Introduction

When it comes to securing your financial future, property investment stands out as a particularly savvy strategy. Yet, like any investment, the rewards it can yield are often shrouded in complexity. Let’s pull back the curtain to unveil the hidden benefits of property investment.

“Property investment is not just about buying bricks and mortar, but about building a solid foundation for financial growth and security.”

What is Property Investment?

In essence, property investment involves buying a property, such as a flat, house, or commercial property, with the aim of earning returns. This can be through rental income, resale value appreciation, or both. It’s a strategy favoured by many, given its potential for lucrative gains.

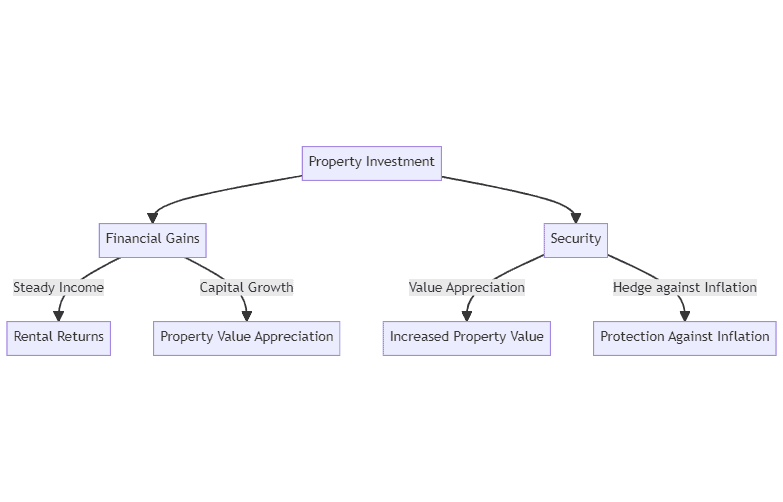

The Hidden Benefits of Property Investment

Financial Gains

Steady Income

One of the most apparent advantages of property investment is the potential for a steady income stream. Renting out a property can provide regular, reliable returns that can serve as an excellent supplement to your main income.

Capital Growth

Properties tend to appreciate in value over time, resulting in what is known as capital growth. This means the property you purchase today may be worth significantly more in the future, making property investment a smart long-term strategy.

Security

Value Appreciation

Unlike many other investments, the value of property generally increases over time. This steady value appreciation offers a sense of security not found with more volatile assets.

Hedge against Inflation

When inflation rises, so often does the value of property. As such, investing in property can serve as an effective hedge against inflation, safeguarding your capital.

Tax Advantages

Property investors can also enjoy a range of tax benefits, including deductions on mortgage interest, property taxes, operating expenses, and even depreciation.

Portfolio Diversification

Adding property to your investment portfolio can provide much-needed diversification, reducing risk by spreading investments across different asset classes.

Possibility of Use and Enjoyment

Unlike other investments, a property can be used and enjoyed. Whether it’s a vacation home for family gatherings or a residential property in a city you love, this is a benefit that cannot be quantified.

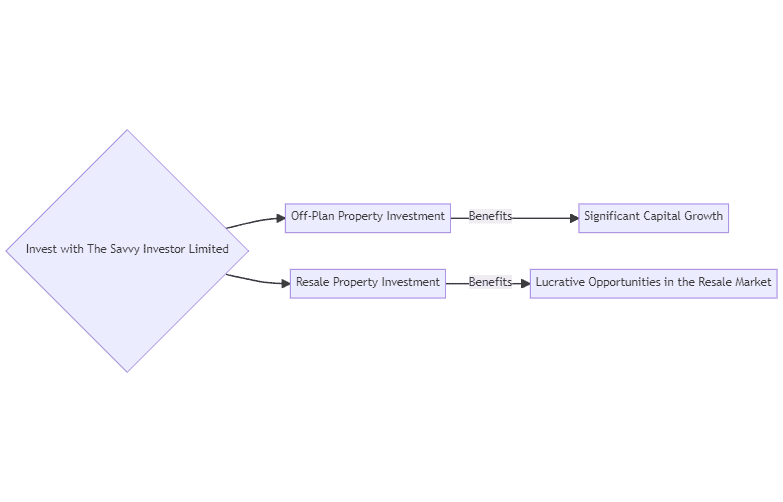

Why Choose The Savvy Investor Limited

At The Savvy Investor Limited, we are committed to helping both experienced and aspiring investors navigate the exciting world of property investment.

Our Specialities

Off-Plan Property Investment

Our expertise extends to off-plan property investment. Investing in a property before it’s built has its unique benefits, such as the potential for significant capital growth.

Resale Property Investment

We also specialise in resale property investment, assisting investors in identifying lucrative opportunities in the resale market.

Our Global Reach

While our current focus is on Northern Cyprus, our global connections enable us to bring you property investment opportunities from around the world.

Conclusion

In summary, property investment offers numerous hidden benefits, from steady income to the possibility of use and enjoyment. Partnering with a company like The Savvy Investor Limited, can help you unlock these benefits and navigate the intricacies of the property investment landscape.

Frequently Asked Questions (FAQs)

While property investment comes with many benefits, it’s essential to understand the potential risks involved as well. These can include market volatility, property maintenance costs, unexpected vacancies, and potential difficulties in selling the property. However, with careful planning and strategic decision-making, many of these risks can be mitigated.

Starting your property investment journey with The Savvy Investor Limited is a straightforward process. Visit our website and fill out the contact form or give us a call. One of our experienced property investment consultants will be more than happy to guide you through our range of services and help you identify the best investment opportunities that align with your goals. You can even book an online Zoom or Google Meet call using the calendar found here – free and with no obligation – at a time to suit you.

Off-plan property investment involves purchasing a property before it is fully constructed. It’s a unique strategy that comes with several advantages, including the potential for significant capital growth. As construction progresses and the property nears completion, it typically increases in value, giving you the opportunity to make a substantial profit.

Diversification is a risk management strategy that involves spreading your investments across various assets, such as stocks, bonds, and property. The main benefit is that it reduces risk – if one investment performs poorly, others in your portfolio may perform well and offset potential losses. Furthermore, different types of investments can offer varying rates of return, which can provide more stable and consistent investment growth over time.

Property is often considered a good hedge against inflation because, generally, as living costs increase, so too does the value of property and the rent that can be charged. This means that, over time, property investment can provide protection for your money, helping to maintain its purchasing power in an inflationary environment.