tax strategy

-

Backdoor Roth IRA: Step-by-Step Guide (2025)

Read more: Backdoor Roth IRA: Step-by-Step Guide (2025)Earn too much for a Roth IRA? The backdoor Roth strategy lets high earners contribute $7,000-$8,000 annually despite income limits. This complete guide walks you through every step for Fidelity, Vanguard, and Schwab, explains the pro-rata rule with real calculations, and shows you exactly how to file Form 8606.

-

Investment Guides, Investment Strategies, IRAs & Tax-Advantaged Accounts, Retirement Planning, Tax Strategy

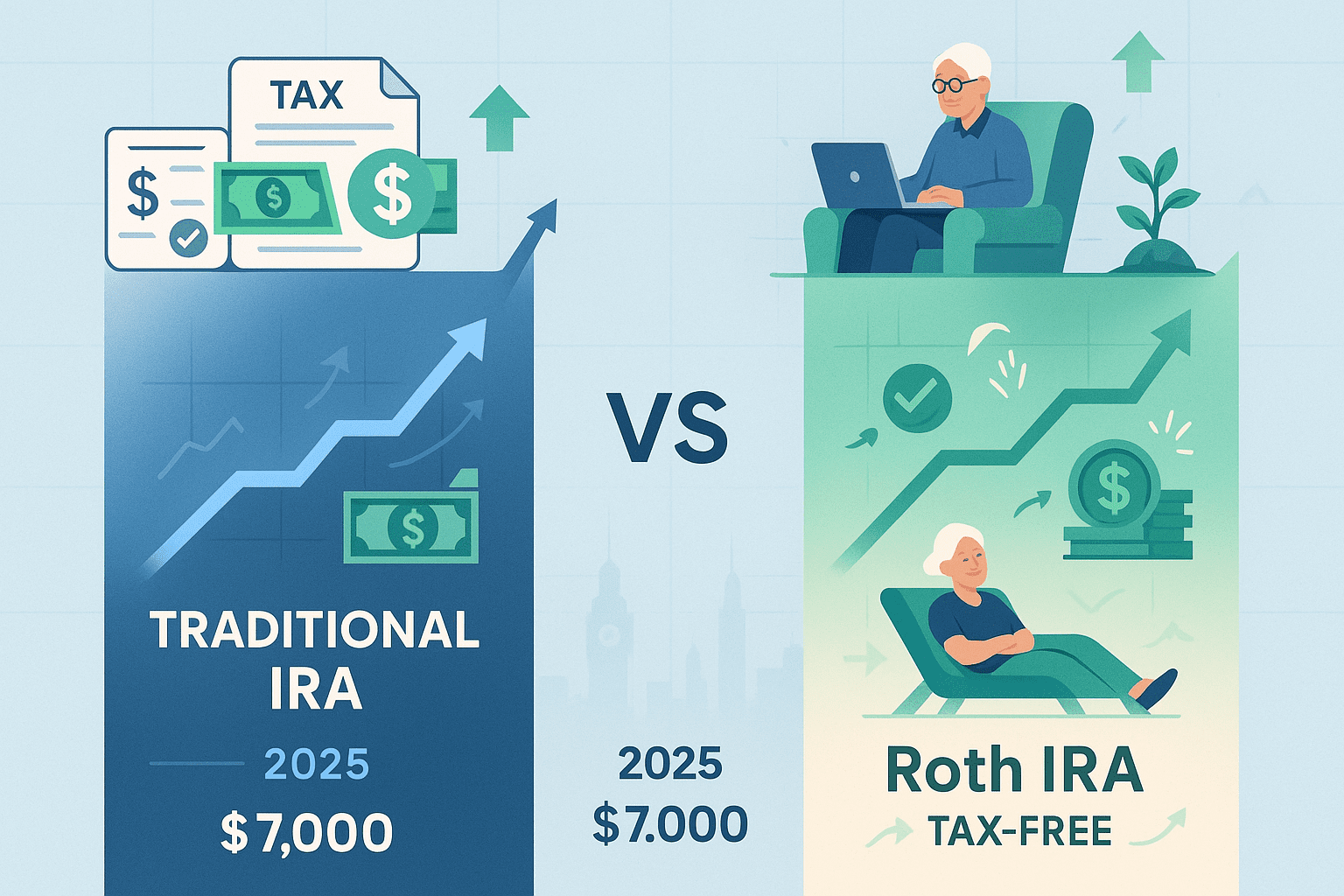

Investment Guides, Investment Strategies, IRAs & Tax-Advantaged Accounts, Retirement Planning, Tax StrategyRoth IRA vs Traditional IRA: Complete 2025 Comparison Guide (With Calculator)

Read more: Roth IRA vs Traditional IRA: Complete 2025 Comparison Guide (With Calculator)Choosing between a Roth IRA and Traditional IRA isn’t just about current versus future taxes—it’s a decision that could impact your retirement wealth by $100,000 or more. In 2025, with contribution limits holding at $7,000 ($8,000 for ages 50+) but income thresholds increasing significantly, understanding which account type suits your situation has never been more…

Subscribe

Sign up with your email address to receive our weekly news

Latest news

- 529 to Roth IRA Rollover: Complete SECURE 2.0 Guide for 2025

- FIRE Movement: The Complete 2025 Guide to Financial Independence and Early Retirement

- Tax-Loss Harvesting Strategy Guide (2025): Complete US & UK Implementation for DIY Investors

- Property Investment for Beginners: Your Complete Getting Started Guide for 2025

- The Complete 401(k) Optimization Playbook for 2025

Categories

- Backdoor Roth (1)

- Expat Living & Lifestyle (1)

- General Blog (2)

- Index Funds (1)

- Investing Basics (4)

- Investment Guides (6)

- Investment Platforms (1)

- Investment Strategies (12)

- Investments (2)

- IRAs & Tax-Advantaged Accounts (8)

- ISAs and Pensions (1)

- Property Investment (7)

- Real Estate Investing (3)

- Retirement Planning (12)

- Tax Strategy (8)

- Tax-Efficient Investing (3)

- UK Investing (3)

- UK Property Investment (2)