years offer a window to lock in the full NI savings before the 2029 cap takes effect.

What Didn’t Change

Several anticipated changes did not materialise:

- The British ISA was scrapped: Jeremy Hunt’s proposed additional £5,000 allowance for UK investments was formally abandoned after industry pushback about complexity

- Lifetime ISA reforms failed to appear: Despite Treasury Select Committee calls for change, the punitive 25% withdrawal penalty and outdated £450,000 property cap remain in place

- The 25% tax-free pension lump sum survived: Pre-Budget speculation about cuts proved unfounded. The £268,275 maximum tax-free cash remains intact

New to UK Investing?

Learn the fundamentals with our comprehensive beginner’s guide

ISA Rules for 2025/26: What You Need to Know

An Individual Savings Account (ISA) is a tax-efficient wrapper for your investments or savings. Think of it as a protective shield around your money that stops HMRC from taxing your investment growth, dividends, or interest. You can open an ISA with most UK banks or investment platforms.

For investors, the most relevant type is a Stocks & Shares ISA, which lets you hold investments like index funds, individual shares, bonds, and ETFs. Every penny you make within the ISA wrapper is completely tax-free, and you can withdraw your money whenever you want without paying a penny in tax.

2025/26 ISA Allowances

📊 ISA Limits at a Glance

- Total ISA Allowance: £20,000 across all ISA types (frozen until April 2030)

- Lifetime ISA: £4,000 maximum (counts within the £20,000 total)

- Junior ISA: £9,000 separate allowance for under-18s

- Cash ISA (under 66, from April 2027): £12,000 maximum

You can split the £20,000 however you like between Cash ISAs, Stocks & Shares ISAs, Innovative Finance ISAs, and Lifetime ISAs. The £20,000 limit hasn’t changed since 2017, meaning inflation has gradually eroded its real value.

Types of ISA Available

Cash ISAs offer tax-free interest for those aged 18+ (raised from 16 in April 2024), with FSCS protection up to £85,000. Best for emergency funds or short-term savings you can’t afford to lose.

Stocks & Shares ISAs shelter investments in shares, funds, bonds, and investment trusts from UK dividend tax and capital gains tax. Best for long-term wealth building. See our guide to index funds vs actively managed funds for investment ideas.

Innovative Finance ISAs permit investment in peer-to-peer lending and crowdfunding debentures. No FSCS protection and potentially lengthy withdrawal timescales. Higher risk than other ISA types.

Lifetime ISAs require opening between ages 18-39, permit contributions until 50, and provide a 25% government bonus (up to £1,000 annually) for first-home purchases up to £450,000 or retirement withdrawals from age 60. More on this in the Lifetime ISA section.

April 2024 Rule Changes (Still in Effect)

Several improvements from April 2024 continue to benefit ISA holders:

- Multiple ISAs of the same type: You can now pay into multiple ISAs of the same type within a single tax year. Want three different Cash ISAs with different providers? That’s now allowed

- Partial transfers: You can now partially transfer current-year ISAs. Previously, the entire current-year balance had to move together

- Dormant accounts: ISA accounts no longer require reapplication after a year of inactivity

Flexible ISA Rules

Some ISA providers offer “flexible” ISAs that allow you to withdraw and replace money within the same tax year without consuming additional allowance. This is useful for temporary access to funds.

Example: You’ve contributed £15,000 this tax year. You withdraw £5,000 for emergency car repairs. With a flexible ISA, you can replace that £5,000 before the tax year ends without it counting against your allowance. Without flexibility, you’d only have £5,000 of allowance remaining.

Major providers offering flexibility: Barclays, Nationwide, Skipton, TSB, and Virgin Money (easy-access only).

Notable providers without flexibility: HSBC, Santander, NatWest, and NS&I.

Always verify with your provider, as the feature varies even between different account types at the same institution.

Transfer Rules

You can transfer existing ISAs between providers or between different ISA types. Critical points:

- Always use official transfer processes. Never withdraw and redeposit manually, which permanently forfeits tax-free status

- Cash ISA transfers must complete within 15 business days

- Stocks & Shares and other types within 30 calendar days

- All ISA managers must allow transfers out, though accepting transfers in remains optional

- Previous years’ ISAs can transfer without affecting current-year allowance

The ISA Advantage: Complete Withdrawal Flexibility

The beauty of ISAs is their simplicity. Put money in, invest it, watch it grow tax-free, take it out whenever you need it. No complicated tax forms. No withdrawal restrictions. No penalties. Just straightforward tax-free investing.

💡 Real-World Example

Sophie invests £10,000 in an ISA at age 30. By age 60, assuming 7% annual growth, it grows to £76,123. If this were in a regular brokerage account, she’d owe capital gains tax on the £66,123 gain. At 20% CGT (above the annual exemption), that’s potentially £13,225 lost to tax. In an ISA? She keeps every penny of the £76,123.

Need money for a house deposit? Emergency fund? Career break? Early retirement? Your ISA is accessible any time with no penalties or taxes. This flexibility is the ISA’s main advantage over pensions.

SIPP Rules for 2025/26: Tax Relief and Limits

A Self-Invested Personal Pension (SIPP) is a type of personal pension that gives you full control over how your retirement money is invested. Unlike workplace pensions with limited fund choices, a SIPP lets you pick from thousands of investments across UK and international markets.

The government encourages pension saving by providing tax relief on contributions. When you pay into a SIPP, HMRC automatically tops up your contribution based on your tax rate. A basic-rate taxpayer putting in £800 sees it become £1,000 after tax relief. Higher and additional-rate taxpayers get even more back.

Annual Allowance: £60,000

The annual allowance for 2025/26 is £60,000, covering all pension contributions including employer contributions, personal contributions, and tax relief. If you earn less than £60,000, your maximum is capped at 100% of your earnings.

📊 SIPP Contribution Limits 2025/26

- Standard Annual Allowance: £60,000 (or 100% of earnings if lower)

- Tapered Allowance (high earners): Reduces from £60,000 down to £10,000 minimum

- Money Purchase Annual Allowance: £10,000 (once you’ve flexibly accessed pension benefits)

- Non-earner/low-earner allowance: £3,600 gross (£2,880 net) regardless of earnings

Tapered Annual Allowance for High Earners

If your total income exceeds certain thresholds, your annual allowance reduces:

- Threshold income above £200,000 AND adjusted income above £260,000: allowance tapers

- Reduces by £1 for every £2 of adjusted income over £260,000

- Minimum tapered allowance: £10,000 (reached at adjusted income of £360,000 or above)

Adjusted income includes your earnings, employer pension contributions, and certain other income. If you’re near these thresholds, speak to a financial adviser about optimising your contributions.

Tax Relief Mechanics

Pension tax relief works through two systems:

Relief at source: Your pension provider claims 20% basic-rate relief from HMRC automatically. You pay £80, and £100 enters your pension. Higher and additional rate taxpayers claim the extra 20-25% via self-assessment or through HMRC’s online service (launched February 2025).

Net pay arrangements: Contributions are deducted before tax calculation, providing full marginal rate relief immediately without additional claims. Common in workplace pension schemes.

Effective Tax Relief Rates:

- Basic rate (20%): 20% relief

- Higher rate (40%): 40% relief

- Additional rate (45%): 45% relief

- £100k-£125,140 earners: 60% effective relief (due to personal allowance restoration)

- Scottish taxpayers face different bands, with top rate (48%) receiving 28% additional relief beyond the automatic 20%

The £100,000-£125,140 Sweet Spot

Earners between £100,000 and £125,140 receive exceptional pension benefits. The personal allowance (£12,570) is lost at £1 for every £2 earned over £100,000, creating a 60% marginal tax rate in this band. Pension contributions can restore the personal allowance.

💡 Example: The 60% Tax Relief

Marcus earns £125,140. By contributing £25,140 to his pension:

- He receives standard tax relief (40% on most of the contribution)

- His taxable income drops to £100,000

- His £12,570 personal allowance is fully restored

- Effective cost: only £15,084 for a £25,140 pension contribution

- That’s an immediate 60% return before any investment growth

If you earn between £100,000 and £125,140, pension contributions are by far the most tax-efficient savings vehicle available.

Tax-Free Lump Sum Rules

When you access your pension, you can take 25% as a tax-free lump sum. The maximum tax-free cash is capped at £268,275 (the Lump Sum Allowance). This cap only affects those with total pension values exceeding £1,073,100.

Access begins at age 55, rising to 57 from 6 April 2028. If you were born before 6 April 1971, you’ll already be 57 by the implementation date, so this change won’t affect you.

Carry Forward: Access Previous Years’ Allowances

You can carry forward unused annual allowance from the previous three tax years. This powerful rule can enable substantial contributions in a single year.

📊 Maximum Possible Contribution 2025/26

If you have unused allowances from previous years:

- 2025/26 current year: £60,000

- 2024/25 carry forward: £60,000

- 2023/24 carry forward: £60,000

- 2022/23 carry forward: £40,000

- Potential maximum: £220,000 in one tax year

Conditions: You must have been a member of a UK registered pension scheme in each year, personal contributions are limited to 100% of current-year earnings, and you must use current-year allowance first.

Carry forward is powerful when you receive a large bonus, sell a business, or have a high-income year. It lets you shelter substantial sums from tax while building retirement wealth.

Lifetime Allowance: Abolished

The Lifetime Allowance was fully abolished on 6 April 2024. There’s no longer a cap on the total value of your pension pots. The old £1,073,100 limit has been scrapped entirely.

It’s been replaced by the Lump Sum Allowance (£268,275 maximum tax-free cash) and Lump Sum and Death Benefit Allowance (£1,073,100 for combined tax-free lump sums and death benefits). Those with existing protections retain enhanced limits.

The SIPP Trade-off: Access Restrictions

The catch with pensions? Your money is locked until minimum pension age (currently 55, rising to 57 in 2028). Early access is only permitted in exceptional circumstances like terminal illness. This restriction is intentional. Pensions are designed for retirement, not flexible saving.

If you might need money at age 50, your SIPP is essentially inaccessible. This is why balancing pension contributions with ISA savings matters. You need accessible wealth for life’s unexpected events.

Tax Efficiency at Different Income Levels

The fundamental tax comparison favours pensions for accumulation in most scenarios, but outcomes depend heavily on your tax rates when contributing versus withdrawing.

Higher-Rate Taxpayers: Clear SIPP Advantage

If you pay 40% tax, the pension advantage is substantial. Research from Evelyn Partners shows a higher-rate taxpayer investing £10,000 achieves a pension value of £40,089 after 20 years at 6% returns, versus £32,071 in an ISA. That’s 25% more wealth from £2,500 less actual cost (since a £10,000 gross pension contribution costs only £6,000 net for a 40% taxpayer).

HMRC data reveals six out of seven higher-rate taxpayers become basic-rate taxpayers in retirement. This means you receive 40% relief on contributions but pay only 20% tax on withdrawals. The maths strongly favours pensions.

📊 Higher-Rate Taxpayer Example

Sarah earns £70,000 and contributes £10,000 gross to her SIPP:

- She pays £6,000 from take-home pay (after 40% effective relief)

- £10,000 enters her pension

- After 20 years at 7% growth: approximately £38,700

- 25% tax-free (£9,675) plus 75% taxed at 20% in retirement (£21,765 net)

- Total received: £31,440

The same £6,000 in an ISA at 7% over 20 years grows to £23,218. The SIPP delivers 35% more wealth.

Basic-Rate Taxpayers: More Nuanced

For basic-rate taxpayers, the calculation is closer. The 20% pension tax relief roughly matches the ISA’s tax-free withdrawal benefit in gross terms. The pension typically edges ahead due to employer matching (where available) and National Insurance savings from salary sacrifice.

Without employer contributions, the decision hinges on whether you’ll remain a basic-rate taxpayer in retirement. If you expect significant pension income, ISA flexibility becomes more valuable.

When ISAs May Prove Better

ISAs can be more tax-efficient than pensions in specific scenarios:

- You’ll be a higher-rate taxpayer in retirement: Large defined benefit pensions, property income, or continued work could push you into 40% tax on pension withdrawals

- You need early access: If there’s any chance you’ll need funds before age 55/57, ISAs are your only option

- Tax certainty matters: ISA withdrawals are always tax-free, regardless of future tax rules. Pension tax treatment could change

- You’re self-employed with variable income: ISAs don’t have the pension allowance’s earnings restriction

Salary Sacrifice: The Hidden Superpower (Until 2029)

If your employer offers salary sacrifice, pension contributions become even more attractive. You save National Insurance (8% for most employees) on top of income tax relief.

Salary Sacrifice Example:

Emma earns £50,000 and sacrifices £5,000 into her pension:

- Income tax saved (40%): £2,000

- Employee NI saved (8%): £400

- Employer may pass through their NI savings too (15%): £750

- Total pension value: Up to £6,150 from £2,600 net cost

From April 2029, only the first £2,000 sacrificed will be exempt from NI. Maximise this benefit while you can.

The Complete Tax Picture

| Tax Stage | ISA | SIPP |

|---|---|---|

| Contributions | From post-tax income (no relief) | 20-45% tax relief (up to 60% for £100k-£125k earners) |

| Growth | Tax-free | Tax-free |

| Dividends | Tax-free | Tax-free |

| Capital gains | Tax-free | Tax-free |

| Withdrawals | 100% tax-free, any amount | 25% tax-free, 75% taxed as income |

| Effect on benefits | No impact on means-tested benefits | Pension income counts for benefit calculations |

| Personal allowance | Withdrawals don’t affect it | Large withdrawals could reduce personal allowance |

Interactive ISA vs SIPP Calculator

Use this calculator to compare projected outcomes based on your specific situation. Enter your details to see which account builds more after-tax wealth for your circumstances.

ISA vs SIPP Comparison Calculator

Compare after-tax retirement values based on your specific situation

Your Results

📘 ISA Scenario

Total Contributions: £

Investment Growth: £

Final Value at Withdrawal: £

Net After-Tax Value: £

📗 SIPP Scenario

Your Net Cost (after tax relief): £

Government Tax Relief: £

Total in Pension: £

Value Before Withdrawal: £

25% Tax-Free Lump Sum: £

Remaining 75% After Tax: £

Net After-Tax Value: £

🏆 Recommendation

This calculator provides educational estimates only. Actual returns vary and are not guaranteed. Assumes contributions remain constant, uses compound annual growth, and applies simple tax calculations. Does not account for inflation, changes in tax legislation, or individual circumstances. Consult an FCA-authorised financial adviser for personalised advice.

The Lifetime ISA: A Middle Ground Option

The Lifetime ISA deserves special mention as a hybrid option offering some SIPP benefits (government bonus) with more ISA-like flexibility (access from age 60 or for first home purchase).

Lifetime ISA Key Features

📊 LISA at a Glance

- Annual contribution limit: £4,000 (counts within your £20,000 ISA allowance)

- Government bonus: 25% on contributions (maximum £1,000 per year)

- Age restrictions: Open between 18-39, contribute until age 50

- Qualifying withdrawals: First home purchase (up to £450,000) or from age 60

- Non-qualifying withdrawal penalty: 25% charge

The 25% government bonus is effectively equivalent to basic-rate pension tax relief. Contribute £4,000, receive £1,000 bonus, giving you £5,000 total. This makes the LISA attractive for basic-rate taxpayers who want flexibility.

The Penalty Trap

The 25% withdrawal penalty on non-qualifying withdrawals is harsh and often misunderstood. You don’t just lose the bonus. You lose more than you put in.

⚠️ How the LISA Penalty Works

You deposit £4,000 and receive £1,000 bonus (total £5,000). If you withdraw for non-qualifying purposes:

- 25% penalty on £5,000 = £1,250 charge

- You receive £3,750

- You’ve lost £250 of your own money

The penalty is 6.25% of your original contribution plus the entire bonus. Only use a LISA if you’re certain about the intended purpose.

The £450,000 property price cap, unchanged since 2017, increasingly excludes buyers in London and the South East. The Treasury Select Committee called this “not fit for purpose,” but the November 2025 Budget made no changes.

When LISA Makes Sense

The LISA works well for:

- Basic-rate self-employed workers without access to employer pensions (25% bonus equals 20% tax relief, plus tax-free withdrawals)

- First-time buyers confident of purchasing under £450,000

- Those supplementing pension savings after maximising employer matching

As Martin Lewis advises: “As a general rule, a pension will likely beat a LISA as a first place to save for retirement funds for anyone who is employed or anyone who is a higher- or top-rate taxpayer.”

LISA vs SIPP Comparison

| Feature | Lifetime ISA | SIPP |

|---|---|---|

| Annual limit | £4,000 | £60,000 |

| Government benefit | 25% bonus | 20-60% tax relief |

| Access age | 60 (or first home) | 55 (57 from 2028) |

| Withdrawal tax | Tax-free | 75% taxed as income |

| NI savings | No | Yes (via salary sacrifice) |

| Employer matching | Not available | Often available |

Many young higher-rate taxpayers use both: £4,000 in a Lifetime ISA for the bonus (especially if planning to buy a first home), then maximise workplace pension through salary sacrifice for superior tax relief. This combines the best of both options.

Decision Framework: Who Should Choose What

The ISA vs SIPP decision isn’t just about tax rates. It’s about your life stage, goals, and flexibility needs.

Choose a SIPP If You:

- Pay 40% or 45% tax: The tax relief is too valuable to ignore. A 40% taxpayer investing £10,000 in a SIPP only sacrifices £6,000 of take-home pay

- Earn £100,000-£125,140: The effective 60% tax relief from personal allowance restoration is unbeatable

- Won’t need the money until after 55/57: If retirement is your goal and you have other savings for emergencies, SIPPs make sense

- Have access to salary sacrifice: The additional National Insurance savings make workplace pension contributions incredibly tax-efficient

- Expect lower tax rates in retirement: Contributing at 40% and withdrawing at 20% delivers significant net tax savings

Choose an ISA If You:

- Pay 20% basic-rate tax: The SIPP advantage is smaller, and flexibility often wins

- Might need the money before 55: House deposit? Starting a business? Early retirement? ISAs provide complete flexibility

- Want tax certainty: ISA withdrawals are always tax-free, regardless of future tax rules or your circumstances

- Are self-employed with variable income: ISAs don’t have the £60,000 annual limit restriction tied to earnings

- Already have substantial pension savings: You might have enough pension provision and want accessible wealth for other goals

The Balanced Approach: Use Both

Rather than choosing one or the other, consider this prioritisation strategy:

💡 Recommended Priority Order

- Capture employer pension match first: This is free money. If your employer matches 5%, contribute at least 5%. Immediate 100% return plus tax relief

- Build emergency fund: 3-6 months’ expenses in accessible savings (not necessarily ISA, just accessible)

- Max out Lifetime ISA if eligible: If you’re under 40 and saving for a first home or retirement, the £1,000 annual bonus is hard to beat

- Additional SIPP if higher-rate taxpayer: Use salary sacrifice or personal contributions to maximise tax relief

- Remaining savings in regular ISA: For flexible, accessible wealth after maximising tax-efficient pension contributions

Age-Based Considerations

Under 35: Life is unpredictable. You might want to buy a house, change careers, start a business, or travel. ISAs often make more sense for flexibility. Exception: if you’re a 40% taxpayer with stable career trajectory, maximising employer pension match and using SIPPs strategically can work.

35-50: The sweet spot for SIPP contributions if you’re a higher-rate taxpayer. You’re established in your career, have likely bought property, and retirement is visible on the horizon. The tax relief is maximised and you won’t need the funds for 15-20 years.

Over 50: You’re approaching pension access age, making SIPPs more attractive even for basic-rate taxpayers. The short time until access reduces the flexibility disadvantage. Maximise pension contributions in your final working years to shelter income from tax.

Planning for Early Retirement (FIRE)

If you’re pursuing financial independence and early retirement, you need both accounts:

- ISA funds to bridge the gap between early retirement and pension access age

- SIPP funds to provide income from age 55/57 onwards

Example: Retire at 50, live on ISA withdrawals for 5-7 years, then access SIPP. This combines ISA flexibility with SIPP tax benefits. Higher-rate taxpayers should still maximise SIPP contributions during their career, just ensure adequate ISA savings exist for the bridging period.

Planning Early Retirement?

Our comprehensive FIRE guide covers exactly how much you need and which accounts to use

Frequently Asked Questions

Priority order for most people: (1) Employer pension match (free money plus tax relief), (2) Emergency fund in accessible savings, (3) Lifetime ISA if eligible for first home or retirement, (4) Additional SIPP if higher-rate taxpayer, (5) Regular ISA for flexible savings. Higher-rate taxpayers should generally prioritise SIPPs after employer match and emergency fund. Basic-rate taxpayers often benefit more from ISA flexibility unless retirement is close.

Yes, absolutely. ISAs and SIPPs have completely separate allowances. You can contribute up to £20,000 to ISAs and up to £60,000 to pensions in the same tax year (subject to earnings for pensions). Most people should use both to balance tax efficiency with flexibility. They serve different purposes and complement each other well.

ISAs: Form part of your estate. Subject to inheritance tax if your total estate exceeds the nil-rate band (£325,000, or £500,000 including main residence for direct descendants). Beneficiaries receive the value tax-free once distributed from your estate. SIPPs (from April 2027): Will also form part of your estate for IHT purposes. Spousal transfers remain exempt. Die before 75 and beneficiaries pay only IHT (if applicable). Die after 75 and they may pay both IHT and income tax on withdrawals, potentially creating 67% effective taxation. HMRC is consulting on this double taxation issue.

Early SIPP withdrawals are extremely difficult and usually prohibited. Exceptions exist only for terminal illness (life expectancy under 12 months) or if you have a very small pension pot under £10,000 and meet specific conditions. Unlawful early access can result in 55% unauthorised payment charges plus your marginal income tax rate. This is why maintaining ISA or emergency fund savings alongside pension contributions is critical. Never lock away money in a pension you might need before retirement age.

No. ISA savings and withdrawals have zero impact on State Pension eligibility or amount. State Pension entitlement depends solely on your National Insurance contribution record (you need 35 qualifying years for full State Pension). ISAs also don’t affect means-tested benefits like Pension Credit, unlike SIPP income which does count for benefit calculations.

No direct transfer exists. These are fundamentally different account types with different tax treatment. You could withdraw from an ISA (tax-free) and contribute to a SIPP (receiving tax relief), though this uses your annual allowances. Going the other way requires waiting until age 55/57, taking pension withdrawals (usually taxable), and then contributing to an ISA within your £20,000 annual limit. Always consider tax implications carefully before moving money between these account types.

ISAs are essential for early retirement before age 55 (57 from 2028) because SIPP money is completely inaccessible. The ideal early retirement strategy uses both: ISA funds to bridge the gap between retirement and pension access age, then SIPP funds from age 55/57. For example, retire at 50, live on ISA withdrawals for 5-7 years, then access SIPP. Higher-rate taxpayers should still maximise SIPP contributions during their career while ensuring adequate ISA savings exist for the bridging period.

The change means pensions will be included in your estate for inheritance tax purposes, removing their historic IHT advantage. Strategic responses include: taking tax-free cash and gifting (using the 7-year potentially exempt transfer rule), accelerating pension drawdown to fund lifetime gifts, considering annuity purchase (which removes capital from estates), and reviewing beneficiary nominations. Spousal transfers remain IHT-free. For those with estates approaching £2m (where the residence nil-rate band tapers), careful planning is now more important than ever.

Key Takeaways

The optimal ISA vs SIPP strategy depends on your individual circumstances, but several principles emerge clearly:

- Pensions retain their accumulation tax advantage: The combination of income tax relief (20-60% depending on marginal rate) and salary sacrifice NI savings creates returns impossible to replicate with ISAs

- Estate planning requires urgent attention before April 2027: The pension IHT change doesn’t make pensions “bad,” but it removes a historic advantage and requires strategy updates

- ISAs provide irreplaceable flexibility: For emergency funds, early retirement, house deposits, or uncertain timelines, ISA accessibility is invaluable

- Most people should use both: Workplace pensions to capture employer matching, additional pension contributions for tax relief, ISAs for accessibility and flexibility

The correct allocation between wrappers depends on marginal tax rate, employer benefits, retirement timeline, estate planning goals, and tolerance for reduced liquidity. Use the calculator above to model your specific situation.