Roth IRA

-

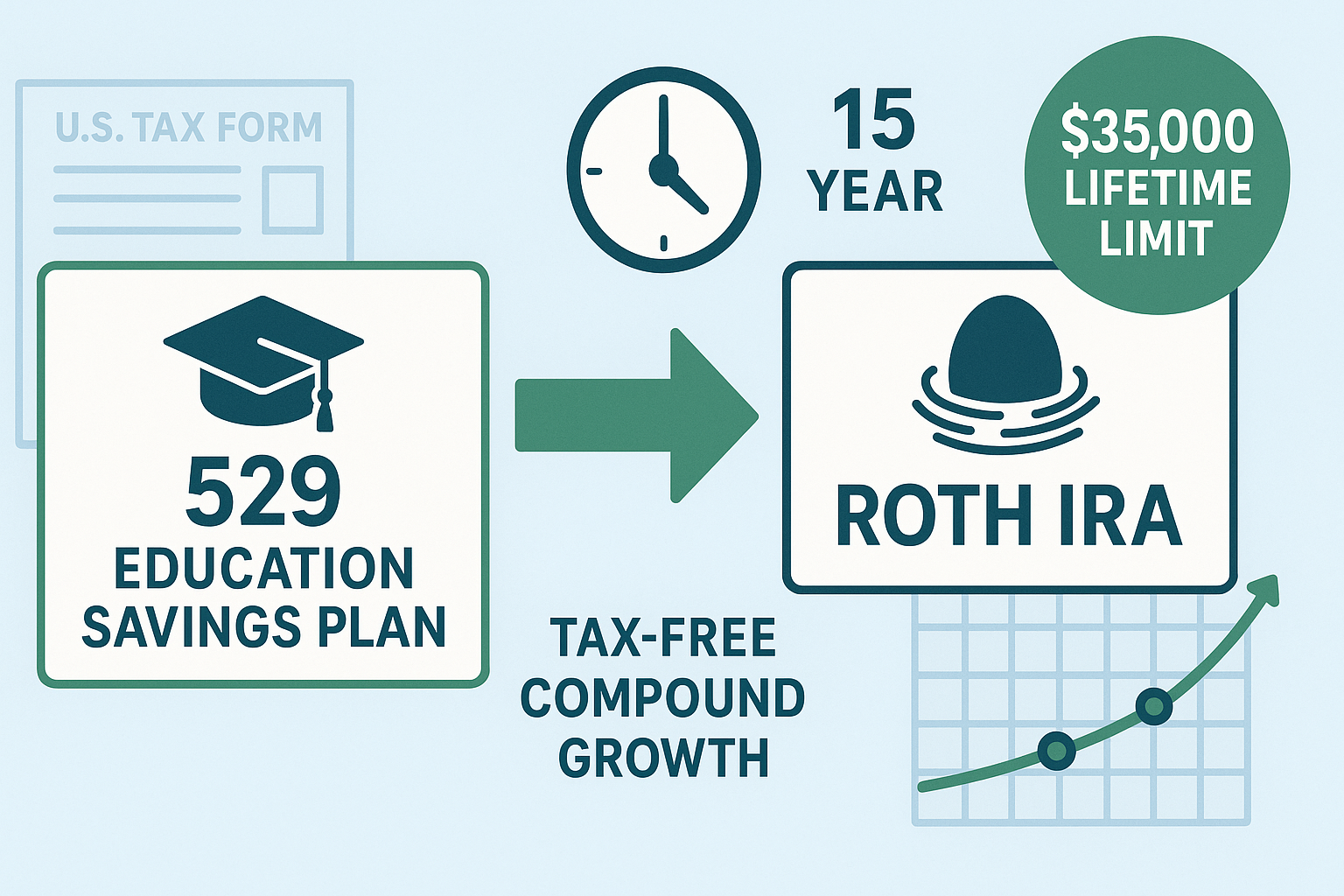

529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

Read more: 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025Master the 529 to Roth IRA rollover strategy under SECURE 2.0. Covers the 15-year rule, $35,000 limit, state tax implications, and step-by-step execution.

-

FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

Read more: FIRE Movement: The Complete 2025 Guide to Financial Independence and Early RetirementMaster the FIRE movement in 2025. Calculate your FI number, compare FIRE variants, plan healthcare coverage, and build your path to financial independence.

-

Investment Guides, Investment Strategies, IRAs & Tax-Advantaged Accounts, Retirement Planning, Tax Strategy

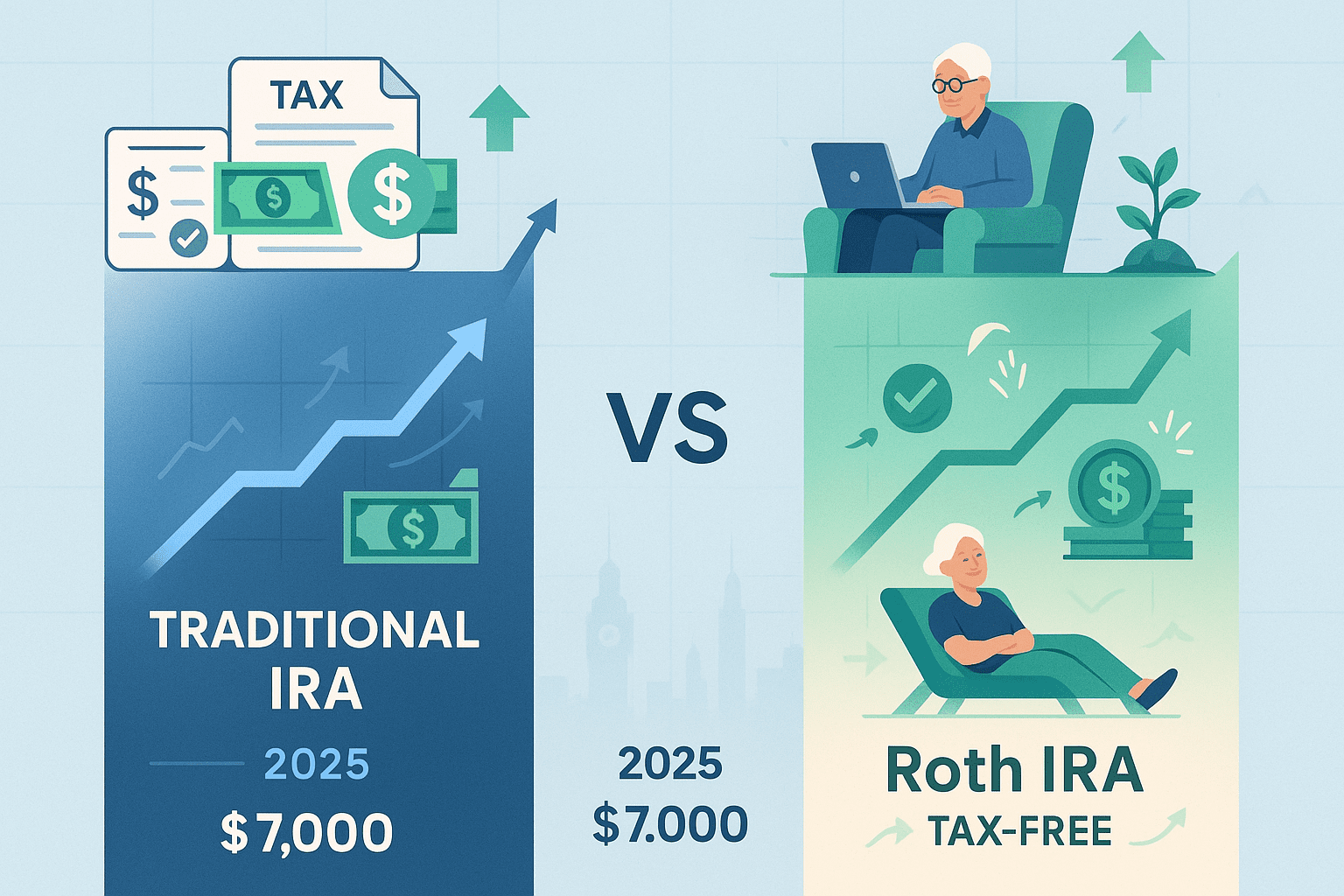

Investment Guides, Investment Strategies, IRAs & Tax-Advantaged Accounts, Retirement Planning, Tax StrategyRoth IRA vs Traditional IRA: Complete 2025 Comparison Guide (With Calculator)

Read more: Roth IRA vs Traditional IRA: Complete 2025 Comparison Guide (With Calculator)Choosing between a Roth IRA and Traditional IRA isn’t just about current versus future taxes—it’s a decision that could impact your retirement wealth by $100,000 or more. In 2025, with contribution limits holding at $7,000 ($8,000 for ages 50+) but income thresholds increasing significantly, understanding which account type suits your situation has never been more…

-

Invest $1,000 in 2025: 7 Strategies Beginners Actually Use (With Returns)

Read more: Invest $1,000 in 2025: 7 Strategies Beginners Actually Use (With Returns)You’ve saved $1,000 and you’re ready to start investing—but where should you begin? This comprehensive guide reveals seven proven strategies for investing your first $1,000 in 2025, from tax-advantaged Roth IRAs with zero-fee index funds to automated robo-advisors that handle everything for you. Whether you prefer hands-off simplicity with target-date funds, want to capture free…

Subscribe

Sign up with your email address to receive our weekly news

Latest news

- 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

- FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

- Tax-Loss Harvesting Strategy Guide (2025): Complete US & UK Implementation for DIY Investors

- Property Investment for Beginners: Your Complete Getting Started Guide for 2025

- The Complete 401(k) Optimization Playbook for 2025

Categories

- Backdoor Roth (1)

- Expat Living & Lifestyle (1)

- General Blog (2)

- Index Funds (1)

- Investing Basics (4)

- Investment Guides (6)

- Investment Platforms (1)

- Investment Strategies (12)

- Investments (2)

- IRAs & Tax-Advantaged Accounts (8)

- ISAs and Pensions (1)

- Property Investment (7)

- Real Estate Investing (3)

- Retirement Planning (12)

- Tax Strategy (8)

- Tax-Efficient Investing (3)

- UK Investing (3)

- UK Property Investment (2)