Table of Contents

- Introduction

- Why Invest in Northern Cyprus?

- Prime Locations for Property Investment

- Types of Properties Available

- Legal Considerations

- Financing Your Property Investment

- Taxation and Fees

- Property Management and Maintenance

- Conclusion

Introduction

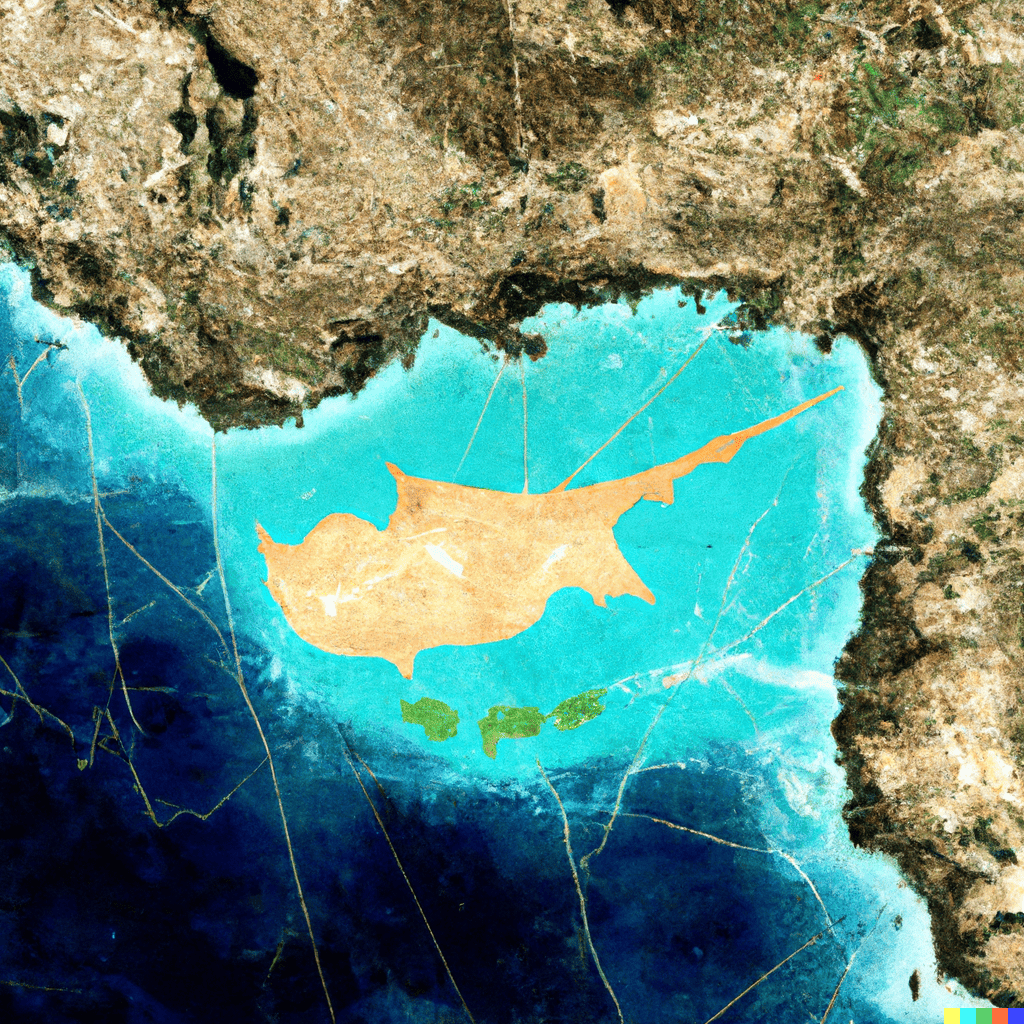

Welcome to our comprehensive guide on property investment in Northern Cyprus. With its stunning beaches, rich cultural heritage, and favourable property market, Northern Cyprus has become an increasingly popular destination for savvy investors. In this guide, we will explore the reasons to invest, prime locations, property types, legal aspects, financing options, taxation, and property management. Let’s dive in!

Why Invest in Northern Cyprus?

Northern Cyprus offers numerous advantages to property investors, including:

- Affordable property prices

- High rental yield potential

- Strong capital appreciation

- A growing tourism industry

- Mild Mediterranean climate

- Low cost of living

- Excellent healthcare and education facilities

Prime Locations for Property Investment

When looking to invest in Northern Cyprus, consider these prime locations:

- Kyrenia: Known for its picturesque harbour, Kyrenia is the most popular tourist destination in Northern Cyprus. Properties in this area enjoy high rental demand and strong capital growth.

- Famagusta: This historic city is home to various universities and boasts a vibrant student population. Investors can benefit from a steady demand for rental properties catering to students and faculty members.

- Iskele: Iskele is a rapidly developing coastal town with new residential and commercial projects underway. Investors can capitalise on the region’s growth potential and attractive property prices.

- Güzelyurt: Güzelyurt is renowned for its lush citrus groves and beautiful countryside. The area offers a peaceful environment for those looking to invest in holiday homes or retirement properties.

Types of Properties Available

Northern Cyprus has a diverse property market, offering the following types of properties:

- Apartments and flats

- Villas and detached houses

- Townhouses and terraced properties

- Bungalows

- Off-plan developments

- Land for custom-build projects

Legal Considerations

Before investing in Northern Cyprus, it is essential to be aware of the legal framework and potential challenges:

- Title Deeds: Ensure the property has a clean title deed, free from any restrictions or claims.

- Pre-74 Turkish Title: Properties with a pre-74 Turkish title are considered the safest investment, as they have a lower risk of future legal disputes.

- TRNC Title: The TRNC title is issued by the government of Northern Cyprus, and while less secure than a pre-74 Turkish title, many investors still purchase these properties without issue.

- Contract of Sale: Engage a reputable solicitor to prepare a legally binding contract of sale, outlining the terms and conditions of the property transaction.

Financing Your Property Investment

Financing options for property investments in Northern Cyprus include:

- Mortgage from a local bank: Some banks in Northern Cyprus offer mortgages to foreign investors, though interest rates and terms may vary.

- Developer financing: Some property developers offer flexible payment plans, allowing investors to spread payments over several years.

- Equity release: Investors can use equity from their existing properties to finance their Northern Cyprus investment.

Taxation and Fees

Property investors in Northern Cyprus should

be aware of the following taxes and fees associated with property transactions:

- Stamp Duty: Payable upon signing the contract of sale, stamp duty is currently set at 0.5% of the property’s purchase price.

- VAT: Value-added tax (VAT) is charged at a rate of 5% on newly built properties and is payable upon transfer of the title deed.

- Title Deed Transfer Fee: This fee is levied at 3% of the property’s assessed value when transferring the title deed into the buyer’s name.

- Capital Gains Tax: If you decide to sell your property, a capital gains tax of 4% on the profit may apply, unless you are a first-time buyer and the property is your primary residence.

- Rental Income Tax: Income generated from renting your property is subject to a 10% withholding tax on the gross rental income.

Property Management and Maintenance

To ensure the success of your property investment, consider engaging professional property management services. These services may include:

- Finding and vetting tenants

- Rent collection and administration

- Regular property inspections

- Maintenance and repairs

- Payment of bills and taxes

Additionally, it is crucial to budget for ongoing maintenance costs, such as:

- Annual property tax

- Utilities (water, electricity, and gas)

- Property insurance

- Cleaning and gardening services

Conclusion

Investing in Northern Cyprus presents a wealth of opportunities for savvy investors seeking affordable property prices, strong capital growth, and high rental yields. By carefully considering prime locations, property types, legal aspects, financing options, taxation, and property management, you can maximise the potential of your investment in this beautiful and thriving region.