Retirement Planning

-

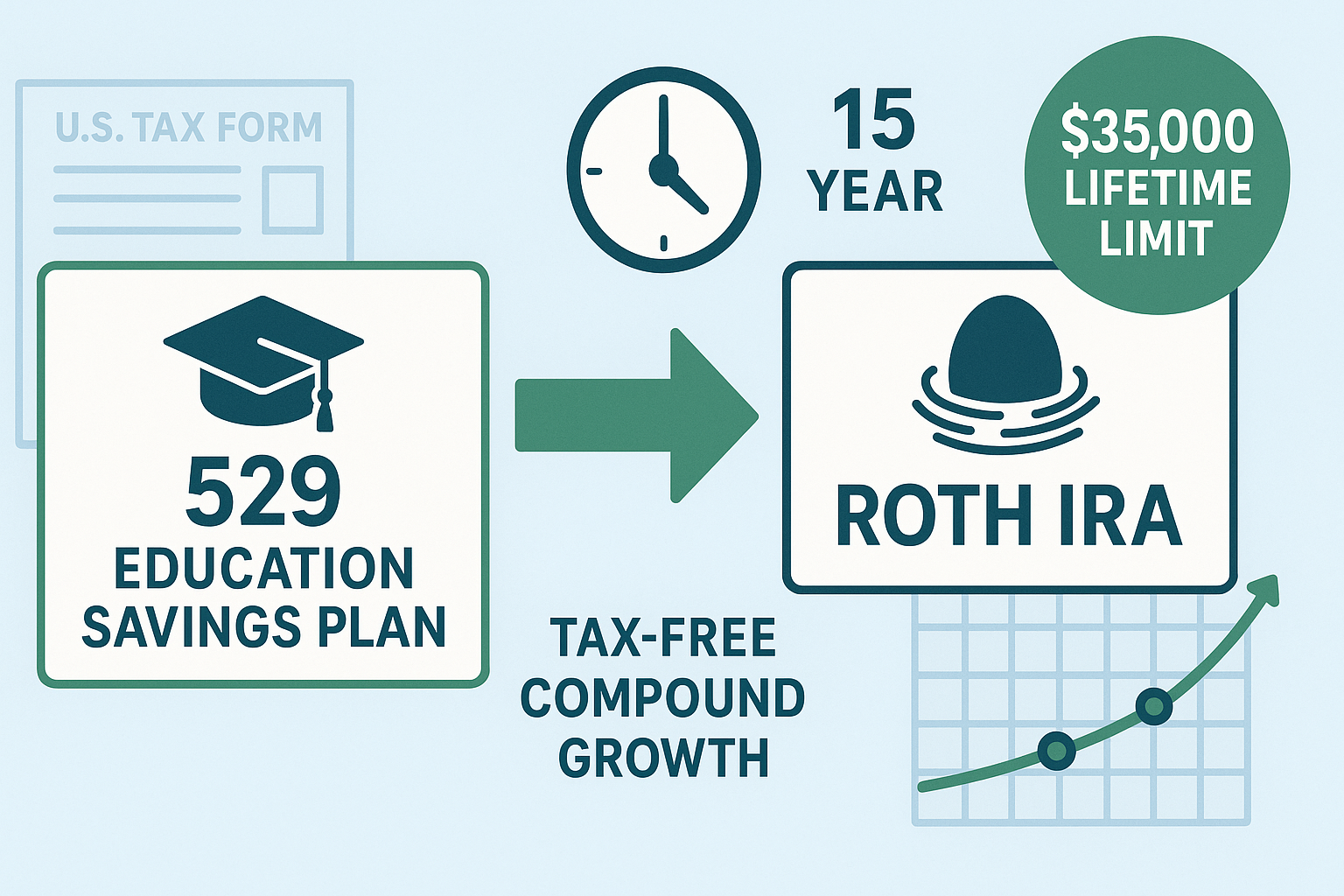

529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

Read more: 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025Master the 529 to Roth IRA rollover strategy under SECURE 2.0. Covers the 15-year rule, $35,000 limit, state tax implications, and step-by-step execution.

-

FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

Read more: FIRE Movement: The Complete 2025 Guide to Financial Independence and Early RetirementMaster the FIRE movement in 2025. Calculate your FI number, compare FIRE variants, plan healthcare coverage, and build your path to financial independence.

-

The Complete 401(k) Optimization Playbook for 2025

Read more: The Complete 401(k) Optimization Playbook for 2025Master every aspect of 401(k) optimization for 2025 with contribution limits up to $34,750 for ages 60-63, mega backdoor Roth strategies allowing $70,000 annual contributions, Traditional vs Roth decision frameworks, expense ratio analysis, and SECURE 2.0 provisions. This comprehensive guide includes investment selection strategies, poor-plan recognition, rollover decisions, and asset location optimization to add hundreds…

-

Backdoor Roth IRA: Step-by-Step Guide (2025)

Read more: Backdoor Roth IRA: Step-by-Step Guide (2025)Earn too much for a Roth IRA? The backdoor Roth strategy lets high earners contribute $7,000-$8,000 annually despite income limits. This complete guide walks you through every step for Fidelity, Vanguard, and Schwab, explains the pro-rata rule with real calculations, and shows you exactly how to file Form 8606.

-

Solo 401(k) Complete Guide for Self-Employed Workers (2025)

Read more: Solo 401(k) Complete Guide for Self-Employed Workers (2025)Self-employed workers can contribute up to $70,000 ($73,500 if 50+) to a Solo 401(k) in 2025, far exceeding SEP IRA and SIMPLE IRA limits. This comprehensive guide covers eligibility, provider comparison, setup process, contribution strategies, and advanced tactics including mega backdoor Roth options within Solo 401(k) plans.

-

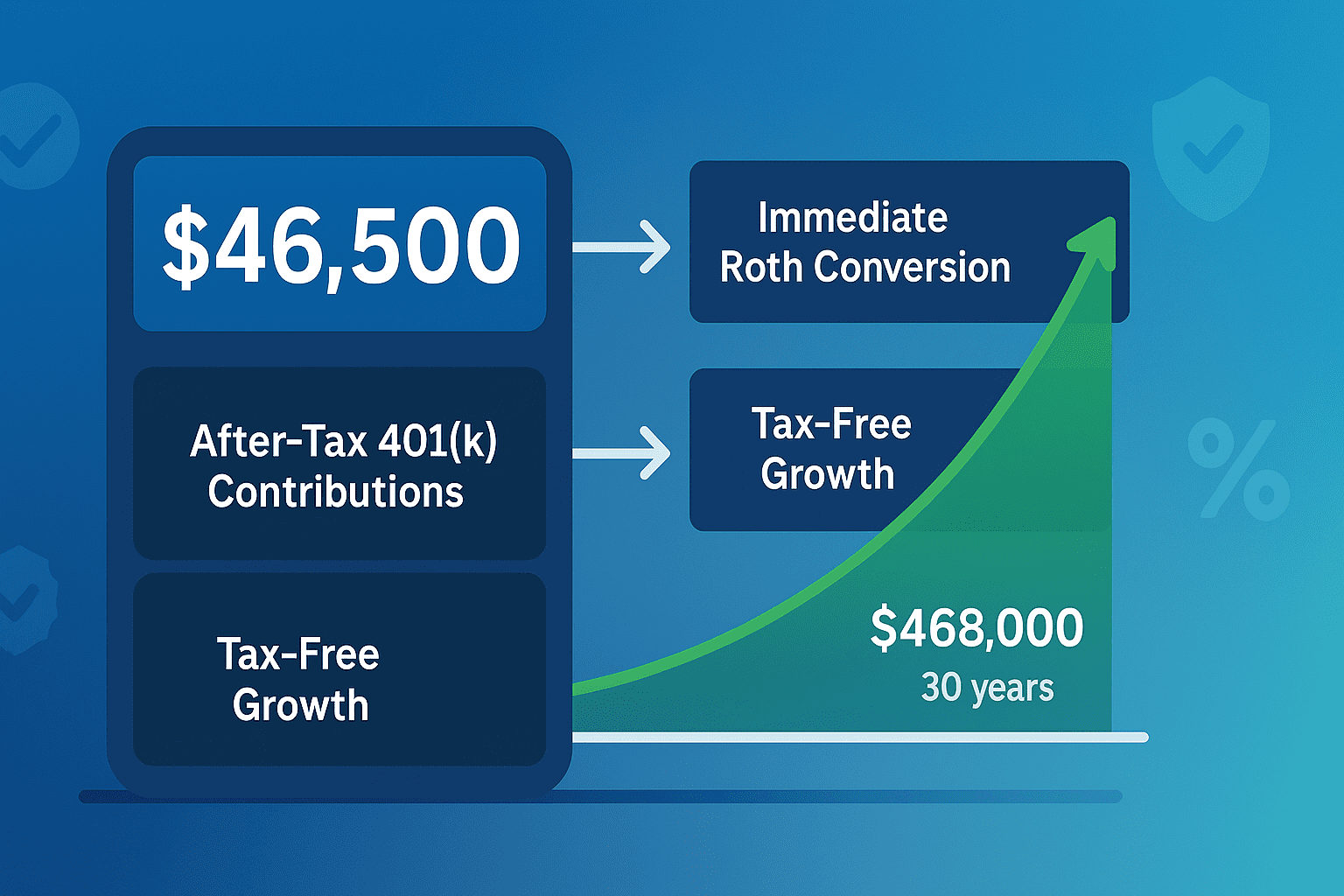

Mega Backdoor Roth: Complete Implementation Guide (2025)

Read more: Mega Backdoor Roth: Complete Implementation Guide (2025)High earners can contribute an additional $46,500 to Roth accounts in 2025 through the mega backdoor Roth strategy. This comprehensive implementation guide provides step-by-step instructions, employer plan compatibility checks, provider-specific walkthroughs, and troubleshooting for every common mistake.

-

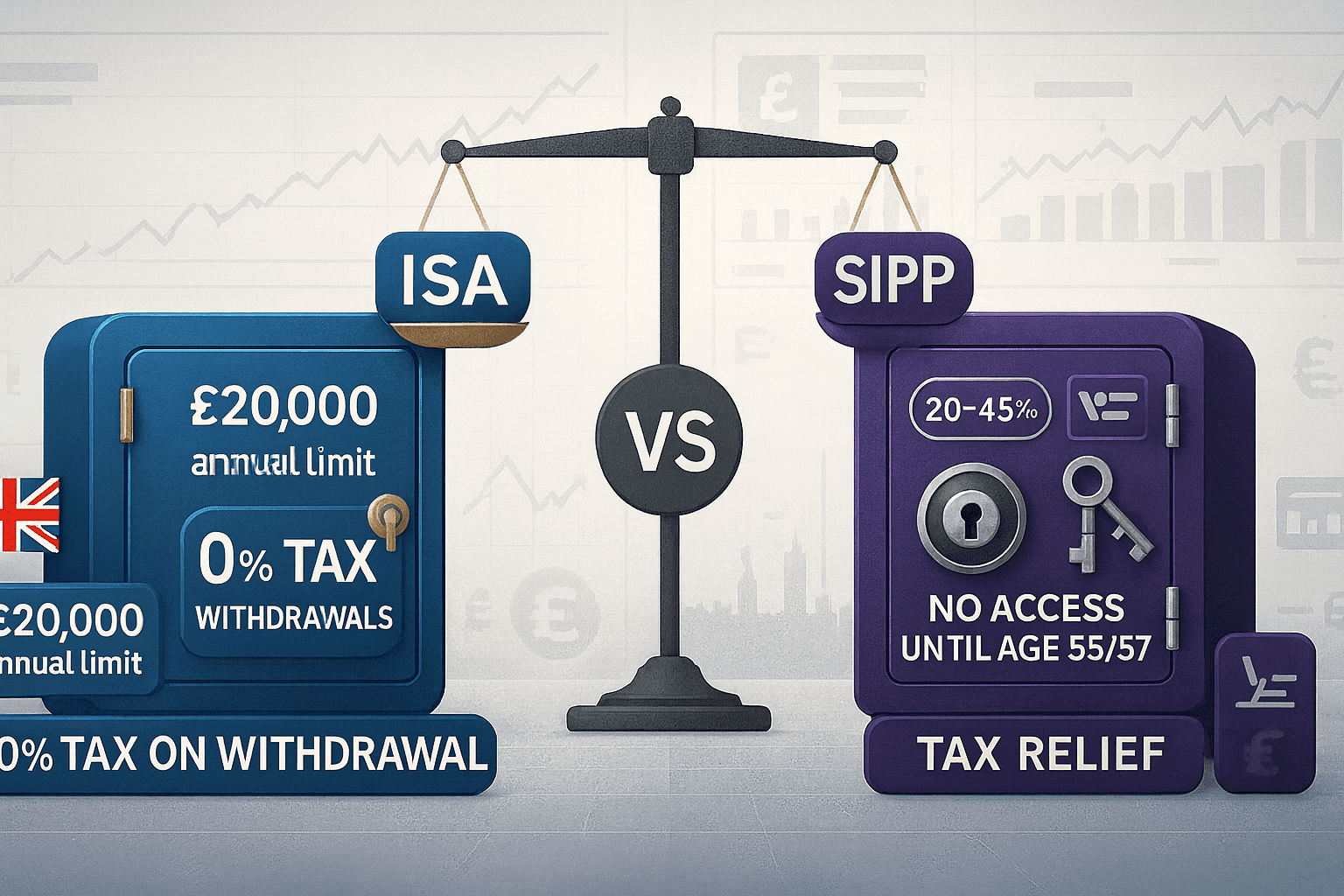

ISA vs SIPP: The Complete 2025/26 UK Comparison Guide After the November Budget

Read more: ISA vs SIPP: The Complete 2025/26 UK Comparison Guide After the November BudgetISA or SIPP? The November 2025 Budget changed everything. Compare tax relief, access rules, and inheritance planning with our interactive calculator.

-

Investment Guides, Investment Strategies, IRAs & Tax-Advantaged Accounts, Retirement Planning, Tax Strategy

Investment Guides, Investment Strategies, IRAs & Tax-Advantaged Accounts, Retirement Planning, Tax StrategyRoth IRA vs Traditional IRA: Complete 2025 Comparison Guide (With Calculator)

Read more: Roth IRA vs Traditional IRA: Complete 2025 Comparison Guide (With Calculator)Choosing between a Roth IRA and Traditional IRA isn’t just about current versus future taxes—it’s a decision that could impact your retirement wealth by $100,000 or more. In 2025, with contribution limits holding at $7,000 ($8,000 for ages 50+) but income thresholds increasing significantly, understanding which account type suits your situation has never been more…

-

Index Funds vs. Mutual Funds: Which Should You Choose in 2025?

Read more: Index Funds vs. Mutual Funds: Which Should You Choose in 2025?Should you choose index funds or mutual funds? This comprehensive guide compares costs, performance, and tax efficiency to help you decide where to invest in 2025.

Subscribe

Sign up with your email address to receive our weekly news

Latest news

- 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

- FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

- Tax-Loss Harvesting Strategy Guide (2025): Complete US & UK Implementation for DIY Investors

- Property Investment for Beginners: Your Complete Getting Started Guide for 2025

- The Complete 401(k) Optimization Playbook for 2025

Categories

- Backdoor Roth (1)

- Expat Living & Lifestyle (1)

- General Blog (2)

- Index Funds (1)

- Investing Basics (4)

- Investment Guides (6)

- Investment Platforms (1)

- Investment Strategies (12)

- Investments (2)

- IRAs & Tax-Advantaged Accounts (8)

- ISAs and Pensions (1)

- Property Investment (7)

- Real Estate Investing (3)

- Retirement Planning (12)

- Tax Strategy (8)

- Tax-Efficient Investing (3)

- UK Investing (3)

- UK Property Investment (2)