Important Educational Disclaimer

This article is for educational and informational purposes only and does not constitute financial, tax, investment, or medical advice. We do not provide financial advisory services or personalized investment recommendations. Health Savings Account rules are complex and individual circumstances vary significantly. Tax laws change regularly, and this information is current as of November 2025. HSA eligibility requires enrollment in a qualified high-deductible health plan. Before making any HSA contribution, investment, or withdrawal decisions, consult with a qualified financial advisor, tax professional, and licensed insurance agent who can evaluate your complete financial and health insurance situation. Past performance does not guarantee future results. All investment strategies carry risk, including loss of principal.

HSA Investment Strategy: How to Use the Triple Tax Advantage for Retirement

Only 13% of HSA owners invest their funds, leaving substantial money on the table. A 30-year-old investing $4,150 annually in their HSA could accumulate over $400,000 tax-free by retirement for healthcare expenses. Yet most people treat HSAs as glorified checking accounts, missing the most powerful tax advantage in the tax code. This comprehensive guide shows you exactly how to implement the triple tax advantage strategy, which providers offer the best investment options, and how to decide between keeping cash versus investing for maximum long-term wealth.

Table of Contents

- The Triple Tax Advantage Explained

- Why HSA Beats Roth IRA for Healthcare Expenses

- The Cash Versus Investment Decision

- Investment Strategy by Age

- The “Pay Now, Reimburse Later” Strategy

- HSA Provider Comparison

- Common Mistakes to Avoid

- Tax Optimization Strategies

- HSA Investment Growth Calculator

- Frequently Asked Questions

Calculate Your HSA Investment Potential

See exactly how much you could accumulate tax-free by investing your HSA instead of leaving it in cash.

Use Our Free Calculator →The Triple Tax Advantage Explained

The HSA offers something no other retirement account can match: tax benefits at three distinct stages. You get a tax deduction when you contribute, your money grows tax-free, and you withdraw it tax-free for qualified medical expenses. This makes it objectively better than both Roth and Traditional IRAs for healthcare costs.

2025 HSA Contribution Limits

- Individual coverage: $4,150

- Family coverage: $8,300

- Age 55+ catch-up: Additional $1,000

- Maximum family contribution (55+): $9,300

Compare this to a Roth IRA, which offers two tax advantages (tax-free growth and withdrawal, but no upfront deduction), or a Traditional IRA (upfront deduction and tax-free growth, but taxable withdrawals). The HSA combines the best of both worlds, then adds a third benefit.

Here’s the math: if you’re in the 24% federal tax bracket and contribute $4,150, you save $996 in taxes immediately. That money grows tax-free. When you withdraw it for medical expenses at any age, you pay zero tax. If you’d put the same money in a taxable brokerage account, you’d pay tax on the contribution (no deduction), pay tax on dividends and capital gains each year, and pay tax again when you sell. The difference compounds dramatically over decades.

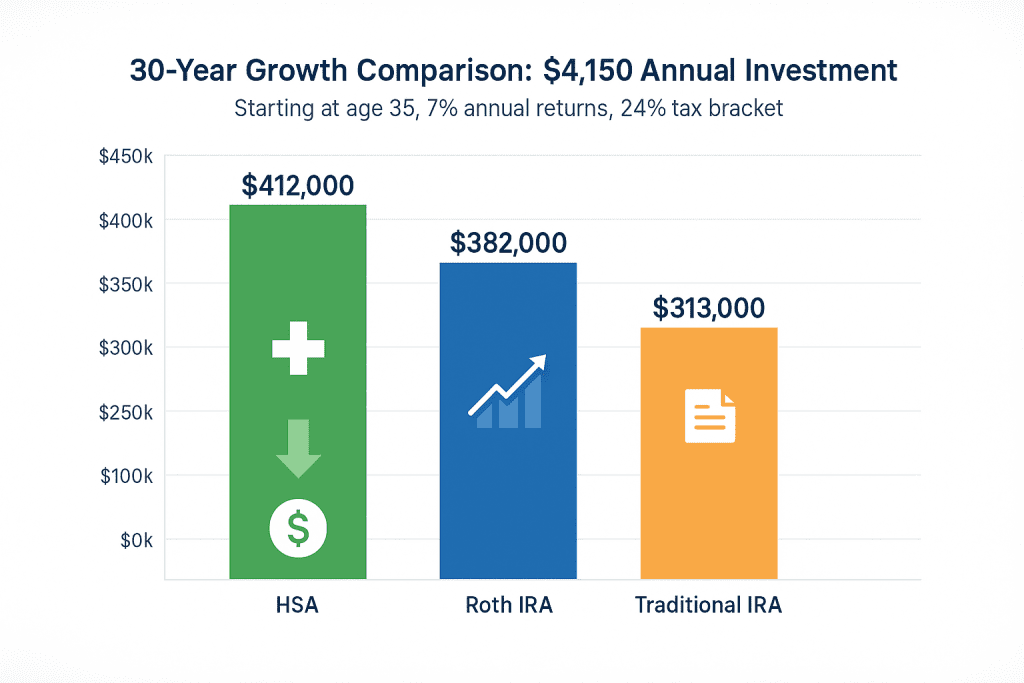

Real-World Comparison: $4,150 Annual Contribution Over 30 Years

HSA (invested): $412,000 tax-free (assuming 7% returns)

Roth IRA: $412,000 tax-free, but you paid $996 in taxes each year on the contribution (lost $29,880 in tax deductions over 30 years)

Traditional IRA: $412,000 pre-tax, but you’ll pay $98,880 in taxes when you withdraw it in retirement (assuming 24% bracket)

Taxable Account: $306,000 after-tax (lost approximately $106,000 to annual taxes and capital gains)

The catch? You must use an HSA for qualified medical expenses to get that third tax benefit. But here’s the insight most people miss: healthcare costs in retirement are massive and predictable. Fidelity estimates the average 65-year-old couple will spend $315,000 on healthcare throughout retirement. Your HSA is purpose-built for exactly this expense.

Why HSA Beats Roth IRA for Healthcare Expenses

If you’re trying to decide between maxing your HSA or your Roth IRA, the HSA wins for healthcare planning. After age 65, the HSA becomes even more flexible. You can withdraw funds for any reason (not just medical), and you’ll simply pay income tax, exactly like a Traditional IRA. But if you use it for medical expenses, it remains completely tax-free.

This means your HSA is a Roth IRA with better tax treatment before 65, and it equals a Traditional IRA after 65 for non-medical expenses. It’s the ultimate retirement account flexibility.

Pro Tip: If you’re under 65 and in good health, prioritize HSA contributions even above Roth IRA contributions. The triple tax advantage is worth more than the Roth’s double tax advantage, especially if you’re in a high tax bracket now. Once you max the HSA ($4,150 or $8,300), then fund your Roth IRA.

The strategic advantage compounds when you consider Medicare. Once you enroll in Medicare at 65, you can no longer contribute to an HSA. But your existing HSA balance continues growing tax-free, and you can use it to pay Medicare premiums (Parts B and D, plus Medicare Advantage), supplemental insurance premiums, and out-of-pocket costs. This creates a tax-free income stream precisely when healthcare costs spike.

Let’s look at a real scenario: Sarah is 35, contributes $4,150 annually to her HSA, invests it in low-cost index funds averaging 7% returns, and has minimal medical expenses now. By 65, she has $425,000 in her HSA. Her Medicare premium is $175/month ($2,100/year), supplemental insurance costs $200/month ($2,400/year), and out-of-pocket costs average $3,500/year. She withdraws $8,000 annually tax-free. If she lives to 90, she’ll withdraw $200,000 completely tax-free while her remaining balance continues growing. In a Traditional IRA, that $200,000 withdrawal would cost her $48,000 in taxes (at 24%). The HSA saves her $48,000 in taxes on just the withdrawals, not counting the decades of tax-free growth.

The Cash Versus Investment Decision

This is where most HSA owners get stuck. Should you keep everything in cash for emergencies, or invest it all for long-term growth? The answer depends on your age, health status, and financial situation, but here’s the framework that works.

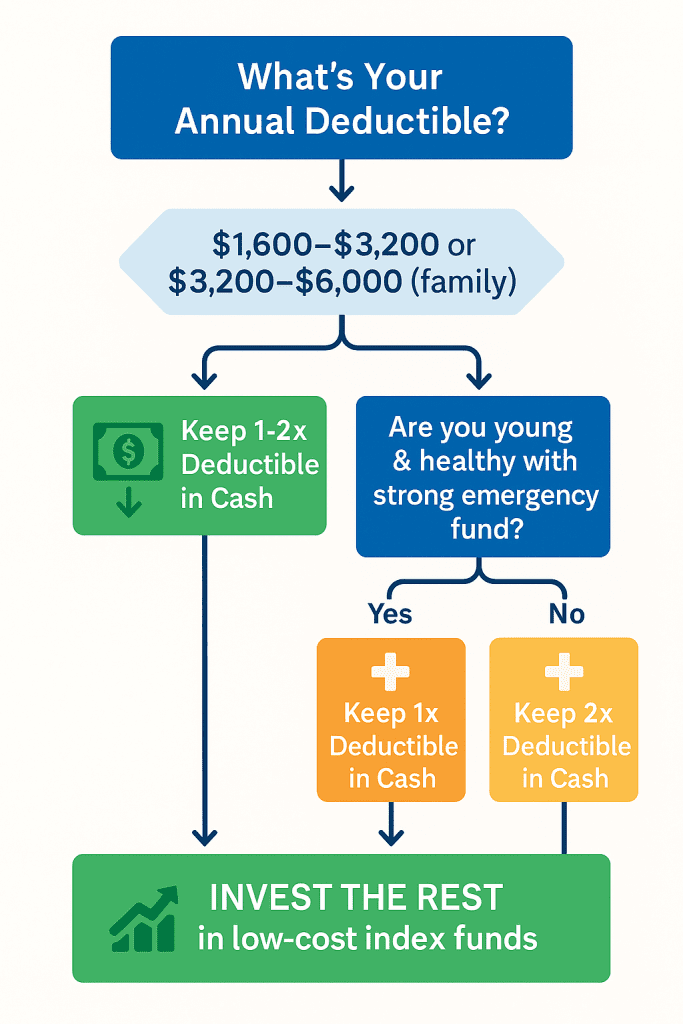

The 1-2x Deductible Rule

Keep one to two times your annual deductible in cash within your HSA. Invest everything above that amount. This gives you immediate access to funds if you face a medical emergency, while allowing the majority of your HSA to grow tax-free.

For 2025, the minimum deductible for an HSA-qualified high-deductible health plan is $1,600 for individuals and $3,200 for families. If your actual plan deductible is $3,000 (individual) or $6,000 (family), keep that amount in cash. Once your HSA balance exceeds $3,000 or $6,000, invest the excess.

Cash Reserve Guidelines by Situation

- Healthy, young adult with low healthcare usage: 1x annual deductible in cash

- Family with children or chronic conditions: 2x annual deductible in cash

- Near retirement (age 55+): 2-3 years of expected healthcare expenses in cash

- High deductible but strong emergency fund elsewhere: Minimum cash (even $1,000), invest the rest

The key insight: you don’t need to use your HSA cash for every medical expense right away. If you have a strong emergency fund in a regular savings account, you can pay medical expenses out-of-pocket and leave your entire HSA invested. This leads to the advanced “pay now, reimburse later” strategy we’ll cover shortly.

What If You Need the Money?

Many people avoid investing their HSA because they worry about needing the money during a market downturn. This is a valid concern, but it’s manageable with proper planning.

First, remember that you control the timing of your HSA withdrawals. Unlike a 401(k) with required minimum distributions, you can let your HSA sit untouched for decades. If the market drops 30% and you need $5,000 for surgery, you can:

- Use your HSA cash reserve ($1,600-$6,000 depending on your deductible)

- Pay out-of-pocket from your emergency fund, save the receipt, and reimburse yourself later when markets recover

- Sell only the amount needed, accepting the temporary loss but preserving the rest of your balance

The flexibility of HSAs makes them far more forgiving than retirement accounts with forced withdrawal schedules. You’re in complete control.

Investment Strategy by Age

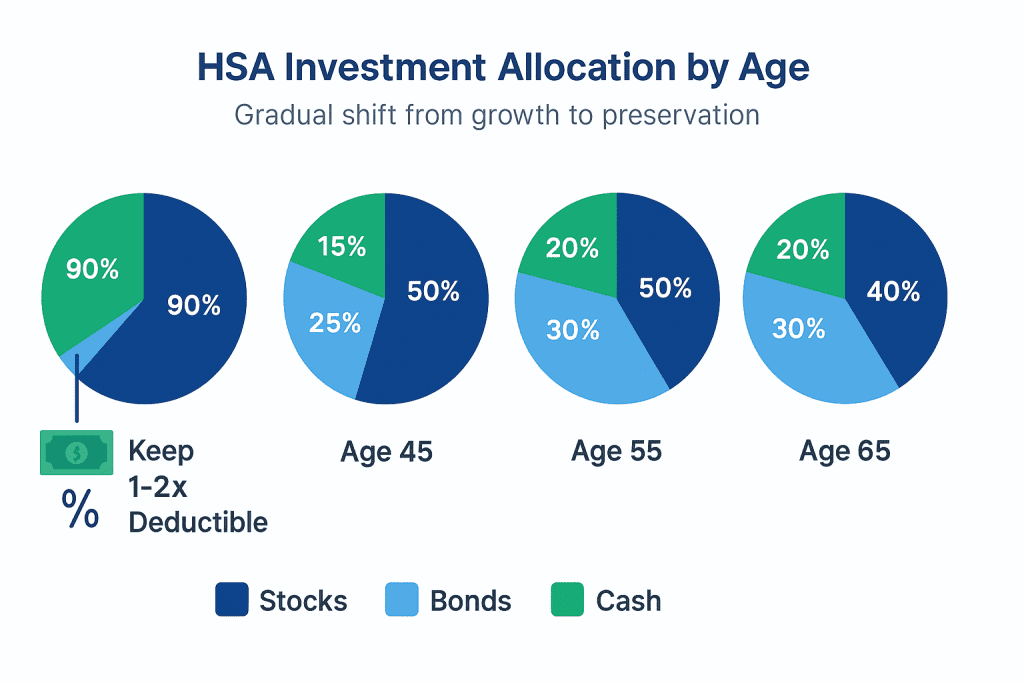

Your HSA investment approach should evolve as you age, similar to how you adjust your retirement account allocation. Here’s the lifecycle strategy that balances growth with safety.

Ages 20-40: Maximum Growth

If you’re young and healthy, invest 90-100% of your HSA in stocks after building your cash reserve. You have 30-45 years until Medicare eligibility, giving you plenty of time to recover from market volatility. Focus on broad market index funds with low expense ratios.

Recommended allocation:

- 70% U.S. total stock market index fund (VTI, FZROX, or equivalent)

- 25% international stock index fund (VXUS, FTIHX, or equivalent)

- 5% cash reserve (or 1-2x your deductible, whichever is higher)

At this age, tax-free compounding is your superpower. A $4,150 annual contribution at age 25, growing at 7% annually, becomes $944,000 by age 65. That’s almost $1 million tax-free for healthcare. Don’t sabotage this by sitting in cash earning 0.5%.

Scenario: Marcus, 28-Year-Old Software Engineer

Income: $95,000 | HSA Balance: $8,000 | Annual Deductible: $2,500

Strategy: Keep $2,500 in cash (1x deductible), invest $5,500 in 70/25/5 stock allocation

Reasoning: Marcus is young, healthy, rarely visits doctors, and has six months of expenses in an emergency fund. He can afford to be aggressive with HSA investments because he has 37 years until age 65. Even if markets drop 40% tomorrow, he has time to recover. His emergency fund covers unexpected medical costs without forcing HSA sales during downturns.

Ages 40-55: Balanced Approach

As you enter your 40s and 50s, gradually reduce stock exposure and increase your cash cushion. You’re approaching the years when healthcare usage typically increases (chronic conditions, surgeries, specialists), so you want more stability.

Recommended allocation:

- 60% stocks (45% U.S., 15% international)

- 25% bonds (intermediate-term bond index fund)

- 15% cash reserve (2-3x annual deductible)

The bond allocation provides stability and reduces the chance you’ll be forced to sell stocks during a downturn. The larger cash reserve handles increased healthcare usage without disrupting your investment strategy.

Ages 55-65: Pre-Medicare Transition

In the decade before Medicare, shift toward preservation while maintaining growth. This is also when you qualify for the $1,000 catch-up contribution, allowing you to contribute up to $5,150 (individual) or $9,300 (family) annually.

Recommended allocation:

- 50% stocks (35% U.S., 15% international)

- 30% bonds

- 20% cash (3-4x annual deductible, or two years of expected healthcare costs)

Build a larger cash buffer because you’re approaching the highest healthcare usage years. If you retire before 65, you’ll likely face higher premiums and out-of-pocket costs before Medicare begins. That cash reserve prevents forced investment sales.

Pro Tip: At 55, max out that catch-up contribution. If you’re married and both spouses are 55+, you can each contribute an extra $1,000 to your family HSA (by opening a second HSA in the other spouse’s name). This lets you contribute $9,300 + $1,000 = $10,300 total to HSAs annually. Over 10 years, that’s $103,000 in contributions, growing to approximately $150,000 by age 65 (at 6% returns). All tax-free.

Ages 65+: Retirement Withdrawal Phase

Once you enroll in Medicare, you can no longer contribute to an HSA, but your existing balance continues growing tax-free. Now your HSA becomes a withdrawal vehicle optimized for tax-free healthcare income.

Recommended allocation:

- 40-50% stocks (to maintain purchasing power against healthcare inflation)

- 30-40% bonds

- 20-30% cash (to cover 2-3 years of Medicare premiums and out-of-pocket costs)

The continued stock allocation might surprise you, but healthcare inflation runs at 4-5% annually. If you have a $300,000 HSA balance at 65 and withdraw $10,000 annually, you need growth to prevent the balance from depleting. Keeping 40-50% in stocks maintains long-term purchasing power over a 20-30 year retirement.

The “Pay Now, Reimburse Later” Strategy

This is the advanced strategy that transforms your HSA from a good retirement account into an exceptional one. Here’s how it works: pay your medical expenses out-of-pocket from your regular checking account, save all the receipts, and leave your HSA invested. Years or decades later, when you need cash in retirement, reimburse yourself for those old medical expenses, tax-free.

The IRS has no time limit on HSA reimbursements. As long as you incurred the medical expense after you opened your HSA, you can reimburse yourself at any time. This creates an incredible tax arbitrage opportunity.

How the Strategy Works: Real Example

Year 1 (Age 30): $2,000 medical bill (dental surgery). Pay from checking account, save receipt, leave $4,150 HSA contribution invested.

Years 2-30: Continue paying medical expenses out-of-pocket ($1,000-$3,000 annually), save all receipts in digital folder, let HSA compound tax-free.

Age 60: You have $400,000 in HSA and $85,000 in saved medical receipts. You retire early and need cash flow before Social Security begins.

Solution: Reimburse yourself $20,000/year for five years using your old receipts. Completely tax-free withdrawals, no age restrictions, no penalties. It’s like having an $85,000 Roth conversion you did 30 years ago, except it was always tax-free.

This strategy requires discipline and organization. You must save and organize receipts for decades. But the payoff is substantial: you’ve essentially created a tax-free income stream you can tap at any age, completely separate from your retirement accounts.

How to Track Receipts for Decades

Use a simple system to prevent receipt loss over time:

- Digital scanning: Photograph or scan every medical receipt immediately after payment. Thermal paper receipts fade within months.

- Cloud storage: Create a dedicated folder in Google Drive, Dropbox, or OneDrive called “HSA Receipts” with subfolders by year.

- Spreadsheet tracking: Maintain a simple spreadsheet listing date, provider, service, amount paid, and filename of receipt image.

- Annual review: Once per year, verify all receipts are readable and backed up. Total your annual unreimbursed expenses.

- Redundant backup: Keep a second backup on an external hard drive or different cloud service.

Pro Tip: IRS rules require receipts showing the expense was for medical care, the date of service, and the amount. Explanation of Benefits (EOB) statements from your insurance company work perfectly and are often easier to obtain than physical receipts. Download your EOBs from your insurance portal immediately after receiving care.

For those uncomfortable with the “pay now, reimburse later” strategy, you can still invest your HSA aggressively. Simply use HSA funds directly for medical expenses as they occur, reducing your invested balance only when necessary. This approach is simpler but less tax-optimized.

HSA Provider Comparison

Not all HSA providers are created equal. The difference between a good provider and a poor one can cost you thousands in fees and limit your investment options. Here’s what you need to know.

What to Look For

Evaluate HSA providers on five criteria:

- Investment options: Robust mutual fund and ETF selection, ideally including low-cost index funds

- Fees: Monthly maintenance fees, investment fees, and hidden charges

- Minimum investment threshold: How much you need before you can invest (some require $1,000-$2,000 in cash first)

- User experience: Mobile app quality, website ease of use, customer service responsiveness

- Additional features: Debit card access, bill pay, receipt storage tools

| Provider | Monthly Fee | Investment Options | Min. to Invest | Best For |

|---|---|---|---|---|

| Fidelity HSA | $0 | Full Fidelity fund lineup, stocks, ETFs | $0 | Active investors, large balances, DIY investors |

| Lively | $0 with $3,000+ balance (otherwise $2.50/month) | TD Ameritrade platform access | $0 | Beginners, small balances, want to avoid fees |

| HealthEquity | $3.75/month + $0.03/day invested assets | Curated mutual fund lineup | $1,000 | Employer-sponsored plans, simple approach |

| Bank of America HSA | $2.50/month (waived with $5,000+ balance) | Merrill Edge platform | $1,000 | Existing BofA customers, integrated banking |

| HSA Bank | $2.50/month | Limited mutual fund selection | $1,000 | Those with employer-selected plan only |

Based on comprehensive analysis, Fidelity HSA offers the best combination of zero fees, excellent investment options, and no minimum balance requirement. If you already have a Fidelity account for your IRA or brokerage, consolidating your HSA there simplifies management and tracking.

Lively works well for those just starting out or maintaining smaller balances. The $0 fee structure (once you reach $3,000) and access to TD Ameritrade’s investment platform provide flexibility without the cost burden that plagues some competitors.

If your employer partners with HealthEquity or HSA Bank and contributes to your HSA, the employer contributions often outweigh the higher fees. However, once you leave that employer, consider transferring your HSA to Fidelity or Lively to eliminate ongoing costs.

Pro Tip: You can transfer your HSA between providers anytime without tax consequences or penalties. If you’re paying $3.75/month in fees at HealthEquity ($45/year), that’s $45 that could be compounding tax-free instead. Over 30 years at 7% returns, those fees cost you $4,229. Transfer to a zero-fee provider and invest that money instead.

What to Invest In

Once you’ve chosen a provider, select investments that match your age-based strategy outlined earlier. For most people, a simple three-fund portfolio works perfectly:

- U.S. Total Stock Market Index: Fidelity FZROX, Vanguard VTI, or Schwab SWTSX

- International Stock Index: Fidelity FTIHX, Vanguard VXUS, or Schwab SWISX

- Bond Index (for ages 40+): Fidelity FXNAX, Vanguard BND, or Schwab SWAGX

Keep expense ratios below 0.10% when possible. The difference between a 0.05% expense ratio and a 0.75% expense ratio is $28,000 over 30 years on a $200,000 balance. Choose low-cost index funds and let compound growth do the heavy lifting.

Common Mistakes to Avoid

Even sophisticated investors make these errors with HSAs. Learn from others’ mistakes and avoid these pitfalls.

Mistake 1: Leaving Everything in Cash

The biggest mistake is treating your HSA like a savings account. If you have a $20,000 HSA balance sitting in cash earning 0.5% interest, you’re losing $1,300 annually to inflation (assuming 3% healthcare inflation). Over 20 years, the opportunity cost of not investing is approximately $275,000 in lost compound growth.

Solution: Keep 1-2x your deductible in cash, invest the rest. Start small if you’re nervous. Move 25% of your excess balance to investments, see how it feels, then gradually increase.

Mistake 2: Insufficient Cash Buffer

The opposite mistake is investing everything aggressively, then facing a $5,000 emergency room bill when markets are down 25%. You’re forced to sell at a loss, locking in the decline.

Solution: Maintain a proper cash reserve based on your deductible and health situation. If you have chronic conditions requiring ongoing care, keep 2-3x your deductible in cash. If you’re young and healthy with a strong emergency fund elsewhere, 1x your deductible suffices.

Mistake 3: Choosing High-Fee Providers

A $3.75 monthly fee might seem trivial, but it compounds negatively over time. That $45/year, if invested at 7% returns for 30 years instead of paid to your HSA provider, grows to $4,229. High fees are a silent wealth destroyer.

Solution: Transfer to Fidelity, Lively, or another zero-fee provider. The transfer process takes 2-3 weeks but saves thousands over a lifetime.

Mistake 4: Not Saving Receipts

If you’re using the “pay now, reimburse later” strategy but lose receipts, you lose the ability to access that money tax-free. Without documentation, the IRS treats withdrawals as taxable income plus a 20% penalty (if under 65).

Solution: Implement a digital receipt system immediately. Scan every receipt the day you receive it. Back up monthly. Test your system by retrieving a receipt from three years ago. If you can’t find it within 60 seconds, your system needs improvement.

Mistake 5: Contributing After Medicare Enrollment

Once you enroll in Medicare (typically at 65), you lose HSA contribution eligibility. Contributing after Medicare enrollment results in excess contributions, which face a 6% annual excise tax until removed.

Solution: Stop HSA contributions the month you enroll in Medicare. If you delay Medicare enrollment while working past 65, you can continue contributing. But the moment you enroll, contributions must cease.

Mistake 6: Forgetting the HDHP Requirement

You can only contribute to an HSA while covered by a qualified high-deductible health plan. If you switch to a traditional PPO or HMO during the year, you lose contribution eligibility for the months you weren’t HDHP-covered.

Solution: If changing jobs or health plans, verify the new plan qualifies as HDHP before making full-year HSA contributions. The IRS contribution rules are pro-rated based on eligible months.

Tax Optimization Strategies

Beyond the basic triple tax advantage, several advanced strategies can squeeze even more value from your HSA.

State Tax Considerations

Two states don’t recognize HSA tax advantages: California and New Jersey. If you live in these states, you still get federal tax deductions and tax-free growth, but state taxes apply. This slightly reduces (but doesn’t eliminate) the HSA advantage.

In the other 48 states, you get both federal and state tax deductions on contributions. For high-tax states like New York (up to 10.9% state tax), California residents (who pay up to 13.3% state tax but can’t deduct HSA contributions), and Massachusetts (5.0% flat state tax), the additional state tax deduction on contributions makes HSAs even more valuable.

Employer Contribution Timing

If your employer contributes to your HSA (common benefit), understand the timing. Employer contributions count toward your annual limit. If your employer contributes $1,000 and the limit is $4,150, you can only contribute $3,150 personally.

Time your personal contributions to maximize investment opportunity. If your employer contributes monthly throughout the year, front-load your personal contributions in January and February to get your money invested sooner. The longer your money compounds tax-free, the more you accumulate.

Family Coverage Strategy

If you have family coverage, both spouses can contribute to the same HSA (up to the family limit of $8,300), or each spouse can have their own HSA. The total contributions can’t exceed $8,300, but separate accounts provide flexibility.

Once both spouses reach 55, the catch-up contribution strategy becomes powerful. Each spouse can contribute an additional $1,000, but it must go to their own HSA. Open a second HSA in the other spouse’s name, and you can contribute $8,300 + $1,000 + $1,000 = $10,300 total. This loophole is completely legal and explicitly allowed by the IRS.

Maximum Family HSA Contributions (Both Spouses 55+)

- Base family limit: $8,300

- Spouse 1 catch-up (separate HSA): $1,000

- Spouse 2 catch-up (separate HSA): $1,000

- Total possible contribution: $10,300

- Tax deduction at 24% bracket: $2,472

Last-Month Rule

If you become HSA-eligible mid-year, the “last-month rule” lets you make a full year’s contribution if you’re eligible on December 1st and remain eligible for the entire following year. This creates a substantial tax deduction in your first partial year.

Example: You start a new job with HDHP coverage on November 1st. You’re eligible for only two months (November-December). Normally you could contribute 2/12 of the annual limit ($691 for individual coverage). But under the last-month rule, because you’re eligible on December 1st, you can contribute the full $4,150, provided you maintain HDHP coverage for all of the following year. This gives you a $4,150 tax deduction instead of a $691 deduction.

Warning: If you fail to maintain HDHP coverage for the entire following year, the excess contribution becomes taxable income plus a 10% penalty. Only use this rule if you’re certain about next year’s health coverage.

HSA Investment Growth Calculator

Calculate Your HSA Investment Potential

See how much you could accumulate tax-free by investing your HSA instead of leaving it in cash.

Your Projected Results

Balance at Age 65

Tax Savings vs. Taxable Account

Estimated taxes avoided on contributions, growth, and withdrawals

Annual Healthcare Withdrawal Capacity

Tax-free annual withdrawal sustainable for 30 years (4% rule)

Note: This calculator provides estimates based on your inputs and assumes consistent contributions and returns. Actual results will vary based on market performance, contribution changes, healthcare spending, and individual circumstances. The tax savings calculation assumes a 24% federal tax bracket, 5% state tax, and 15% long-term capital gains rate for comparison purposes. Consult a financial advisor for personalized guidance.

Frequently Asked Questions

Yes, most major HSA providers offer investment options including mutual funds, index funds, ETFs, and sometimes individual stocks. Once your cash balance exceeds your provider’s minimum (often $1,000-$2,000, or $0 at Fidelity), you can move funds into investments. Choose low-cost index funds tracking the total stock market for the best long-term growth with minimal fees.

Your HSA belongs to you forever, regardless of job changes or insurance switches. It’s fully portable and never expires. If you leave your employer, your HSA stays with you. You can continue using it for medical expenses even if your new job doesn’t offer HDHP coverage. However, you can only make new contributions during months when you have qualified HDHP coverage. If you switch to a non-HDHP plan, your existing balance remains yours to use and invest, but new contributions stop until you return to HDHP coverage.

You can absolutely save your HSA for retirement. There’s no “use it or lose it” rule like FSAs have. Your HSA balance rolls over indefinitely and continues growing tax-free. Many sophisticated investors pay current medical expenses out-of-pocket (saving receipts for potential future reimbursement) and let their HSA compound tax-free for decades. After age 65, you can withdraw for any reason without penalty, though you’ll pay income tax on non-medical withdrawals, exactly like a Traditional IRA. For medical expenses, withdrawals remain completely tax-free at any age.

Follow this priority order for retirement savings: (1) Contribute to 401(k) up to employer match (free money, always do this first), (2) Max your HSA ($4,150 individual or $8,300 family for 2025), (3) Max Roth IRA ($7,000 or $8,000 if 50+), (4) Return to 401(k) and contribute up to the $23,500 limit. The HSA’s triple tax advantage makes it mathematically superior to both Roth and Traditional IRAs for healthcare expenses, which you’ll definitely have in retirement. After capturing your 401(k) match, maxing the HSA provides the best tax-advantaged growth available.

IRS Publication 502 defines qualified medical expenses. This includes doctor visits, hospital stays, prescription medications, dental care, vision care (glasses, contacts, exams), mental health services, physical therapy, chiropractic care, and many over-the-counter medications. It also covers Medicare premiums (Parts B, D, and Medicare Advantage), long-term care insurance premiums (up to age-based limits), and COBRA premiums. Not qualified: health club memberships, cosmetic procedures, most nutritional supplements, and non-prescription drugs (except insulin). When in doubt, check IRS Publication 502 or consult a tax professional.

Generally no. If you have a Health FSA (flexible spending account), you cannot contribute to an HSA in the same year. The exception is a Limited Purpose FSA, which covers only dental and vision expenses, not general medical costs. You can have an HSA alongside a Limited Purpose FSA. Additionally, you can have a Dependent Care FSA (for childcare expenses) simultaneously with an HSA, since it doesn’t cover medical expenses. If you’re switching from an FSA to an HSA-eligible plan, any remaining FSA balance must be spent or forfeited before you can start HSA contributions, unless your employer offers an FSA grace period or carryover.

Absolutely yes, and arguably even more valuable. If you’re young and healthy with minimal current healthcare needs, your HSA becomes a stealth retirement account with better tax treatment than a Roth IRA. Pay your infrequent medical expenses out-of-pocket, save the receipts, and let your entire HSA balance grow tax-free for 30-40 years. By the time you reach retirement, you’ll have accumulated hundreds of thousands tax-free. Healthcare costs average $315,000 per couple in retirement, so you will have substantial medical expenses eventually. Building your HSA now when you’re healthy means that money is ready when you need it most.

If you have family HDHP coverage, the family contribution limit ($8,300 for 2025) applies to the household, not per person. Either spouse can contribute, or both can contribute to the same HSA, as long as the total doesn’t exceed $8,300. However, catch-up contributions ($1,000 additional for ages 55+) must go to each individual’s own HSA. So if both spouses are 55+, you can contribute $8,300 + $1,000 + $1,000 = $10,300 total, but the catch-up amounts must each go to separate HSAs. This requires opening a second HSA in the other spouse’s name.