⚠️ Educational Content Only: This article provides investment education for informational purposes. We are not regulated by the FCA or SEC and do not provide personalized financial, investment, tax, or legal advice. Property investment involves significant risks including loss of capital, illiquidity, and leverage risk. Returns vary significantly by market, property type, and individual circumstances. Consult qualified financial, tax, and legal professionals who can evaluate your complete financial situation before making investment decisions.

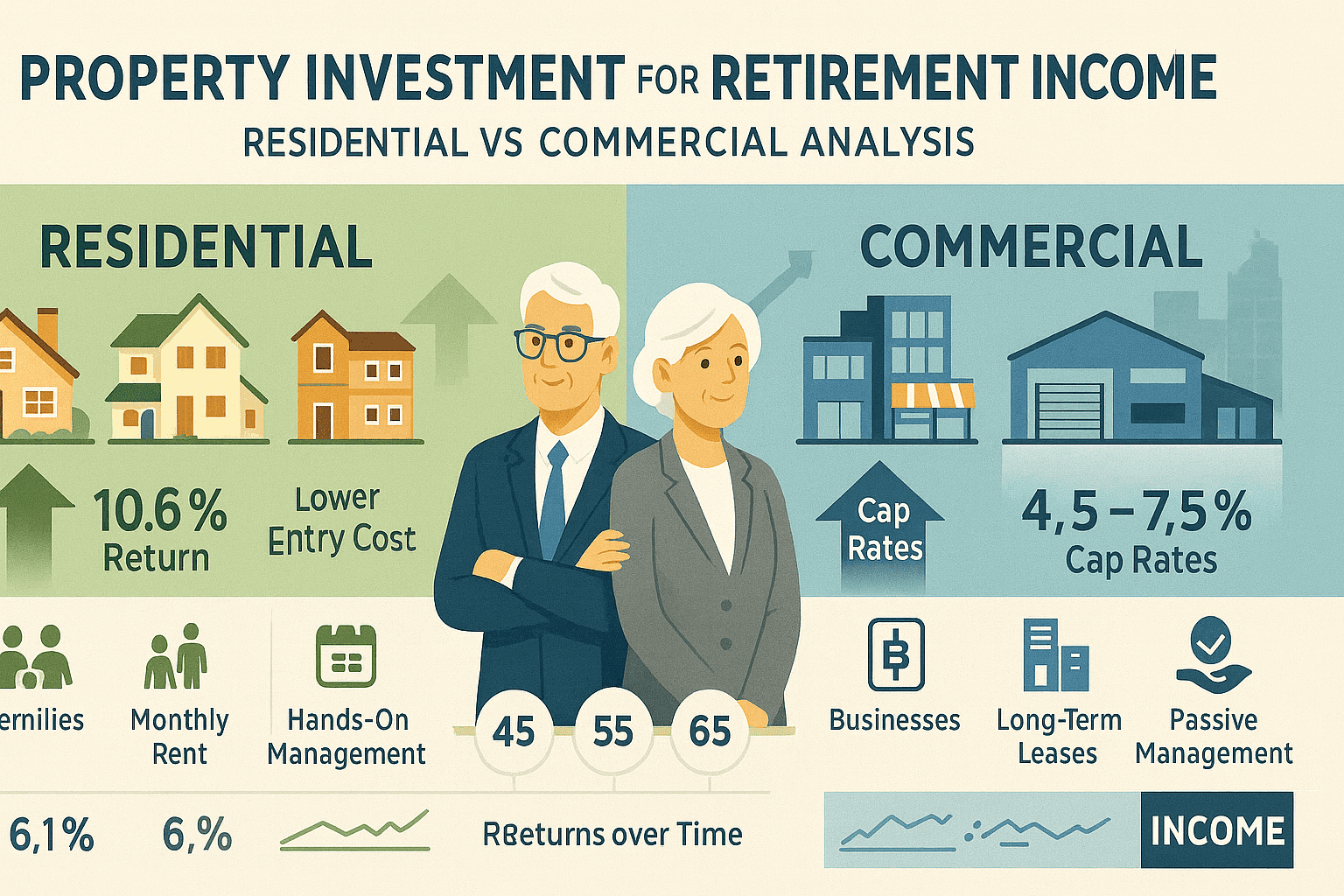

For investors aged 50 and older, property investment offers compelling retirement income opportunities through both residential and commercial real estate. Residential properties deliver consistent 10.6% annual returns with lower entry barriers, while commercial properties provide 4.5-7.5% current yields with professional tenant relationships. The strategic answer for most retirement investors combines both sectors alongside REITs for diversification and liquidity.

Contents

- Quick Decision Framework

- Returns Comparison: Residential vs Commercial vs REITs

- Risk Profiles and Entry Barriers

- Management Requirements and Time Commitments

- Tax Advantages for Retirement Planning

- Market Trends and Geographic Opportunities

- Expert Allocation Recommendations by Age

- Implementation Roadmap

- Frequently Asked Questions

Quick Decision Framework: Which Property Type Fits Your Retirement Goals?

Before diving into detailed analysis, here’s a quick framework to identify which property investment approach aligns with your retirement timeline, capital, and preferences:

| Your Situation | Best Fit | Why |

|---|---|---|

| Age 65+, Need immediate income Capital: £100k-£300k / $150k-$500k |

70% REITs + 30% Managed Residential | Immediate 3-4% REIT dividends, complete liquidity, minimal time commitment. Residential for diversification. |

| Age 55-65, Building retirement income Capital: £200k-£500k / $300k-$750k |

50% REITs + 35% Residential + 15% Commercial Partnerships | Balanced approach captures growth while maintaining manageable complexity. Commercial through partnerships reduces management burden. |

| Age 45-55, Peak earning years Capital: £300k+ / $500k+ |

40% REITs + 40% Direct Ownership + 20% Private Funds | Aggressive positioning for 8-12% returns. Time to recover from market volatility. Focus on wealth accumulation. |

| Limited time availability Full-time career or busy lifestyle |

80% REITs + 20% Professionally Managed Properties | REITs require zero time. Property management reduces direct properties to 5-10 hours monthly oversight. |

| Hands-on, enjoy property management Available time: 15+ hours/month |

30% REITs + 70% Direct Residential Properties | Direct management saves 8-12% in fees, potentially higher returns. REITs provide liquidity buffer. |

| Higher risk tolerance, seeking maximum income Experienced with leverage |

20% REITs + 40% Leveraged Residential + 40% Commercial | Leverage amplifies returns on residential. Commercial provides professional relationships and longer leases. REITs for emergency liquidity. |

💡 Key Insight: Most retirement investors should begin with REITs and single residential properties to gain experience before considering commercial investments. The combination of demographic tailwinds, tax advantages, and current market conditions creates compelling opportunities for patient capital positioned strategically across property types and geographies.

Let’s explore each property type in detail to understand how they fit into your retirement income strategy, starting with a comprehensive returns comparison.

Returns Comparison: Residential vs Commercial vs REITs

Understanding the return profiles of each property investment type helps you build a retirement portfolio aligned with your income needs and risk tolerance. Let’s examine the historical performance and income characteristics of each approach.

Residential Properties: Consistent Wealth Building

Residential properties demonstrate remarkable consistency for retirement investors. Over the past 20 years, single-family rentals delivered 10.6% annual returns including rental income, according to BiggerPockets analysis. This breaks down into:

- Property appreciation: 3.97% annually on average

- Rental income: Typically 4-6% of property value annually

- Mortgage paydown: 2-3% annual equity build (if leveraged)

When leveraged with typical 65% mortgage financing (35% down payment), returns increased to 11.7% annually through Arrived’s analysis. The resilience becomes particularly evident during economic downturns, with housing demand remaining relatively stable due to necessity-based consumption.

🏡 Residential Return Example:

Property Purchase: £200,000 / $300,000

Down Payment (25%): £50,000 / $75,000

Annual Rental Income (6%): £12,000 / $18,000

Annual Expenses (40% of rent): -£4,800 / -$7,200

Mortgage Payment (75% LTV, 6%): -£10,800 / -$16,200

Annual Cash Flow: -£3,600 / -$5,400 (first year, improves as rents increase)

Mortgage Paydown: £4,500 / $6,750

Appreciation (4%): £8,000 / $12,000

Total Return on £50k/$75k: £8,900 / $13,350 = 17.8% in year 1

For retirement investors already retired or within 5 years of retirement, you might prefer purchasing properties without leverage to generate immediate positive cash flow rather than maximizing returns through financing. This is where you can learn strategies for investing $50,000 in real estate that focus on cash flow generation.

Commercial Properties: Higher Immediate Income

Commercial real estate offers different but equally compelling benefits for retirement income. Revcaplending data shows commercial properties delivered 9.5% average annual returns over 20 years through the NCREIF Property Index, with some sectors significantly outperforming.

Current commercial cap rates (2025):

- Industrial: 4.5-6.0% (expected compression as fundamentals improve)

- Retail: 5.0-7.5% (varies significantly by location and tenant quality)

- Office: 5.5-8.0% (higher rates reflect work-from-home impacts)

- Multi-family (apartments): 4.0-5.5% (lower cap rates due to strong demand)

- Senior housing: 7.0-8.5% (attractive for demographic-focused investors)

The income component of commercial properties provides 5.22% annually on average according to Invesco research, making them particularly attractive for investors prioritizing immediate retirement income over long-term appreciation.

⚠️ Commercial Entry Barrier: While commercial properties offer higher immediate yields, they demand £200,000-£1,000,000+ / $300,000-$1,500,000+ initial investments with 20-40% down payments. This limits direct access to higher-net-worth retirees. However, commercial partnerships and funds provide exposure with lower minimums (typically £25,000-£100,000 / $50,000-$150,000).

For retirement investors with substantial capital looking to build a diversified property portfolio, understanding portfolio diversification strategies across both residential and commercial properties becomes essential.

REITs: Professional Management and Liquidity

Real Estate Investment Trusts bridge both sectors with professional management while eliminating direct property management responsibilities. REITs offer 3-4% current dividend yields according to Motley Fool analysis, with the significant advantage of immediate liquidity—you can sell shares within minutes during market hours.

Over 20 years, REITs averaged 11.8% annual returns through Master Multifamily’s comprehensive analysis, providing the highest total returns among real estate investment options while maintaining liquidity essential for retirement portfolios requiring flexible access to capital.

📊 REIT Advantages for Retirees:

- Immediate liquidity: Sell shares anytime during market hours

- Zero management: No tenant calls, no maintenance, no time commitment

- Diversification: Own hundreds of properties across sectors with single investment

- Professional oversight: Experienced management teams handle acquisitions and operations

- Regular income: Quarterly dividends provide predictable cash flow

- Lower minimums: Start with as little as £1,000 / $1,500

- Tax efficiency: Hold in Roth IRA or ISA/SIPP for tax-advantaged growth

Comparative Returns Summary Table

| Investment Type | Average Annual Return | Current Income Yield | Time to Liquidity |

|---|---|---|---|

| Direct Residential (Leveraged) | 11.7% | 4-6% | 30-90 days |

| Direct Residential (Cash) | 10.6% | 4-6% | 30-90 days |

| Direct Commercial | 9.5% | 5.0-7.5% | 90-180+ days |

| REITs (Diversified) | 11.8% | 3-4% | Same day (market hours) |

Critical insight for retirement planning: The current market environment creates unique opportunities. Commercial real estate cap rates are expected to compress 25-40 basis points across most sectors by end-2025 as recovery accelerates, while residential markets remain “largely frozen” with subdued 3% growth through 2025 due to elevated mortgage rates currently at 6.7%+.

This creates strategic timing opportunities: patient capital can acquire residential properties at favorable prices while mortgage rates normalize, while commercial properties offer attractive entry points before cap rate compression reduces yields.

Risk Profiles and Entry Barriers

Understanding risk becomes essential for retirement investors who have limited time to recover from market downturns or poor investment decisions. Different property types carry distinct risk profiles that align with various retirement timelines.

Volatility and Stability Comparison

Residential investments exhibit lower volatility with 6.1% annual standard deviation compared to commercial properties’ 15-20% volatility. This stability stems from consistent housing demand—people always need somewhere to live—and shorter vacancy periods averaging 30-60 days between tenants.

Commercial properties present higher short-term volatility but offer superior risk-adjusted returns through professional tenant relationships and longer lease terms of 3-10 years. The Sharpe ratio of 0.39 for commercial REITs outperforms direct real estate investments, indicating better risk-adjusted performance when professionally managed.

⚠️ Concentrated Tenant Risk:

Commercial properties carry significant concentrated tenant risk. Losing a single tenant in a small retail center can eliminate 25-50% of rental income for 3-12 months while you find replacement tenants. Residential properties spread risk across multiple shorter-term leases, though this requires more frequent turnover management.

Capital Requirements by Investment Type

Entry barriers create distinct investment thresholds that directly affect your retirement planning strategy:

| Investment Type | Minimum Capital Required | Down Payment | Additional Reserves |

|---|---|---|---|

| REITs | £1,000 / $1,500 | N/A (no financing) | None required |

| Residential Rental | £50,000-£150,000 $75,000-$225,000 |

15-25% | 6-12 months expenses (£5k-£10k / $7.5k-$15k per property) |

| Commercial Property | £200,000-£1,000,000+ $300,000-$1,500,000+ |

20-40% | 12-18 months expenses (£15k-£50k+ / $25k-$75k+) |

| Commercial Partnerships/Funds | £25,000-£100,000 $50,000-$150,000 |

N/A (pooled investment) | None required |

For investors with £50,000 / $75,000 available capital, strategic property investment approaches typically focus on residential rentals or REIT diversification rather than attempting commercial property ownership.

Financing Considerations for Retirement-Age Investors

For investors aged 50+, financing becomes increasingly challenging as traditional employment income verification becomes difficult approaching or during retirement. However, several alternatives exist:

- Asset-based lending: Uses investment portfolio value rather than W-2 income

- Portfolio loans: Private lenders evaluate entire financial picture

- Seller financing: Direct negotiation with property owners (typically 10-20% of transactions)

- SBA 504 loans: Up to 90% financing for owner-occupied commercial properties

- Cash purchases: Many retirees use proceeds from IRA distributions or existing home equity

💡 Self-Directed IRA Strategy:

Self-directed IRAs allow direct property investment within retirement accounts with strict compliance rules. All income and expenses must flow through the IRA, and you cannot personally use the property. Debt-financed portions generate Unrelated Business Income Tax (UBIT). For most retirees, this complexity favors holding REITs in Roth or Traditional IRAs while keeping direct properties in taxable accounts to optimize tax efficiency.

🏠 Build Your Property Investment Portfolio

Learn proven strategies for residential and commercial property investing. Get weekly property insights, rental income strategies, and retirement planning guidance.

Management Requirements and Time Commitments

The time and effort required to manage different property types directly affects whether property investment fits your retirement lifestyle. Let’s examine the realistic management burden for each approach.

Time Commitments by Property Type

Residential properties require 5-15 hours monthly per property for direct management, involving:

- Monthly rent collection and accounting

- Frequent maintenance requests (average 2-5 per month)

- Annual tenant turnover (30-50% turnover rate)

- 24/7 availability expectations for emergencies

- Property inspections (quarterly recommended)

Commercial properties require 2-8 hours monthly with significantly more professional relationships:

- Business-hour communications only

- Tenants handle basic maintenance responsibilities

- 3-10 year lease terms (minimal turnover)

- Professional tenant relationships

- Quarterly review meetings

REITs require zero time commitment—simply collect quarterly dividends and monitor performance annually.

Professional Property Management Costs

Hiring professional management transforms residential properties into relatively passive investments at the following costs:

| Management Fee Type | Residential | Commercial |

|---|---|---|

| Monthly Management Fee | 8-12% of collected rent | 4-8% of collected rent |

| Leasing Fee (new tenant) | 50-100% of first month’s rent | 3-6% of total lease value |

| Annual Cost (£2,000/$3,000 monthly rent) | £2,920-£4,880 $3,500-$7,300 |

£2,320-£4,640 $2,900-$6,900 |

| Typical Time Reduced To | 5-10 hours monthly (oversight) | 2-5 hours monthly (oversight) |

Consider professional management if:

- You live more than 30 minutes from the property

- You value your time at more than £20-30 / $25-40 per hour

- You own multiple properties (economies of scale improve)

- You lack construction/maintenance experience

- You want truly passive retirement income

Capital Expenditure Expectations

Residential properties require 1-1.5x monthly rent annually for maintenance and capital expenditures:

- Frequent minor repairs: £100-£500 / $150-$750 monthly

- HVAC replacement: £300-£1,500 / $450-$2,250 annually

- Roof repairs: £500-£2,000 / $750-$3,000 every 3-5 years

- Appliance replacement: £200-£800 / $300-$1,200 per item

Commercial properties need 0.5-1x monthly rent for maintenance, with major improvements often negotiated into lease agreements:

- HVAC replacement: £1,000-£5,000 / $1,500-$7,500 annually

- Parking lot resurfacing: £3,000-£15,000 / $5,000-$25,000 every 10-15 years

- Roof replacement: £10,000-£50,000 / $15,000-$75,000 every 20-25 years

- Tenant improvements: Often negotiated in lease (tenant-funded or split)

💼 Triple-Net Lease Advantage:

Commercial triple-net (NNN) leases shift property taxes, insurance, and maintenance costs to tenants, dramatically reducing landlord expenses and management complexity. This makes commercial properties more passive than residential despite their larger scale. However, verify tenant creditworthiness carefully—a defaulting NNN tenant leaves you with significant expense obligations.

For investors seeking multiple rental properties to generate substantial retirement income, understanding how many rental properties you need to make $100,000 annually helps set realistic portfolio building targets and management expectations.

Tax Advantages for Retirement Planning

Property investment offers substantial tax benefits that significantly enhance retirement returns. Understanding and optimizing these advantages can save tens of thousands annually while building wealth more efficiently than traditional investments.

Depreciation: The Silent Wealth Builder

Recent tax legislation dramatically enhanced real estate investment benefits. The “One Big Beautiful Bill Act” signed July 4, 2025, made 100% bonus depreciation permanent for property placed in service after January 19, 2025, creating substantial first-year tax deductions for retirement investors.

Standard depreciation schedules:

- Residential properties: 27.5-year depreciation schedule

- Commercial properties: 39-year depreciation schedule

- Bonus depreciation: 100% of qualifying improvements in year one

- Cost segregation studies: Accelerate depreciation on building components (5-15 year schedules)

💰 Depreciation Example:

Property Purchase: £275,000 / $400,000

Land Value (non-depreciable): £55,000 / $80,000 (20%)

Building Value (depreciable): £220,000 / $320,000

Annual Depreciation (27.5 years): £8,000 / $11,636

Tax Bracket: 24% federal + 5% state = 29%

Annual Tax Savings: £2,320 / $3,374 for 27.5 years

This depreciation benefit shelters rental income from taxation while the property appreciates in value. When combined with tax-advantaged retirement accounts holding REITs, you create a powerful wealth-building combination maximizing after-tax returns.

1031 Exchanges: Tax-Deferred Growth Strategy

1031 exchanges provide powerful tax-deferral strategies particularly valuable for retirees relocating to tax-friendly states. The exchange allows selling investment properties and deferring all capital gains taxes by purchasing replacement properties of equal or greater value within specific timeframes.

Key 1031 exchange benefits for retirement investors:

- Defer federal capital gains: Up to 23.8% for high-income investors (20% long-term gains + 3.8% net investment income tax)

- Geographic arbitrage: Exchange from high-tax California or New York properties to Florida or Texas

- State tax savings: £15,000-£25,000 / $20,000-$35,000 annually when moving to no-tax states

- Portfolio optimization: Trade three small properties for one larger property with better management

- Asset reallocation: Shift from residential to commercial (or vice versa) without tax consequences

📝 1031 Exchange Rules (45/180 Day Timeline):

- Day 0: Close on sale of relinquished property

- Day 45: Identify up to 3 replacement properties (or unlimited if total value doesn’t exceed 200% of sold property)

- Day 180: Close on replacement property (or properties)

- Critical: All proceeds must be held by qualified intermediary—never touch the money personally or the exchange fails

Real-world exchange success: A pre-retiree exchanged three California properties for nine Dallas properties through 1031 exchanges, tripling monthly income while maintaining the same total investment, avoiding California’s subsequent market decline and saving approximately £18,000 / $25,000 annually in state taxes.

State Tax Considerations for Retirement

State tax considerations significantly impact retirement returns. Nine US states impose no income taxes, creating strategic relocation opportunities:

| State | Income Tax | Property Tax Rate | Special Benefits |

|---|---|---|---|

| Florida | 0% | 0.80% | Homestead exemption, no estate tax |

| Texas | 0% | 1.60% | Strong property rights, no estate tax |

| Nevada | 0% | 0.53% | Lowest property tax among no-income-tax states |

| Tennessee | 0% | 0.56% | Low cost of living, growing markets |

| Oklahoma | 5% (with exemptions) | 0.85% | 100% capital gains exclusion on properties held 5+ years |

UK property tax considerations: UK investors face different but equally significant tax planning opportunities through SIPPs and ISAs. Property REITs held within ISAs or SIPPs grow completely tax-free, while direct property ownership provides mortgage interest relief and capital gains allowances (£6,000 annual CGT allowance in 2025/26 tax year).

Retirement Account Property Investment

Self-directed IRA and SIPP investments enable tax-deferred or tax-free real estate growth but require strict compliance:

- Prohibited transactions: Cannot personally use property or conduct business with family members

- All transactions through account: Income and expenses must flow through the IRA/SIPP

- UBIT on leveraged properties: Unrelated Business Income Tax applies to debt-financed portions

- No personal guarantees: Financing must be non-recourse loans

- Contribution limits: £60,000 / $8,000 annually for investors 50+ (plus catch-up contributions)

Optimal strategy: Most retirees find greater success holding REITs within Roth IRAs or ISAs/SIPPs for tax-free growth while keeping direct properties in taxable accounts to capture depreciation deductions. Self-employed investors can maximize this strategy through Solo 401(k) contributions up to £61,500 / $70,000 annually.

Market Trends and Geographic Opportunities

Understanding current market dynamics and demographic trends helps retirement investors position portfolios for optimal returns over the next 10-20 years.

Demographic Tailwinds Create Investment Opportunities

Two powerful demographic trends create sustained real estate demand:

📊 Demographic Opportunity:

- Baby Boomer Wave: 4 million baby boomers reach age 80 in the next five years, creating massive senior housing demand

- Millennial Homebuying: 72 million millennials represent 43% of all home purchasers—the largest homebuying cohort in history

- Generation Transfer: This transition creates sustained demand for both senior housing and family rentals simultaneously

Healthcare real estate emerges as dominant opportunity with senior housing occupancy recovering to 87.4% in Q1 2025, the highest since early 2020. Supply-demand imbalances require 250,000+ new senior housing units through 2027, yet only 21,750 units are currently under construction.

Senior housing investment returns offer:

- Going-in yields: 7%+ (exceptionally high for defensive real estate)

- Unlevered IRRs: Low-to-mid teens (12-15%)

- Demographic certainty: Aging population is guaranteed, not speculative

- Recession resistance: Essential housing need regardless of economic conditions

Sun Belt Dominance: Where to Invest Geographically

Geographic opportunities concentrate in Sun Belt markets driven by business-friendly policies, lower taxes, and sustained population migration from higher-cost regions. Top markets for 2025-2030 retirement property investment:

| Market | Population Growth | Key Advantages | Best For |

|---|---|---|---|

| Dallas-Fort Worth | 11% since 2020 | No state income tax, corporate relocations, strong job growth | Residential & Commercial |

| Tampa-St. Petersburg | 8.5% since 2020 | Florida tax benefits, tourism growth, retirement destination | Residential & Senior Housing |

| Miami | 7.3% since 2020 | International investment, finance hub, luxury market | Luxury Residential & Commercial |

| Phoenix | 6.8% since 2020 | Tech industry growth, affordable housing, snowbird destination | Residential & Multi-family |

| Nashville | 9.2% since 2020 | No state income tax, healthcare industry, quality of life | Residential & Senior Housing |

| Charlotte | 7.9% since 2020 | Banking center, lower taxes than Northeast, moderate climate | Commercial & Residential |

UK market opportunities: UK property investors find strongest opportunities in university cities (Manchester, Birmingham, Leeds) for residential rentals with consistent student and young professional demand. London remains dominant for commercial property but requires significantly higher capital (£500,000+ entry points).

For UK investors with £50,000 capital, strategic property investment approaches typically focus on emerging Northern markets with 6-8% gross yields rather than lower-yielding Southern markets.

Interest Rate Environment and Timing Strategies

Mortgage rates expected to remain elevated at 6.7% through 2025, down slightly from current 7%+ levels but well above the 3-4% rates seen in 2020-2021. The housing market remains “largely frozen” until rates approach 5%, creating potential acquisition opportunities for patient capital with cash reserves.

Commercial real estate shows signs of recovery with £1.3 trillion / $1.8 trillion in debt maturities coming due in 2026, creating refinancing pressures and potential distressed opportunities for well-capitalized investors. Cap rate compression of 25-40 basis points expected across most commercial sectors by end-2025 as fundamentals improve.

⏰ Strategic Timing for Retirement Investors:

- Ages 65+: Focus on immediate income—current market offers attractive REIT dividends (3-4%) with entry points following 2022-2023 corrections

- Ages 55-65: Balance current acquisitions (lock in prices before recovery) with cash reserves for opportunistic purchases if rates normalize

- Ages 45-55: Aggressive accumulation phase—elevated rates create temporary acquisition advantages before rates normalize and prices increase

The combination of demographic tailwinds, geographic migration trends, and current market dislocations creates compelling opportunities for patient capital positioned strategically across property types and geographies.

Expert Allocation Recommendations by Age

Your optimal property investment allocation depends primarily on your retirement timeline and current financial position. These recommendations balance return potential against the time available to recover from market downturns or property vacancies.

Ages 45-55: Aggressive Wealth Accumulation Phase

With 10-20 years until retirement, you have sufficient time to weather market cycles and maximize leverage benefits. This decade represents peak earning years when most investors can deploy the most capital while managing risk through diversification.

🎯 Recommended Allocation (Ages 45-55):

- 40% REITs: Diversified exposure to both residential and commercial sectors with immediate liquidity

- 40% Direct Property Ownership: Split between 2-3 leveraged residential properties for maximum return potential

- 20% Private Funds/Partnerships: Commercial real estate exposure through syndications or crowdfunding platforms

- Target Annual Return: 10-12% across entire property allocation

Strategy rationale: Aggressive positioning captures maximum growth while maintaining professional diversification through REITs and partnerships. Direct property ownership builds hands-on experience essential for managing larger portfolios in retirement. Leverage amplifies returns during prime earning years when you can qualify for best financing terms.

Implementation example with £300,000 / $500,000 capital:

- £120,000 / $200,000 in REITs: Diversified REIT ETF providing 3.5% current yield plus appreciation

- £120,000 / $200,000 for direct properties: Down payments on 2-3 residential rentals (£40-50k / $65-100k each)

- £60,000 / $100,000 in private funds: Commercial syndications or crowdfunding platforms (£25-30k / $40-50k per deal across 2-3 investments)

This allocation positions for 8-12% returns while maintaining manageable complexity across 4-6 total investments. For guidance on identifying profitable residential properties, learn how many rental properties you need to generate $100,000 annually and plan your accumulation strategy accordingly.

Ages 55-65: Balanced Growth and Income Transition

The pre-retirement decade requires careful balance between continued growth and reducing complexity. This period involves gradually shifting from aggressive wealth accumulation toward stable income generation while maintaining enough growth to outpace inflation through retirement.

🎯 Recommended Allocation (Ages 55-65):

- 50% REITs: Increased allocation for liquidity and reduced management burden

- 35% Direct Residential Properties: Proven cash-flowing properties with professional management

- 15% Commercial Partnerships: Established partnerships with strong track records

- Target Annual Return: 8-10% across entire property allocation

Strategy rationale: Increased REIT allocation provides liquidity buffer for unexpected expenses while reducing direct management responsibilities. Residential properties transition to professional management (if not already), converting active income to passive streams. Commercial partnerships remain for enhanced returns without operational complexity.

Transition actions during this decade:

- Hire professional management: Transition all direct properties to 8-12% management fees

- Consider 1031 exchanges: Trade multiple small properties for fewer larger properties with better management

- Pay down mortgages: Reduce or eliminate leverage on primary residence and consider same for rentals

- Geographic consolidation: If properties are scattered, consider exchanging into same-market portfolio for easier oversight

- Build cash reserves: Increase emergency fund to 18-24 months expenses covering both personal and property obligations

For investors approaching retirement with significant capital, understanding optimal property investment strategies for £50,000 / $75,000 helps evaluate whether to add properties or focus on consolidation and professional management.

💡 Tax Planning Opportunity:

Ages 55-65 present optimal timing for geographic arbitrage through 1031 exchanges. Trade California or New York properties for Florida or Texas properties before retirement to lock in tax savings. This single decision can save £15,000-£25,000 / $20,000-$35,000 annually in state taxes throughout retirement while potentially upgrading to better cash-flowing properties in growing markets.

Ages 65+: Income Generation and Capital Preservation

Once retired, your property allocation prioritizes predictable income streams and complete liquidity over maximum returns. The goal shifts from wealth accumulation to wealth preservation while generating retirement income to supplement Social Security, pensions, and IRA distributions.

🎯 Recommended Allocation (Ages 65+):

- 70% REITs: Maximum liquidity with 3-4% dividend yields providing quarterly income

- 30% Managed Residential Properties: 1-2 fully managed properties for diversification and inflation protection

- 0% Direct Management: Zero properties requiring personal involvement in tenant relationships or maintenance

- Target Annual Return: 6-8% focused on income over appreciation

Strategy rationale: REIT dominance provides immediate access to capital for healthcare expenses, family emergencies, or quality-of-life expenditures without selling physical properties during unfavorable markets. The small allocation to managed residential properties maintains inflation protection and diversification while requiring minimal time investment (5-10 hours monthly oversight of property managers).

Considerations for 65+ investors:

- Healthcare costs: Average couple needs £260,000 / $400,000 for retirement healthcare—maintain liquidity for unexpected medical expenses

- Cognitive decline planning: Simplify portfolio before any cognitive decline makes management difficult

- Estate planning: REITs provide easier inheritance transfers than physical properties requiring probate

- Assisted living planning: Liquid assets convert faster if you need to relocate to assisted living facilities

- Step-up basis strategy: Holding properties until death provides heirs with step-up in basis, eliminating capital gains taxes

⚠️ Red Flags Requiring Reallocation:

- Spending 10+ hours monthly on property management: Time to sell or hire professional management

- Dealing with difficult tenants causing stress: Quality of life matters more than marginal returns

- Properties located 100+ miles from residence: Remote management becomes increasingly difficult with age

- Significant deferred maintenance accumulating: Indicates you’ve lost interest or capacity to manage properly

- Health declining or mobility reducing: Liquidate before forced sales during health crises

Portfolio Rebalancing Schedule

Property portfolios require different rebalancing timelines than stock/bond portfolios due to illiquidity and transaction costs. Follow these guidelines for strategic reallocation without excessive trading expenses:

| Portfolio Component | Review Frequency | Action Triggers |

|---|---|---|

| REIT Holdings | Quarterly | Rebalance when allocation drifts 10%+ from target |

| Direct Properties | Annually | Consider selling if cash-on-cash returns drop below 6% or appreciation stagnates for 3+ years |

| Commercial Partnerships | Semi-annually | Exit underperforming partnerships (returns <7%) or partnerships with poor communication |

| Overall Allocation | Every 5 years | Major reallocation aligned with age-based recommendations (shift from 45-55 allocation toward 55-65 allocation) |

Transaction cost considerations: Selling direct properties costs 6-10% in commissions, closing costs, and taxes (if not using 1031 exchanges). This makes frequent rebalancing impractical. Instead, use new capital or REIT dividends to gradually adjust allocation toward target percentages over 2-3 years rather than executing immediate large-scale property sales.

📈 Optimize Your Retirement Portfolio

Get expert property investment strategies, retirement account optimization tips, and tax-advantaged wealth-building guidance delivered weekly.

Implementation Roadmap: From Planning to Portfolio

Understanding optimal allocation means nothing without a clear implementation plan. This roadmap walks you through practical steps to build your retirement property portfolio systematically, whether you’re starting from scratch or optimizing existing holdings.

Phase 1: Foundation Building (Months 1-3)

Before making any property investments, establish the financial and educational foundation that prevents costly mistakes and ensures long-term success.

📋 Foundation Checklist:

- Emergency fund: Secure 6-12 months living expenses in high-yield savings (separate from investment capital)

- Debt optimization: Pay off high-interest debt (>6%); consider maintaining low-rate mortgage debt for tax benefits

- Credit score: Achieve 740+ credit score for best mortgage rates (can save £15,000+ / $25,000+ over loan life)

- Tax-advantaged accounts: Maximize Roth IRA and 401(k) contributions before taxable property investment

- Market research: Identify 2-3 target markets through demographic analysis, job growth data, and cap rate comparisons

- Professional team: Interview 3-5 real estate agents, 2-3 mortgage brokers, and 2-3 property managers in target markets

Educational resources to complete during Phase 1:

- Property analysis: Learn to calculate NOI, cap rates, cash-on-cash returns, and debt service coverage ratios

- Tax implications: Understand depreciation schedules, 1031 exchanges, passive activity loss rules, and state tax differences

- Financing options: Compare conventional mortgages, portfolio loans, asset-based lending, and seller financing

- Legal structure: Consult attorney on LLC formation, asset protection strategies, and liability insurance requirements

Capital deployment timeline: Do NOT rush into investments during Phase 1. The foundation period requires discipline to resist attractive-looking deals until you’ve built proper knowledge and assembled your professional team. Poor first investments often result from inadequate preparation.

Phase 2: REIT Portfolio Establishment (Months 2-4)

Begin building your property exposure through REITs while continuing education on direct property investment. REITs provide immediate market exposure and demonstrate your commitment to real estate investing without the complexity of direct ownership.

| Investment Type | Allocation | Example Holdings | Annual Cost |

|---|---|---|---|

| Diversified REIT ETF | 60% | VNQ (US) or XLRE (US) / iShares UK Property (UK) | 0.12-0.15% |

| Residential REIT | 20% | EQR (apartments) or INVH (single-family) | 0.40-0.60% |

| Commercial REIT | 10% | PLD (industrial) or O (retail NNN) | 0.40-0.60% |

| Healthcare REIT | 10% | WELL (senior housing) or VTR (healthcare facilities) | 0.50-0.70% |

REIT account structure recommendations:

- Tax-advantaged priority: Hold REITs in Roth IRA (US) or ISA/SIPP (UK) first

- Taxable accounts second: Use taxable brokerage accounts only after maxing tax-advantaged space

- Dividend reinvestment: Enable automatic dividend reinvestment (DRIP) for compound growth

- Rebalancing schedule: Review quarterly, rebalance when any holding drifts 10%+ from target

💡 Tax Efficiency Strategy:

REIT dividends are taxed as ordinary income (not qualified dividends), making them tax-inefficient in taxable accounts where you’ll pay 22-37% federal rates. By holding REITs exclusively in Roth IRAs or ISAs, you eliminate all taxes on dividends and capital gains. Reserve taxable account space for direct property ownership where you can capture depreciation deductions and 1031 exchange benefits.

Phase 3: First Direct Property Acquisition (Months 6-12)

After building your REIT foundation and completing education, acquire your first direct property using these systematic selection criteria that minimize risk while maximizing learning opportunities.

Ideal first property characteristics:

- Single-family or duplex: Simplest management structure for learning fundamentals

- Move-in ready condition: Avoid renovation projects until you’ve managed at least one property through full annual cycle

- Within 30 minutes of residence: Drive-by inspections and emergency responses remain manageable

- B-class neighborhoods: Balance of stable tenants, reasonable appreciation, and affordable entry prices

- 1% rule minimum: Monthly rent should equal or exceed 1% of purchase price (£150k property = £1,500+ monthly rent)

- Strong school districts: Attracts family tenants with longer average tenancy (3-5 years vs 1-2 years)

📊 First Property Financial Checklist:

- Down payment saved: 20-25% of purchase price plus £10,000 / $15,000 reserves

- Closing costs budgeted: Additional 3-5% for inspections, appraisals, legal fees

- Cash-on-cash return projected: Minimum 8% after all expenses and vacancy allowance

- Debt service coverage ratio: 1.25+ (NOI / annual debt service)

- Cap rate verified: Minimum 6% in target market (higher in secondary markets)

- Professional inspection completed: Zero deferred maintenance or capital expenditures needed in first 2 years

Financing strategy for first property: Use conventional mortgage financing rather than cash purchase (even if you have cash available). Leveraging with 20-25% down payment amplifies returns while preserving capital for additional acquisitions. Target mortgage rates require 740+ credit scores and strong debt-to-income ratios below 43%.

For investors with £50,000 / $75,000 available capital, review comprehensive strategies in our guide on the best ways to invest $50,000 in real estate to identify properties matching your budget and return requirements.

Phase 4: Portfolio Expansion (Years 2-5)

After successfully managing your first property through a complete annual cycle (including tenant turnover, tax season, and property tax payments), systematically expand your portfolio using proven analysis frameworks and risk management protocols.

Expansion strategy by available capital:

| Annual Capital Available | Recommended Pace | Target Portfolio (5 Years) |

|---|---|---|

| £30,000-£50,000 $50,000-$75,000 |

1 property every 18-24 months | 3-4 residential properties + REIT diversification |

| £50,000-£100,000 $75,000-$150,000 |

1 property annually | 5-6 residential properties + commercial partnership |

| £100,000+ $150,000+ |

2 properties annually or 1 commercial | 8-10 residential or 2-3 commercial + private funds |

Quality gates before each additional acquisition:

- Existing properties performing: All current properties achieving projected returns with stable tenancy

- Management systems working: Rent collection automated, maintenance requests handled within 48 hours, financial tracking current

- Capital reserves maintained: 6 months expenses per property plus 10% of property value for capital expenditures

- Personal bandwidth available: Not spending more than 15 hours monthly on current properties before adding another

- Market conditions favorable: Cap rates attractive, rental demand strong, economic indicators positive

⚠️ Expansion Warning Signals:

- Stop expanding if: Current properties underperforming, personal stress levels elevated, or relationship strain emerging

- Pause and consolidate if: Property management consuming 20+ hours monthly or multiple vacancy periods concurrent

- Consider selling if: Net cash flow negative after covering all expenses or appreciation stagnant for 3+ consecutive years

To understand the portfolio size needed for substantial retirement income, calculate requirements using our guide on how many rental properties generate $100,000 annually and adjust your expansion pace accordingly.

Phase 5: Optimization and Professional Management (Years 5-10)

Once you’ve built a substantial portfolio (5+ properties or £500,000+ / $750,000+ in property value), transition focus from acquisition to optimization, potentially shifting toward professional management for truly passive income.

Optimization strategies for mature portfolios:

- 1031 exchange consolidation: Trade multiple small properties for fewer larger properties with better economies of scale

- Geographic concentration: Focus holdings in 1-2 markets for easier management and deeper market knowledge

- Professional management transition: Hire property management for all holdings (8-12% of rent) to reclaim time

- Debt optimization: Refinance higher-rate mortgages when rates favorable, consider paying down mortgages approaching retirement

- Tax entity restructuring: Evaluate LLC, S-Corp, or partnership structures for tax efficiency and asset protection

Performance benchmarks for mature portfolios:

| Metric | Excellent | Good | Needs Improvement |

|---|---|---|---|

| Cash-on-Cash Return | 12%+ | 8-12% | <6% |

| Occupancy Rate | 95%+ | 90-95% | <90% |

| Debt Service Coverage | 1.5+ | 1.25-1.5 | <1.25 |

| Operating Expense Ratio | <40% | 40-50% | >50% |

| Annual Appreciation | 5%+ | 3-5% | <3% |

Exit strategy considerations: As you approach retirement (60-65), begin evaluating which properties to hold long-term and which to liquidate. Properties with strong appreciation but weak cash flow make excellent sale candidates, while properties generating 8%+ cash-on-cash returns despite minimal appreciation justify continued ownership through retirement.

Common Implementation Mistakes to Avoid

Learning from others’ mistakes saves tens of thousands in unnecessary costs. Here are the most common implementation errors that derail retirement property investors:

🚫 Top 10 Implementation Mistakes:

- Buying before building foundation: Rushing into first property without adequate reserves or professional team

- Overestimating rental income: Using asking rents rather than actual market rents for area and property condition

- Underestimating expenses: Forgetting to budget for vacancy, capital expenditures, property management, or HOA fees

- Emotional property selection: Buying properties you’d want to live in rather than properties tenants actually want to rent

- Ignoring cash flow for appreciation: Speculating on future appreciation while accepting negative monthly cash flow

- Geographic overexpansion: Acquiring properties in multiple distant markets that become unmanageable

- Skipping professional inspections: Saving £350-500 / $500-750 on inspections that uncover £15,000+ / $25,000+ in deferred maintenance

- Inadequate insurance coverage: Underinsuring properties or lacking proper liability coverage and umbrella policies

- Poor tenant screening: Accepting marginal tenants to avoid vacancy periods, resulting in evictions and damage

- Neglecting tax planning: Missing depreciation benefits, failing to use 1031 exchanges, or improper entity structure costing thousands annually

Success metric tracking: Implement quarterly portfolio reviews tracking cash-on-cash returns, occupancy rates, maintenance costs, and debt service coverage ratios. Properties failing to meet benchmarks for two consecutive quarters require immediate attention—either property improvements, rent adjustments, or consideration of selling through 1031 exchange.

Frequently Asked Questions

Should I invest in residential or commercial property for retirement income?

Most retirement investors benefit from a balanced approach combining both residential and commercial properties alongside REITs rather than choosing exclusively one type. Residential properties offer lower entry barriers (£50,000-£150,000 / $75,000-$225,000), consistent demand, and 10.6% average annual returns with moderate management requirements. Commercial properties provide higher immediate yields (5-7.5%) with longer lease terms (3-10 years) and more professional tenant relationships, but require larger capital commitments (£200,000-£1,000,000+ / $300,000-$1,500,000+).

The optimal allocation depends on your age and capital: investors aged 65+ should allocate 70% to REITs and 30% to managed residential properties for maximum liquidity and minimal time commitment. Investors aged 55-65 benefit from 50% REITs, 35% residential, and 15% commercial partnerships to balance growth with manageable complexity. Younger investors (45-55) can pursue more aggressive allocations with 40% REITs, 40% direct ownership, and 20% private funds to maximize wealth accumulation during peak earning years.

How much capital do I need to start investing in rental properties?

Minimum £50,000 / $75,000 in liquid capital provides sufficient foundation for first rental property investment, covering down payment (20-25%), closing costs (3-5%), and essential reserves (6-12 months expenses). This capital requirement breaks down as: £40,000 / $60,000 for down payment on £150,000-200,000 / $225,000-300,000 property, £5,000 / $7,500 for closing costs and inspections, and £5,000-£10,000 / $7,500-$15,000 in reserves for unexpected repairs and vacancy periods.

However, REITs offer property investment exposure with as little as £1,000 / $1,500, making them ideal starting points for investors building toward direct property ownership. This approach allows you to gain market exposure and learn real estate fundamentals while accumulating larger capital for direct ownership. For investors with £50,000 available, review our comprehensive guide on the best ways to invest $50,000 in real estate for detailed strategies matching your budget.

Can I manage rental properties in retirement, or do I need professional management?

Professional property management becomes increasingly valuable approaching and during retirement, though the decision depends on your available time, proximity to properties, and personal preferences. Direct management of residential properties requires 5-15 hours monthly per property, including rent collection, maintenance coordination, tenant communication, and periodic inspections. This time commitment intensifies during tenant turnover (30-50% annual turnover rate) when you handle showings, applications, and move-in preparations.

Professional management costs 8-12% of collected rent for residential properties (4-8% for commercial), plus 50-100% of first month’s rent as leasing fees for new tenants. While this reduces net cash flow by £2,000-£5,000 / $3,000-$7,500 annually per property, it provides freedom from 24/7 availability requirements and tenant relationship management. Most retirement investors hire professional management for properties more than 30 minutes from their residence or when they value their time at more than £20-30 / $25-40 hourly. Consider professional management essential for maintaining quality of life in retirement rather than viewing it as unnecessary expense.

What returns can I realistically expect from residential vs commercial properties?

Residential properties historically deliver 10.6% average annual returns including rental income (4-6% of property value), appreciation (3-4% annually), and mortgage paydown when leveraged (2-3% annual equity build). These returns increase to 11.7% annually when using typical 65% mortgage financing, demonstrating leverage’s amplification effect during residential property investment.

Commercial properties provide 9.5% average annual returns with higher immediate income yields (5-7.5% current cap rates) but lower appreciation potential. The income component of commercial properties averages 5.22% annually, making them particularly attractive for retirees prioritizing immediate cash flow over long-term wealth accumulation. REITs average 11.8% annual returns while providing complete liquidity and zero management requirements, though current dividend yields of 3-4% are lower than direct property ownership income.

These return expectations assume proper property selection, adequate reserves, and normal market conditions. Individual results vary significantly based on property location, tenant quality, market timing, and management effectiveness. Experienced investors in strong markets can exceed these averages, while inexperienced investors or those in declining markets may underperform substantially.

How do property investments compare to stock market index funds for retirement?

Property investments and index funds serve complementary rather than competing roles in diversified retirement portfolios. Index funds provide superior liquidity (sell within seconds), lower transaction costs (0.03-0.20% expense ratios), complete passivity requiring zero time commitment, and automatic diversification across hundreds or thousands of companies. Historical stock market returns average 10-11% annually with higher volatility (15-20% standard deviation) compared to real estate’s more stable returns.

Property investments offer unique advantages unavailable through index funds: leverage amplification (control £200,000 / $300,000 asset with £50,000 / $75,000 down payment), tax benefits through depreciation deductions (sheltering rental income), inflation hedging through rental rate increases, and tangible asset ownership providing psychological comfort during market volatility. Properties also generate monthly cash flow supporting retirement expenses, while index funds typically require selling shares for income.

Optimal retirement portfolios typically allocate 40-60% to index funds, 20-40% to property investments (including REITs), and 10-20% to bonds, adjusting percentages based on age, risk tolerance, and income needs. This diversification captures benefits of multiple asset classes while mitigating concentration risk. For comprehensive guidance on index fund selection, review our comparison of index funds vs mutual funds to understand optimal fund structures for retirement accounts.

Should I use leverage (mortgages) for rental properties approaching retirement?

Leverage strategy depends critically on your retirement timeline and risk tolerance, with recommendations shifting substantially based on age. Investors aged 45-55 should aggressively leverage properties with 20-25% down payments to amplify returns during peak earning years when mortgage qualification remains straightforward and time exists to weather market volatility. This approach can increase returns from 10.6% (cash purchase) to 11.7% (leveraged) or higher when properly executed.

Investors aged 55-65 should evaluate leverage case-by-case, potentially maintaining mortgages on strong cash-flowing properties while paying down or avoiding debt on marginal performers. Consider gradually reducing leverage throughout this decade, targeting 50% loan-to-value ratios by age 65 rather than typical 75-80% ratios used during accumulation phase. This balanced approach maintains some leverage benefits while reducing vulnerability to interest rate increases or property value declines.

Retirees aged 65+ generally benefit from minimal or zero leverage to maximize monthly cash flow and eliminate mortgage payment obligations during fixed-income retirement years. Cash purchases or fully paid properties generate 4-6% net cash flow without mortgage payments, providing reliable retirement income without debt service pressure. Exceptions exist for sophisticated investors with substantial liquid reserves and multiple income sources who can manage leverage risk comfortably. The psychological benefit of debt-free property ownership often outweighs marginal return improvements from leverage during retirement years.

What are the tax advantages of property investment for retirement income?

Property investment provides three major tax advantages that significantly enhance after-tax retirement returns. First, depreciation deductions allow you to deduct property value deterioration (27.5 years for residential, 39 years for commercial) against rental income despite properties typically appreciating in value. This shelters £6,000-£10,000 / $10,000-$15,000 annually in rental income from taxation on typical investment properties, saving £1,500-£4,000 / $2,500-$6,000 annually in taxes for higher-income investors.

Second, 1031 exchanges enable indefinite capital gains tax deferral by exchanging properties rather than selling, allowing you to upgrade or relocate investments without triggering 15-23.8% federal capital gains taxes. This strategy proves particularly valuable for retirees relocating from high-tax states (California, New York) to zero-income-tax states (Florida, Texas, Nevada), potentially saving £15,000-£25,000 / $20,000-$35,000 annually in state taxes while building larger property portfolios through tax-deferred exchanges.

Third, preferential capital gains treatment provides substantial tax savings compared to ordinary income. Long-term capital gains (properties held 12+ months) are taxed at 0-20% federal rates compared to 10-37% ordinary income rates, saving up to 17% on appreciation gains when eventually sold. Combined with depreciation recapture at 25% maximum rate, the effective tax rate on property investment income remains significantly lower than earned income taxation. UK investors benefit from similar advantages through capital gains allowances (£6,000 annual exemption in 2025/26) and SIPP/ISA property REIT holdings providing completely tax-free growth. For comprehensive UK tax planning, review our comparison of ISA vs SIPP structures to optimize tax-advantaged property investment holdings.

How many rental properties do I need to generate substantial retirement income?

Generating £50,000 / $75,000 in annual retirement income typically requires 8-12 residential rental properties or equivalent commercial property investments, assuming properties deliver £5,000-£7,500 / $7,500-$11,000 in net annual cash flow each after all expenses including property management, maintenance, taxes, insurance, and vacancy allowance. This calculation assumes properties purchased with 20-25% down payments and generating 6-8% cash-on-cash returns on invested capital.

For investors targeting £100,000 / $150,000 in retirement income, the requirements approximately double to 15-20 residential properties or strategic combinations of residential, commercial, and REIT holdings. However, higher-value properties in appreciation markets may require fewer total properties—five £500,000 / $750,000 properties generating £10,000-£12,500 / $15,000-$18,750 each can achieve similar income targets with reduced management complexity compared to 15 smaller properties.

The most realistic path involves building diversified portfolios combining multiple income sources: 5-8 direct residential properties providing £35,000-£50,000 / $50,000-$75,000, REIT holdings generating £10,000-£15,000 / $15,000-$22,500 in dividends, and IRA distributions supplementing property income. This diversification provides income stability when individual properties experience vacancy or require major repairs. For detailed portfolio building strategies, review our complete guide on how many rental properties generate $100,000 annually with specific examples and calculations.

🎯 Ready to Build Your Retirement Property Portfolio?

Get weekly investment strategies, property analysis frameworks, retirement planning insights, and tax optimization guidance. Join thousands of investors building wealth through strategic property investment.