solo 401k

-

Solo 401(k) Complete Guide for Self-Employed Workers (2025)

Read more: Solo 401(k) Complete Guide for Self-Employed Workers (2025)Self-employed workers can contribute up to $70,000 ($73,500 if 50+) to a Solo 401(k) in 2025, far exceeding SEP IRA and SIMPLE IRA limits. This comprehensive guide covers eligibility, provider comparison, setup process, contribution strategies, and advanced tactics including mega backdoor Roth options within Solo 401(k) plans.

-

Mega Backdoor Roth: Complete Implementation Guide (2025)

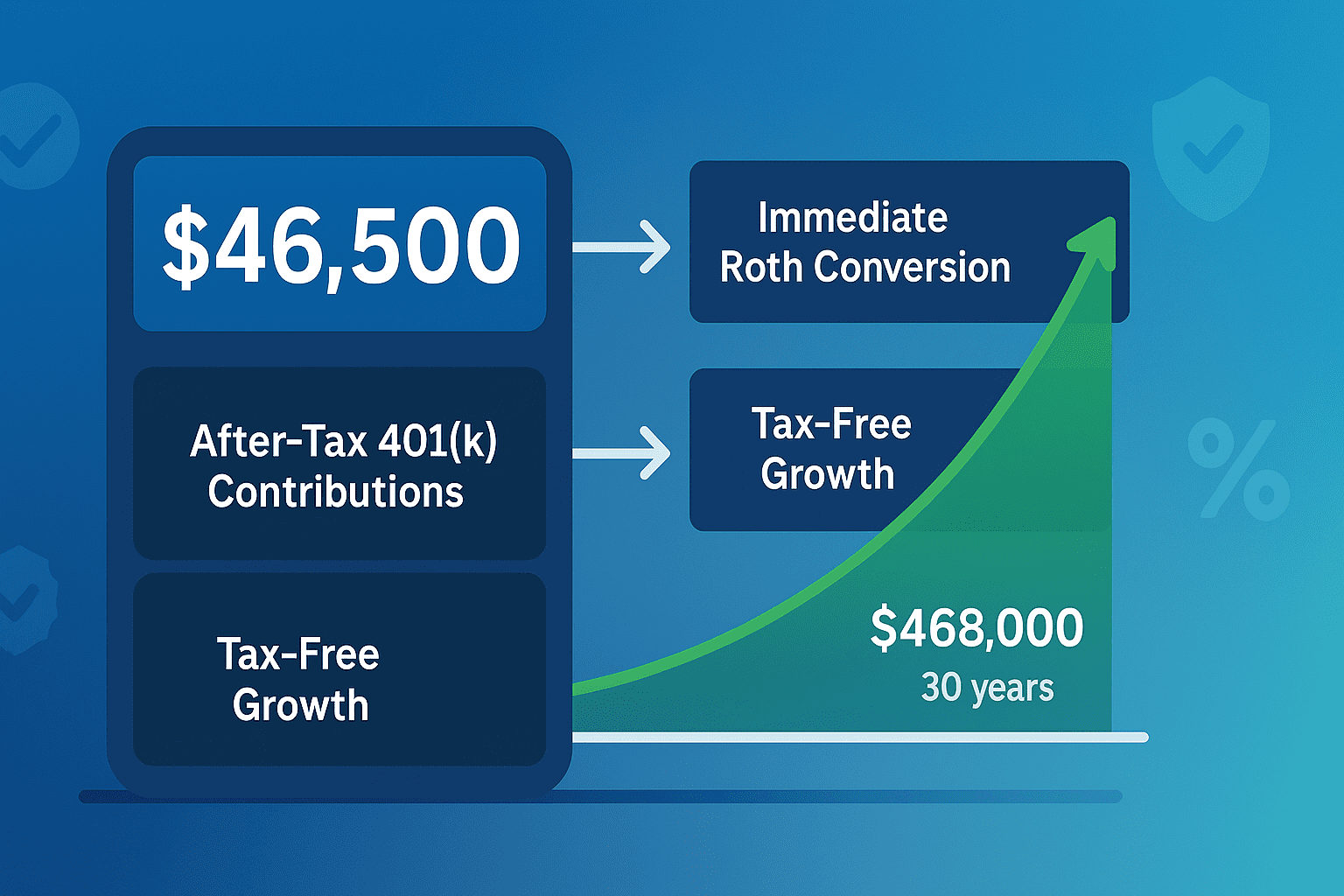

Read more: Mega Backdoor Roth: Complete Implementation Guide (2025)High earners can contribute an additional $46,500 to Roth accounts in 2025 through the mega backdoor Roth strategy. This comprehensive implementation guide provides step-by-step instructions, employer plan compatibility checks, provider-specific walkthroughs, and troubleshooting for every common mistake.

Subscribe

Sign up with your email address to receive our weekly news

Latest news

- 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

- FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

- Tax-Loss Harvesting Strategy Guide (2025): Complete US & UK Implementation for DIY Investors

- Property Investment for Beginners: Your Complete Getting Started Guide for 2025

- The Complete 401(k) Optimization Playbook for 2025

Categories

- Backdoor Roth (1)

- Expat Living & Lifestyle (1)

- General Blog (2)

- Index Funds (1)

- Investing Basics (4)

- Investment Guides (6)

- Investment Platforms (1)

- Investment Strategies (12)

- Investments (2)

- IRAs & Tax-Advantaged Accounts (8)

- ISAs and Pensions (1)

- Property Investment (7)

- Real Estate Investing (3)

- Retirement Planning (12)

- Tax Strategy (8)

- Tax-Efficient Investing (3)

- UK Investing (3)

- UK Property Investment (2)