Discover the ultimate guide to investing £50k in property with The Savvy Investor Limited. We recognize the significance of well-informed choices when it comes to property investments. Within this comprehensive guide, you will gain access to invaluable insights, expert tips, and proven strategies to enhance your investment returns. Whether you’re an experienced investor or embarking on your first venture, this article will provide you with the essential knowledge and tools required to thrive in the fiercely competitive realm of real estate.

You might have saved up, or inherited a nest egg, congratulations! But what is the best way to invest your £50k? It should be pointed out at the start that a £50k investment is great, but might not be sufficient to fully finance a property investment in the current market. It would, however, be a great deposit for an off-plan property or other investment property!

Understanding Real Estate Investment Strategies

Off-Plan Property Investments

Investing in off-plan properties can offer significant advantages for savvy investors, otherwise we would not be such advocates for it! By purchasing a property before it’s completed, you can secure it at a lower price and potentially benefit from capital appreciation. Our guide on off-plan property investments provides a detailed analysis of the benefits, risks, and essential considerations associated with this investment strategy. You can see a selection of the current off-plan properties we are promoting in Northern Cyprus here.

Wholesaling and Flipping Contracts

For those seeking short-term gains, wholesaling and flipping contracts can be lucrative options. This strategy involves finding motivated sellers and leveraging negotiation techniques to secure profitable deals. Our comprehensive guide on wholesaling and flipping contracts offers practical insights into finding motivated sellers, closing deals, and maximizing your profits.

Fix and Flip Strategy

Another popular investment strategy is the fix and flip approach. This involves purchasing properties in need of renovation, improving them, and selling them at a higher price. Our detailed guide on the fix and flip strategy covers essential aspects such as property identification, renovation tips, and effective selling strategies.

Buy and Hold Strategy

Investors looking for long-term returns and passive income often turn to the buy and hold strategy. By acquiring rental properties, you can generate steady cash flow and build a portfolio over time. Our guide on the buy and hold strategy provides valuable insights on generating passive income, building a real estate portfolio, and managing long-term rental properties.

Legal and Tax Considerations for Property Investments

Tax Implications of Investment Property Ownership

Understanding the tax implications of owning investment properties is crucial for maximizing your returns. Our guide on tax implications provides comprehensive information on tax benefits, capital gains taxes, deductible expenses, and depreciation considerations related to property investments.

Legal Aspects of Buying Investment Property

Navigating the legal landscape of buying investment properties requires careful attention to contract negotiation, documentation, and compliance with property laws and regulations. Our guide on legal aspects offers essential insights into these crucial aspects, including tenant rights, contract negotiation, and understanding property laws for global investors.

Responsibilities of a Property Manager

For investors who opt for professional property management, understanding the responsibilities of a property manager is vital. Our guide on property management provides valuable information on lease agreements, tenant screening, rent collection, maintenance, and legal considerations related to property management.

Financing Investment Properties

Financing is a crucial aspect of property investment. Our guide on investment property financing strategies covers various financing options, including traditional mortgages, private lenders, and commercial property financing. Additionally, we offer insights on navigating down payment requirements and conducting cash flow analysis for property investments.

Researching and Locating Investment Properties

Evaluating Investment Opportunities

When assessing potential investment opportunities, it’s crucial to evaluate property value, ROI, market trends, and conditions. Our guide on evaluating investment opportunities provides valuable tips and strategies for assessing property value, conducting comparative market analysis, and analyzing market trends.

Locating Potential Investment Properties

Finding the right investment property is essential for maximizing returns. Our guide on locating potential investment properties offers insights on hiring real estate agents, utilizing online platforms and tools, and leveraging real estate listings to identify lucrative investment opportunities.

Types of Investment Properties

Understanding the different types of investment properties allows investors to explore specialized markets and niches. Our guide on types of investment properties covers various options such as commercial properties, off-plan investments, residential properties, and specialized properties like senior living communities and student housing investments.

Conclusion

Investing £50k in property can provide an excellent opportunity to grow your wealth and achieve financial independence. By implementing the strategies and tips outlined in this comprehensive guide, you’ll be well-equipped to make informed decisions and maximize your returns. Remember, successful property investment requires thorough research, careful planning, and staying up to date with market trends. Start your journey to financial prosperity today and let your investments work for you.

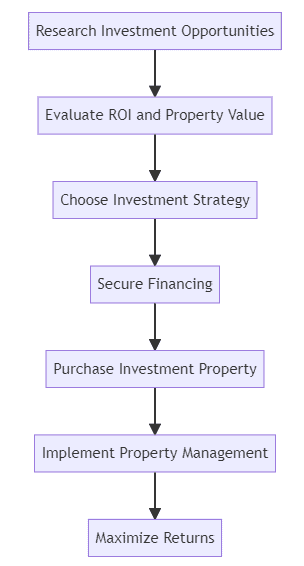

This diagram illustrates the key steps in the property investment process, from research and evaluation to financing, management, and maximizing returns.

Note: The diagram is a visual representation of the property investment process, highlighting the sequential flow of steps for achieving success in the real estate market.

Remember, success in property investment requires continuous learning and adaptation. Stay informed, seek professional advice when needed, and make strategic decisions based on your individual goals and risk tolerance. With dedication and the right approach, you can unlock the full potential of your £50k investment and build a prosperous future in the dynamic world of real estate.