-

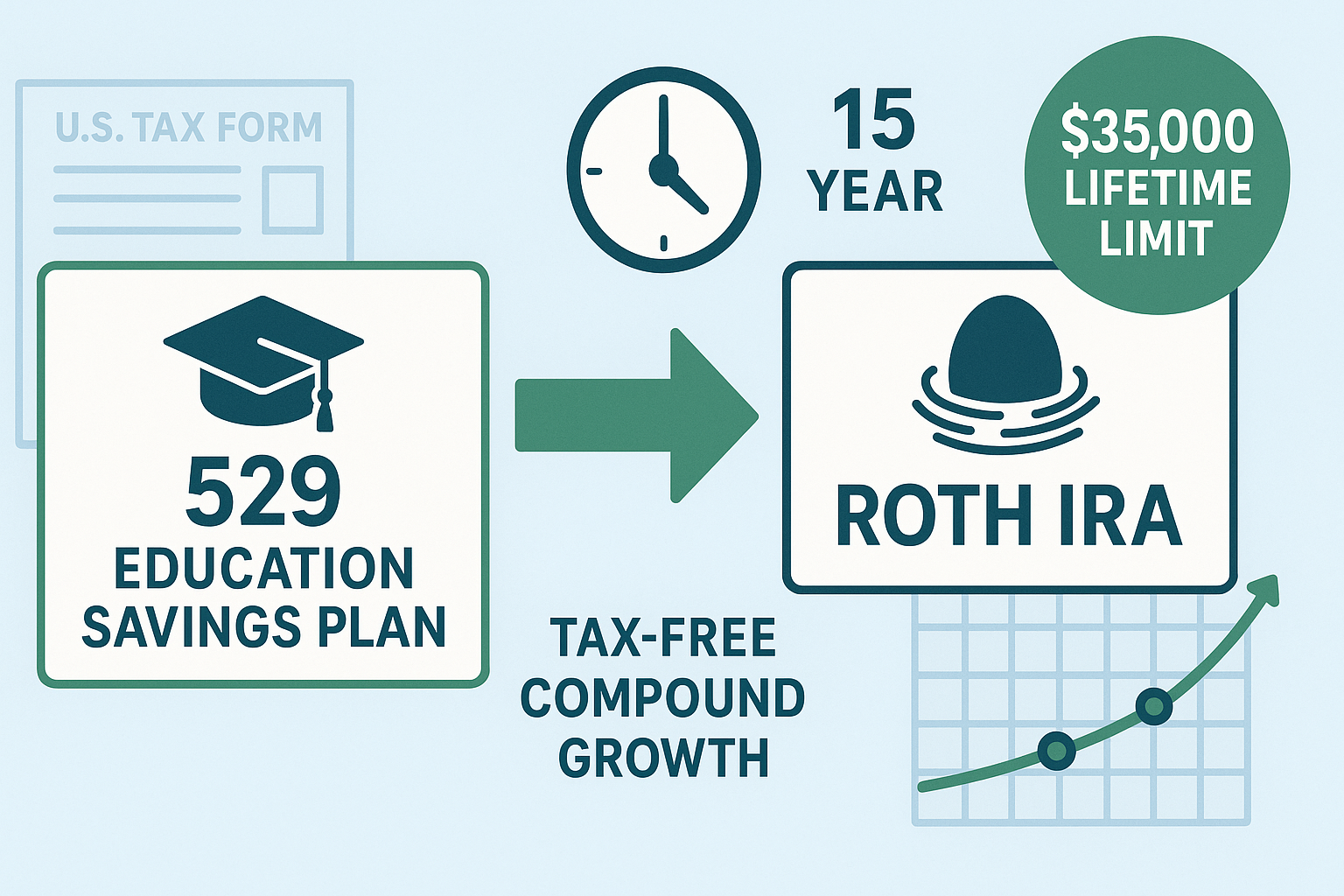

529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

Read more: 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025Master the 529 to Roth IRA rollover strategy under SECURE 2.0. Covers the 15-year rule, $35,000 limit, state tax implications, and step-by-step execution.

-

FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

Read more: FIRE Movement: The Complete 2025 Guide to Financial Independence and Early RetirementMaster the FIRE movement in 2025. Calculate your FI number, compare FIRE variants, plan healthcare coverage, and build your path to financial independence.

-

Tax-Loss Harvesting Strategy Guide (2025): Complete US & UK Implementation for DIY Investors

Read more: Tax-Loss Harvesting Strategy Guide (2025): Complete US & UK Implementation for DIY InvestorsMaster tax-loss harvesting strategies for both US and UK markets. Complete guide to wash-sale rules, ETF pairs, and automated vs manual approaches.

Latest news

- 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

- FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

- Tax-Loss Harvesting Strategy Guide (2025): Complete US & UK Implementation for DIY Investors

- Property Investment for Beginners: Your Complete Getting Started Guide for 2025

- The Complete 401(k) Optimization Playbook for 2025

Categories

- Backdoor Roth (1)

- Expat Living & Lifestyle (1)

- General Blog (2)

- Index Funds (1)

- Investing Basics (4)

- Investment Guides (6)

- Investment Platforms (1)

- Investment Strategies (12)

- Investments (2)

- IRAs & Tax-Advantaged Accounts (8)

- ISAs and Pensions (1)

- Property Investment (7)

- Real Estate Investing (3)

- Retirement Planning (12)

- Tax Strategy (8)

- Tax-Efficient Investing (3)

- UK Investing (3)

- UK Property Investment (2)

Search

Weekly insights on retirement planning, property investment, and index funds.

Get exclusive guides, interactive calculators, and strategies to build wealth intelligently.

By subscribing, you consent to receive marketing emails from The Savvy Investor’s Guide (Company No. 14816921). You can unsubscribe anytime using the SafeUnsubscribe® link. Emails serviced by Constant Contact. Read our Privacy Policy.